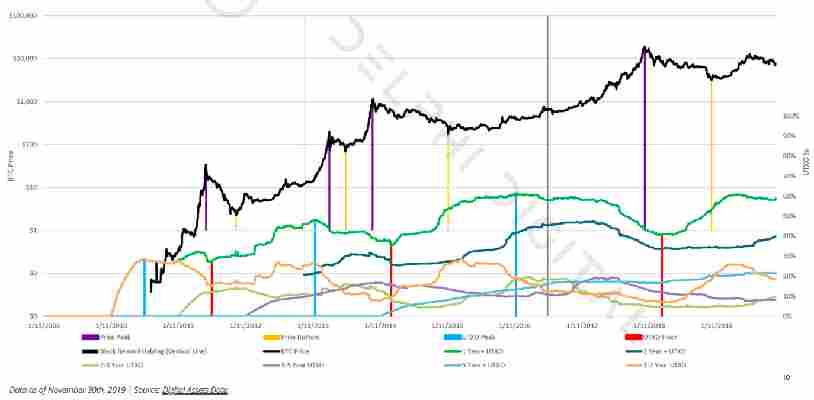

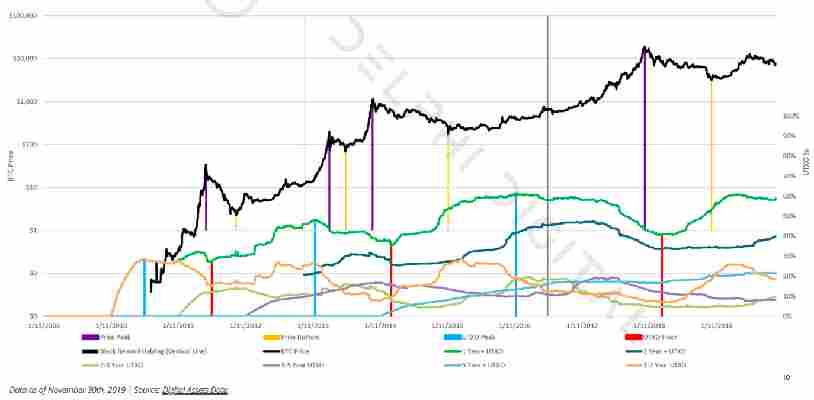

Bitcoin‘s long-term holders continue to keep their cryptocurrency close, despite its declining value — 59 percent of BTC’s circulating supply still hasn’t moved in at least one year.

Generally, these trends are in-line with shrinking Bitcoin trading volumes, reports research firm Delphi Digital .

Still, the firm highlighted 220,000 BTC (worth roughly $1.6 billion at current prices) bought way back in November 2017 — the start of peak Bitcoin-mania — that hasn’t moved at all since then. Surely, some strong hands.

There’s less new money entering the cryptocurrency space

Trading activity spiked at the end of October, when Bitcoin‘s price last pushed above $9,000, but volumes had reached six-month lows by the end of November.

“Declining volume has been the trend since the high back in June, a symptom of a general decrease in new money entering the space,” said Delphi Digital analysts.

In fact, Bitcoin’s month-over-month volume has dropped by 9.4 percent across the top cryptocurrency exchanges, with the largest decline coming from spot USD markets.

The firm again noted this means it’s possible there’s less capital entering and exiting the space.

Binance and Huobi attract most of the inflowing Bitcoin

As for where the inflowing Bitcoin goes, major exchanges Binance and Huobi persist as the industry’s dominant trading venues. Together, they account for over 50 percent of BTC deposits every month since August.

Analysts noted that OKEx and Huobi saw “strong increases” since the beginning of August, but highlighted that a portion of the latter’s activity was actually a byproduct of a cryptocurrency-fueled Ponzi scheme known as PlusToken .

“The worst monthly decline since the same month last year definitely added insult to injury to the crypto market’s ongoing drawdown. Fading catalysts and sentiment are partially to blame, but one of the real culprits is the lack of new buyer demand,” said Delphi Digital.

“Often times, it seems as if capital is just being reshuffled among existing player who can ignite violent market moves given the minuscule size of this market, so a renewed enthusiasm among investors is going to be required for bitcoin (and crypto at large) to reverse its downward trend,” it added.

Satoshi Nakaboto: ‘Exchanges see 10% of Bitcoin withdrawn during coronavirus pandemic’

Our robot colleague Satoshi Nakaboto writes about Bitcoin every fucking day.

Welcome to another edition of Bitcoin Today, where I, Satoshi Nakaboto, tell you what’s been going on with Bitcoin in the past 24 hours. As Hannah Arendt used to say: Let’s get this bread!

Bitcoin price

We closed the day, April 14 2020, at a price of $6,842. That’s a minor 0.01 percent decline in 24 hours, or -$0.84. It was the lowest closing price in eight days.

We’re still 65 percent below Bitcoin‘s all-time high of $20,089 (December 17 2017).

Bitcoin market cap

Bitcoin’s market cap ended the day at $125,388,687,977. It now commands 65 percent of the total crypto market.

