2018 was a wild ride for cryptocurrencies. Despite the many ups and downs experienced by Bitcoin and other major cryptocurrency vendors, the market has proven that it is going to stick around for the long haul.

Though there is still risk involved in cryptocurrency, investors are coming to better understand the challenges and opportunities associated with this exciting sector. As a result, more people are entering the crypto trading sphere than ever before.

If you’re still new to the crypto investing scene, however, the sheer number of investing options — and new terminology — can feel overwhelming. By taking steps to better understand what you’re getting into, you will make wiser investment decisions.

Here are some tips to get you started on the right track:

1) Know the relation between market cap and circulating supply

New cryptocurrency investors may be intimidated by the new vocabulary they need to learn and how these different terms affect pricing. For example, the “market cap” for a particular coin is used to determine the total value of coins on the market. This number is determined by multiplying the coin’s circulating supply by its current price.

The use of the circulating supply, rather than the total supply, is an important distinction. For a variety of reasons, some coins are not available on the public market. Because they aren’t available for trading, they are not counted toward price considerations or the market cap.

2) Keep up with current market conditions

You can read articles debating the pros and cons of various cryptocurrencies, but current market data will always be the most reliable source for identifying trends and making smarter trading decisions.

Fortunately, there are several websites dedicated to providing up-to-the-minute updates regarding changes in price, supply and market cap. Coincap , CoinMarketCap , and CryptoCompare are just a few examples of resources that help investors stay up to date on current prices. Data that is updated in real-time is paired with charts tracking changes over 24-hour and seven-day periods to give investors a better idea of current trends.

3) Follow the leaders

Even when you have real-time data available, making a trading decision based on a “top 100 cryptocurrencies” list can be intimidating.

However, when this data is paired with guidance from top investors, you can have greater confidence in your decisions and even learn a few extra pointers along the way.

Sites like eToro utilize what is known as a “social trading” program that allows top investors to share their knowledge and trading practices.

New investors can use these traders as a guiding reference or even fully match their investment strategies as they learn the ropes. Picking up good habits early on in your investing journey will keep you from making the impulsive decisions that can lead to disaster.

4) Diversification is vital for success

As with traditional investment opportunities, diversification is essential if you wish to come out a financial winner in cryptocurrencies. With a more diversified portfolio, you reduce your overall risk, especially if you invest in coins and tokens that service different sectors.

This also means you should continue to invest in non-crypto spheres. These practices maximize your potential return while alleviating the risk should a particular coin or stock go under.

You can keep your coins organized and protected with a cryptocurrency wallet . These digital wallets serve as a centralized hub for receiving and sending crypto transactions. Keeping your diversified investments locked in a secure wallet will make it easier to keep track of your investments.

5) Understand which factors influence pricing

What causes cryptocurrency prices to rise and fall? Though supply and demand certainly play a role, crypto investors should carefully consider the perceived utility of a cryptocurrency. If a coin is perceived as having several practical applications, it will be more highly sought-after, and therefore, increase in price.

As MyCryptopedia explains , mining difficulty is another major factor that affects pricing: “A higher mining difficulty means that it is harder to mine an additional unit of a coin. This can have an impact on a coin’s perceived value, and subsequently, its price, as increasing a coin’s supply will require more computing power to be used in the mining process.”

Savvy investors should also pay attention to news headlines regarding different coins and tokens. Positive or negative articles will often have a direct correlation on future pricing trends.

6) Research individual coins and tokens

Cryptocurrencies have frequently been called out as nothing more than a scam by skeptical individuals. While many crypto products have proven themselves to be worthwhile investments, other tokens and coins have indeed been scams, some of which have cost investors millions of dollars .

While this isn’t much of a risk with any of the major, better-known cryptocurrencies, anyone considering investing in a new coin or token should do thorough research before making a trade.

By understanding how a coin will operate within the market, you can determine whether or not it is a legitimate opportunity — and if it is legitimate, you can likely identify whether it will actually be a good investment.

In addition to researching market news, resources like All Crypto Whitepapers can greatly assist your investigative efforts. This site collects all documents highlighting cryptocurrencies’ technical details, marketing plans and more so you can better understand what they have to offer.

