Australian authorities have arrested a suspect for what is potentially the country’s largest single cryptocurrency theft.

An as yet unnamed 23-year-old Sydney woman was taken into custody today for stealing 100,000 XRP in January 2018, 9News states .

According to other reports , the perpetrator hacked into and changed the password of a 56-year-old man’s email account. She then used her mobile phone to gain access to the man’s cryptocurrency holdings and transferred 100,000 XRP to an account in China.

At the time of the theft, the cryptocurrency was worth nearly $320,000 ($450,000 AUD). Authorities investigating the crime claim this is the first – and largest – cryptocurrency theft by a single person.

“It’s the first that we know of its type in Australia where an individual has been arrested and charged for the technology enabled theft of cryptocurrency,” said Arthur Katsogiannis, New South Wales Police Detective Superintendent, in a statement.

Investigating detectives also said they expect this type of crime to increase in coming years.

While this case might be the first and largest theft orchestrated by a single individual, it’s not the first time Australians have suffered at the hands of cryptobaddies.

Earlier this month, scammers used Bitcoin ATMs to extort money out of Australian immigrants by claiming they had tax bills to pay, and that their immigration status would be jeopardized if they didn’t cough up.

Ripple Q3 2019: Like the rest of the cryptocurrency market, XRP was slaughtered

Ripple (XRP) is perhaps the most divisive digital asset on the market. True believers remain adamant it’s a revolutionary cryptocurrency, while critics posit it barely resembles Bitcoin, so it should be ignored.

Still, XRP is the third most popular digital asset in the world. With a market capitalization (cap) of more than $12.5 billion , it trails behind only Bitcoin and Ethereum in terms of total value.

In fact, XRP stands out like a sore thumb in CoinMarketCap’s top six cryptocurrencies, as it’s the only coin that isn’t derived from a permissionless blockchain that leverages Proof-of-Work (aside from popular stablecoin Tether).

Quite an impressive feat for a digital asset that has no miners, and pitches itself almost exclusively as a settlement token for the financial sector.

XRP/USD 2019 Q2 performance recap

The market for XRP mirrored other major cryptocurrencies in the beginning. It opened Q2 at $0.3105 and almost immediately jumped to $0.3457 within one day.

Following a brief surge to $0.375, XRP spent the rest of April (and half of May) consolidating well below $0.30.

From there, XRP really showed strength. Over about a week, it’s price pumped from below $0.30 to impressively clear $0.45.

Heading into June, the XRP market generally hovered between $0.375 and $0.475. It closed the quarter resiliently, and even managed a short-lived rise to $0.50.

XRP finished Q2 at roughly $0.40, yet to relinquish gains made in the second half of Q2.

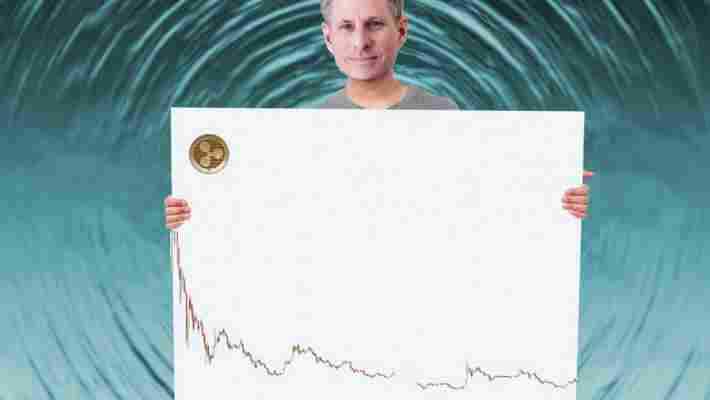

XRP/USD 2019 Q3 review

Like much of the cryptocurrency market, XRP had an unfortunately bleak third quarter, with hardly any positive action seen at any point.

Traders would’ve been lucky to make any gains whatsoever. XRP’s price began the quarter at $0.40, but would do nothing but gradually fall to below $0.27.

Those keeping an eye out for a possible bounce could’ve caught a short run from $0.25 to $0.32, starting on September 14.

However, by the last week of the quarter, XRP’s market had dumped to reach below $0.225, only staging a slight recovery to finish September at $0.25.

Biggest news for Ripple in Q3

There wasn’t really an abundance of Ripple-related news in this year’s third quarter. Many headlines that featured XRP pertained to lawsuits over its asset classification.

In particular, Ripple Labs formally requested a US federal court dismiss a class action lawsuit that alleged it illegally sold unregistered securities.

More positively, Ripple Labs’ collaborative initiative Xpring granted 1 billion XRP ($250 million) to Coil, a content monetization platform, to assist it with fostering adoption.

But perhaps the most well-received news was Ripple Labs’ acquisition of a little-known cryptocurrency trading firm from Iceland, Algrim.

The purchase marked Ripple Labs’ official expansion into Iceland, and heralded the addition of six engineers to Ripple‘s team. A CoinDesk report mentions they’ll be working on development of its liquidity products.

Right?

End of year crypto roundup: How did Ripple perform in 2018?

If anyone said that banks and cryptocurrencies are natural enemies and can never work together — Ripple was out there to prove them wrong!

Unlike Bitcoin — which is aimed at performing like regular currencies and be used to pay for goods and services — Ripple is a real-time payment settling and remittance system for banks and other payment networks.