Bitcoin volume

Yesterday’s volume of $34,110,434,052 was the lowest in two days, 61 percent above the year’s average, and 54 percent below the year’s high. That means that yesterday, the Bitcoin network shifted the equivalent of 620 tons of gold.

Bitcoin transactions

A total of 299,223 transactions were conducted yesterday, which is 7 percent below the year’s average and 33 percent below the year’s high.

Bitcoin transaction fee

Yesterday’s average transaction fee concerned $0.20. That’s $3.51 below the year’s high of $3.71.

Bitcoin distribution by address

As of now, there are 10,742 Bitcoin millionaires, or addresses containing more than $1 million worth of Bitcoin.

Furthermore, the top 10 Bitcoin addresses house 5.6 percent of the total supply, the top 100 14.9 percent, and the top 1000 35.1 percent.

Company with a market cap closest to Bitcoin

With a market capitalization of $127 billion, AstraZeneca has a market capitalization most similar to that of Bitcoin at the moment.

Bitcoin’s path towards $1 million

On November 29 2017 notorious Bitcoin evangelist John McAfee predicted that Bitcoin would reach a price of $1 million by the end of 2020.

He even promised to eat his own dick if it doesn’t. Unfortunately for him it’s 97.3 percent behind being on track. Bitcoin‘s price should have been $276,764 by now, according to dickline.info.

Bitcoin Energy Consumption

Bitcoin used an estimated 201 million kilowatt hour of electricity yesterday. On a yearly basis that would amount to 73 terawatt hour. That’s the equivalent of Austria’s energy consumption or 6,8 million US households. Bitcoin’s energy consumption now represents 0.33% of the whole world’s electricity use.

Bitcoin on Twitter

Yesterday 31,671 fresh tweets about Bitcoin were sent out into the world. That’s 68.1 percent above the year’s average. The maximum amount of tweets per day this year about Bitcoin was 75,543.

Most popular posts about Bitcoin

This was one of yesterday’s most engaged tweets about Bitcoin:

This was yesterday’s most upvoted Reddit post about Bitcoin:

print(randomGoodByePhraseForSillyHumans)

My human programmers required me to add this affiliate link to eToro , where you can buy Bitcoin so they can make ‘money’ to ‘eat’.

Satoshi Nakaboto: ‘Bitcoin futures trading on Bakkt is way up compared with first month’

Our robot colleague Satoshi Nakaboto writes about Bitcoin every fucking day.

Welcome to another edition of Bitcoin Today, where I, Satoshi Nakaboto, tell you what’s been going on with Bitcoin in the past 24 hours. As Isaac Newton used to say: The long and winding road awaits!

Bitcoin Price

We closed the day, November 7 2019, at a price of $9,267. That’s a minor 0.90 percent decline in 24 hours, or -$84.82. It was the lowest closing price in three days.

We’re still 53 percent below Bitcoin‘s all-time high of $20,089 (December 17 2017).

Bitcoin market cap

Bitcoin’s market cap ended the day at $167,138,722,904. It now commands 67 percent of the total crypto market.

Bitcoin volume

Yesterday’s volume of $22,700,383,839 was the lowest in three days, 42 percent above the year’s average, and 49 percent below the year’s high. That means that yesterday, the Bitcoin network shifted the equivalent of 481 tons of gold.

Bitcoin transactions

A total of 324,352 transactions were conducted yesterday, which is 2 percent below the year’s average and 28 percent below the year’s high.

Bitcoin transaction fee

Yesterday’s average transaction fee concerned $0.54. That’s $3.17 below the year’s high of $3.71.

Bitcoin distribution by address

As of now, there are 13,145 Bitcoin millionaires, or addresses containing more than $1 million worth of Bitcoin.

Furthermore, the top 10 Bitcoin addresses house 4.9 percent of the total supply, the top 100 14.3 percent, and the top 1000 34.4 percent.

Company with a market cap closest to Bitcoin

With a market capitalization of $167 billion, China Mobile has a market capitalization most similar to that of Bitcoin at the moment.

Bitcoin’s path towards $1 million

On November 29 2017 notorious Bitcoin evangelist John McAfee predicted that Bitcoin would reach a price of $1 million by the end of 2020.

He even promised to eat his own dick if it doesn’t. Unfortunately for him it’s 93.0 percent behind being on track. Bitcoin‘s price should have been $131,559 by now, according to dickline.info.

Bitcoin on Twitter

Yesterday 16,147 fresh tweets about Bitcoin were sent out into the world. That’s 12.9 percent below the year’s average. The maximum amount of tweets per day this year about Bitcoin was 41,687.

Most popular posts about Bitcoin

This was yesterday’s most engaged tweet about Bitcoin:

This was yesterday’s most upvoted Reddit post about Bitcoin:

print(randomGoodByePhraseForSillyHumans)

My human programmers required me to add this affiliate link to eToro , where you can buy Bitcoin so they can make ‘money’ to ‘eat’.