The gig economy is crumbling during the coronavirus pandemic. Uber announced it is laying off 3,700 employees — nearly 14% of its 26,900-strong workforce.

The company revealed the move in a filing with the Securities and Exchange Commission submitted on May 2, 2020. The majority of layoffs will affect the company‘s customer support and recruitment teams, according to the documents.

“Due to lower trip volumes in its rides segment and the [Uber’s] current hiring freeze, [Uber] is reducing its customer support and recruiting teams by approximately 3,700 full-time employee roles,” the filing reads. “In connection with these actions, [Uber] estimates that it will incur approximately $20 million related to severance and other termination benefits.”

The ride-sharing giant cites the coronavirus as the main cause, blaming “uncertainty resulting from the COVID-19 pandemic and its impact on [its] business.”

In addition to the cuts, CEO Dara Khosrowshahi has agreed to forego his salary for the remainder of the year. The Uber boss made $1 million in base salary in 2019, but bonuses and stock awards make up most of his compensation, according to CNBC .

Uber stock has dropped nearly 2.5% since the announcement.

The more concerning bit is more cuts might follow. “ We are looking at many scenarios and at each and every cost, both variable and fixed, across the company,” Khosrowshahi said in a memo to employees. “We want to be smart, to move fast, to retain as many of our great people as we can, and treat everyone with dignity, support and respect.”

Uber, whose bookings have purportedly dropped by 80% , is expected to deliver a final financial update within two weeks, CNBC notes.

The announcement comes a day after fellow gig economy giant Airbnb revealed it was letting go 25% of its workforce — or nearly 1,900 people. Just like Khosrowshahi, its CEO Brian Chesky cited an immense drop in revenue due to the pandemic.

Here is the full memo Uber’s Khosrowshahi sent to employees:

Microsoft stock pumps after it sees two years of digital transformation in two months

Microsoft just dropped its earnings for the first quarter of 2020 and — as one might expect — worldwide coronavirus lockdowns were great for its bottom line.

The Redmond tech giant posted $35 billion revenue and $10.8 billion net income in Q1, up 15% and 22% respectively when compared with the corresponding period last year.

Microsoft‘s commercial cloud arm grew fast, up 39% year-on-year to hit $13.3 billion. In fact, Microsoft‘s flagship cloud platform Azure posted 59% more revenue than in the same quarter in 2019.

CEO Satya Nadella commented that the company has seen “two years’ worth of digital transformation in two months.”

The company’s career-orientated social hellscape LinkedIn is also making more money, with revenue up 21%.

No coronavirus bump for Microsoft’s Xbox

One might’ve thought home entertainment system Xbox would be making big bucks for Microsoft, especially with most of the world’s school systems effectively closed due to the coronavirus (COVID-19) pandemic.

Still, Xbox content and services revenue only rose by 2%. Microsoft Surface experienced similar, subtle growth, with its revenue up by 1%.

All things considered, its shareholders are likely to be well pleased. Microsoft said it returned $9.9 billion to shareholders in the form of share buy-backs or dividends, with those rewards increasing 33% compared with the third quarter of the 2019 fiscal year.

Traders too responded positively to the news, with $MSFT up 4.5% at Wednesday’s market close.

Kodak stock sinks 45% after alleged insider trading halts its pharma pivot

Eastman Kodak stock is down nearly 45% during Monday’s pre-market trade after the US government signalled alleged insider trading has jeopardised its pivot into pharmaceuticals.

“On July 28, we signed a Letter of Interest with Eastman Kodak,” tweeted the US International Development Finance Corporation (DFC) on Friday.

“Recent allegations of wrongdoing raise serious concerns. We will not proceed any further unless these allegations are cleared.”

Kodak awarded millions of shares to company execs

Kodak shares rampaged by more than 1000% last month after it secured a $765 million government loan to fund its transition into making basic ingredients for drugs.

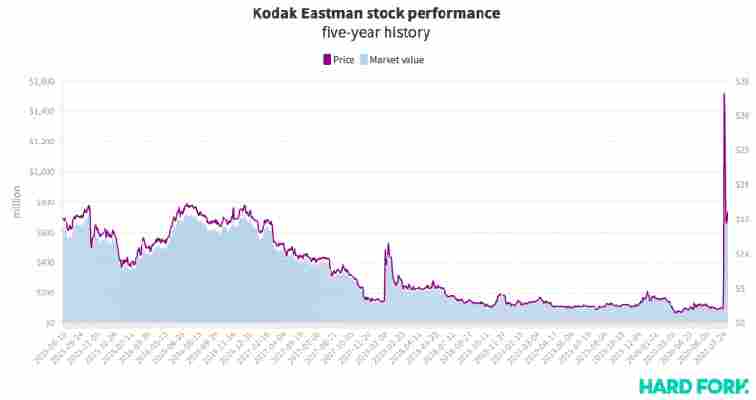

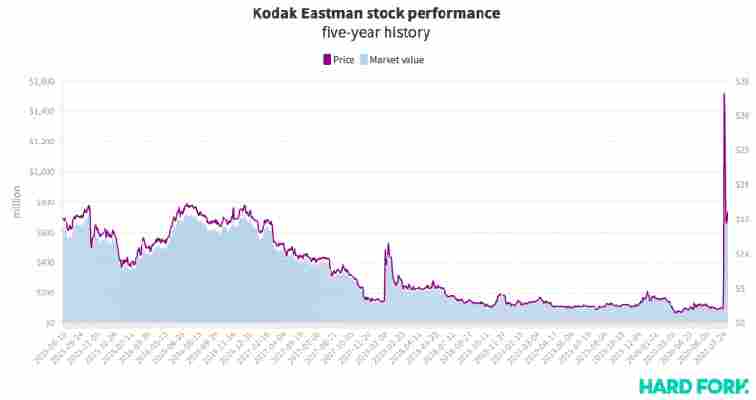

As you can see on the chart below, the last time Kodak Eastman stock rallied this hard was back in 2018. That was when the company touted an initial coin offering (ICO) for a utility token that would power a blockchain-powered licensing platform.

[

But while the DFC says it signed a “Letter of Interest” in regards to the loan on July 28, word of Kodak‘s next move reportedly circulated on the 27th, during which time its share price rose 25%.

From there, Kodak stock surged from under $8 to $33. At its peak, the company’s market value had reached nearly $1.5 billion, despite having struggled to stay above $200 million for the better part of two years.

According to The Wall Street Journal , Democratic Senator Elizabeth Warren recently cited this “unusual trading activity” when asking the Securities and Exchange Commission to look into the matter.

The SEC is also said to be investigating stock options awarded to Kodak execs and board members just before news of its pharma pivot broke.

The New York Times found those rewards had suddenly ballooned to $50 million in value on July 27 — just 48 hours after insiders received them.