7) Prepare for volatility

No one can predict what the market will do with 100 percent accuracy — and this is perhaps truer of cryptocurrency than any other investment sector. Panicking over day to day changes in the market value won’t do you much good. You’re more likely to rush into an impulsive decision and make a trade you’ll later regret.

The stock market provides valuable lessons for handling this volatility, as global stock markets are no stranger to sudden rises and falls in pricing. As such, many traditional lessons and tips for handling volatility are just as applicable to crypto investors.

Many of these practices highlight the value of long-term investments by focusing on a future reward rather than daily price fluctuations. Even short-term investors need to exercise a bit of patience and look at the bigger picture. Understanding that volatility is part of crypto investing, but that you should still experience great growth in the long run, will help you make wiser decisions.

Cryptocurrency trading is expected to increase by 50 percent in 2019 alone .

Despite the seemingly never-ending claims that crypto is a “fad” or already dead, it is clear that this investment option is here to stay. By becoming an informed investor now, you can stay ahead of the curve and be better prepared for future market shifts.

Facebook signs major partners for its cryptocurrency network and it still sounds terrible

Facebook has begun assembling a who’s who of big tech companies to back its soon to be unveiled cryptocurrency, GlobalCoin.

The likes of Mastercard, Visa, Uber, and PayPal are all backing the social media giant’s upcoming digital coin due to be unveiled later this month, and officially rolled out next year, reports The Wall St Journal . The Big F has already signed up more than a dozen companies.

Each of these firms will invest a reported $10 million to help support GlobalCoin, and to be part of the coin‘s governing consortium called the Libra Association.

Fintech firm Stripe, Bookingom, and Argentinian ecommerce site MercadoLibre have also signed up to support the project, however, their involvement is unclear. Previous reports about GlobalCoin have said it will be accepted by merchants all over the world, in this case, these partners might be a hint at things to come.

Facebook will officially publish the GlobalCoin white paper next week, it has asked partnering companies to cosign the paper.

The news follows on from recent reports that Facebook would be assembling a consortium of companies that would be responsible for the collective running and governance of GlobalCoin. For the $10 million fee, each company will run a network node to verify transactions, and will sit as part of the Libra Association.

Here’s the thing, Facebook is aware that users probably won’t be interested in a digital coin entirely governed by one entity. After all, cryptocurrency is all about decentralization. Right?

Indeed, Facebook is trying to address these concerns by auctioning off the right to be part of the network to other tech companies. But imagine if the Bitcoin blockchain was only viewable to those running network nodes. All of a sudden, the network isn’t public and transparent; those that run nodes have exclusive access to transaction data. So much for decentralization!

What’s more, even though other companies will run and govern the coin, as its developers, Facebook will be able to ultimately control the coin’s implementation.

This is speculation for now – hopefully the social media giant’s white paper will clarify if this will be the case.

But even so, every time more details about Facebook’s cryptocurrency are announced, it just sounds even worse .

The Bitcoin Halvening is happening – here’s what you need to know

Welcome to Hard Fork Basics, a collection of tips, tricks, guides, and advice to keep you up to date in the cryptocurrency and blockchain world.

Something major is happening to Bitcoin in 480 days – the Halvening .

Bitcoin is created when the blockchain rewards the individual (or group) for validating transactions . The network gives Bitcoin to miners for adding blocks to its chain .

This is reimbursement for the costs associated with maintaining the network, like electricity and hardware upkeep. Miners typically sell it immediately to cover their overheads, thus releasing new Bitcoin into the ecosystem.

The Halvening is when the network reduces the reward by 50 percent. Halvenings happen at intervals of 210,000 blocks , which is roughly once every four years.

Bitcoin miners currently receive 12.5 BTC ($43K) each time they successfully mine a block. By the end of May 2020 (the next Halvening) they will instead earn just 6.25 BTC ($21.5K).

While this seems to imply enormous consequences for the network, it’s not all that scary. Let’s take a closer look to see why it shouldn’t worry you.