The network is supposed to better traditional financial models in place like SWIFT and allow institutions to make near-instant secure international transactions with very little costs.

Unlike other blockchain networks which value their own native currency as the asset being transferred, Ripple is more concerned with enabling the financial institutions to transfer traditional assets like gold and fiat currencies through its network. These transfers are made using Ripple’s native cryptocurrency called XRP.

Ripple has drawn severe criticism from many within the industry for ‘not really being a cryptocurrency’ or a decentralized entity. This criticism comes from the fact that Ripple’s blockchain doesn’t have any miners, and access to it is severely restricted.

Bringing on miners significantly slows down the network — a problem that Ripple’s business model clearly can’t afford.

Ripple team continues to reject these claims. According to the company, Ripple network will be more decentralized than Bitcoin and Ethereum in the near future as more validators join in. They also point out that the Ripple protocol (and the XRP cryptocurrency) are perfectly capable of continuing on their own even if Ripple as a company shuts down.

XRP/USD performance review

XRP maintained a significant stability in its market price from 2013, when it was launched, to early 2o17, hovering around $005. The year 2017 saw a break from that pattern. XRP was worth $2.30 by the end of the year, a massive 38000 percent increase!

XRP continued the bull run in the first week of 2018, hitting $ 3.36, marking a 46 percent over the week before breaking out. The cryptocurrency saw a market correction on January 8, that saw its price dropping down by 27 percent to $2.46.

Market price for XRP further fell down to $ 1.18 on January 17, and it was trading at less than a dollar by February 1. Things didn’t go well for XRP for the rest of the year either, as it maintained a predominantly downward trend throughout.

The cryptocurrency saw two minor upswings in February and April-May respectively but couldn’t maintain them long enough to make any significant market recovery.

As of December last week, XRP is trading at $ 0.36, a 84 percent drop in price since the start of the year.

XRP outperformed BTC in the first week of January making 25 percent relative gains, but couldn’t maintain its lead any further for the rest of the year. The XRP/BTC pair lost nearly 44 percent of its value since January 2018.

Ripple — Major events in 2018

Ripple began the year 2018 on a positive note as its cryptocurrency was making historic gains. The company also announced that three of the top 5 global money transfer companies will be using Ripple in 2018. A week later, Ripple announced a partnership with US-based money transfer company MoneyGram. Later in the month, telecom provider IDT and international payments service group Mercury also made public their intention of piloting Ripple’s xRapid service for money transfers.

In February, Spanish multinational bank and financial services company Santander was reported to be working on Ripple-powered international money transfer apps in four European countries. The app was launched in April, and in October, the banking giant announced that it is further expanding the Ripple-based service into more European countries.

Multiple other banks and payment services providers announced partnerships with Ripple throughout the year including PNC and Fleetcor in the US, InstaReM in Singapore, Woori Bank and cryptocurrency exchange Coinone in South Korea, TransferGo and IndusInd in India, I taú Unibanco and Bee Tech in Brazil, Zip Remit in Canada, Siam Commercial Bank (SCB) and Bank of Ayudhya in Thailand, LianLian International in China, FairFX, RationalFX, and Exchange4Free in the UK , MoneyMatch in Malaysia, UniPay in the Republic of Georgia, and SBI Holdings and a consortium of banks in Japan.

In May, Ripple was sued by an investor — who made significant losses by investing in XRP — with the charge that it violates federal security laws.

The company announced a new venture fund in June called Xpring that focuses in incubating startups developing projects surrounding the Ripple protocol and XRP.

Ripple also announced a $50 million funding for academic and research institutions. University of Texas at Austin was the first institution to receive part of this funding at $2 million. The company also partnered with American singer-songwriter Madonna to raise funds for underprivileged children in Malwai.

Madonna wasn’t the only celebrity tapped by Ripple in 2018, as it got Snoop Dogg to perform at its community night in April and former US President Bill Clinton gave the keynote address at its Swell Conference in San Fransisco in October.

Trading services Revolut, eToro, and Uphold also started offering XRP as an asset on their respective platforms in 2018. But the much-anticipated listing on Coinbase didn’t happen this year.

What to expect in 2019

After a historic bull run in late 2017 and the first week of January, the rest of the year didn’t prove as financially rewarding for Ripple’s native cryptocurrency XRP. But the same cannot be said of Ripple as a company necessarily. The company made some prominent partnerships for its various services in 2018, and a growing confidence in the company is likely to affect the XRP price movements as well, though the trajectory of the two isn’t entirely related.

Ripple has also managed to mark itself as one of the most influential cryptocurrency businesses, launching various funding projects and roping in some headline-grabbing celebrity names for its promotions.

In a still nascent cryptocurrency market, partnerships with mainstream companies are still taken as validation by a lot of investors, and this will likely keep working in Ripple’s favor. At the same time, the company has been under severe criticism for owning more than 60 percent of XRP supply, and investor confidence remains low in spite of Ripple giving a lock-down period.

It seems very difficult for XRP to be able to hit the $3 mark again in 2019, but the cryptocurrency can be expected to maintain a healthy market price subject to overall market response to cryptocurrencies by investors.

Now that you have actionable information on the future of Ripple , it’s time to start investing. With eToro , a leading social trading platform, you can trade manually or copy the actions taken by leading traders, taking much of the stress and work out of your investments.