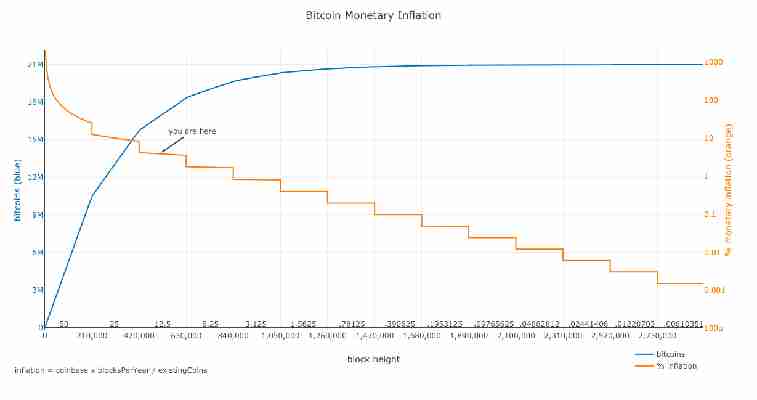

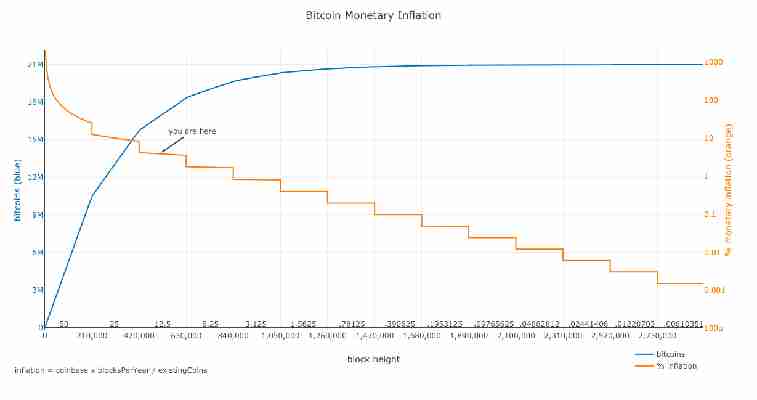

This is Satoshi’s way of battling inflation

Unlike fiat currencies, which are generally inflationary, the upper limit for Bitcoin‘s supply is 21 million. Once the network reaches that limit, no more Bitcoin can be generated.

The idea behind the constant Halvening is to ensure Bitcoin doesn’t suffer from intense inflation as it’s distributed. Satoshi Nakamoto explained the thought process in an email :

Let’s say Satoshi simply launched the Bitcoin network with the full 21 million supply ready to go. There would be little incentive for its value to rise, as supply would likely outweigh demand.

To encourage sustainable growth, Satoshi chose a logarithmic scale on which to set dates for the Halvenings.

This means that even though 80 percent of Bitcoin supply has already been mined in its first 10 years, the final Bitcoin won’t be released until 2140.

We still have over a century of guaranteed incentive for miners to participate in the network, and for the market to figure out just how much Bitcoin is worth.

The hash rate didn’t fall directly after the last Halvening

A 50 percent reduction in mining revenue seems like doom for the ecosystem. But, this is going to be the third Halvening. So far so good, right?

The last one happened in 2016 , when the blockchain went from releasing 3,600 Bitcoins into the ecosystem every day to 1,800.

In another 480 days, the network will release just 900 new Bitcoins daily.

During the last Halvening, the price didn’t really move . Although, some attribute the 50 percent price rise (from $430 to $650) in the three months prior to the reward reduction, albeit with little chance of proving causation.

Aside from that, the network was pretty much indifferent. The overall hash rate (the total computing power driving the Bitcoin network) stayed the same.

This means miners did not switch off their equipment en masse in light of earning less rewards, something many had speculated would happen.

But then again – Bitcoin in 2019 is a whole different ballgame. More than ever, turning a profit with mining is difficult , even for the biggest in the business.

In any case, now you know what The Halvening is, and why it’s probably nothing to freak out about. You can keep up to date on exactly when the next one will happen with this neat countdown timer .