Cryptocurrency giveaway scams are nothing new. Fraudsters have been known in the past to impersonate the likes of Elon Musk or Vitalik Buterin to con unwitting victims. And now, just days after its launch, we are seeing crypto con artists impersonate Bitcoin futures platform Bakkt.

Con artists launched a fake website, bakktlauncom, earlier this week, according to a whois URL lookup . Seemingly to capitalize on the recent launch of the actual Bakkt futures which, after being in development for the last couple of years, launched earlier this week .

The fake site appears to rip off the appearance of the legit Bakkt Medium page and claims to offer a “Bakkt official BTC and ETH giveaway.”

The scammers, while opportunistic, have been particularly uncreative in their endeavors. Seemingly they’ve ripped-off an official description of Bakkt which mentions the platform’s “warehouse” which is protected by $125 million insurance policy.

The fake website then encourages users to click a link to receive either Bitcoin or Ethereum. On clicking links one is presented with an all too familiar scene. A page which asks you to deposit a small amount of cryptocurrency to “verify your address,” and claims that you will receive back a greater amount of BTC or ETH, afterwards.

But obviously you never do. and the scammers make off with all the deposits that unfortunate victims send.

Neither of the addresses presented appear to have received any cryptocurrency at the moment, but these kinds of scams often generate new addresses for each user to obfuscate their illicit operations.

It’s all beginning to sound like a broken record. Cryptocurrency scams have been around almost as long as Bitcoin itself.

At least in this case the scammers actually waited for Bakkt to launch. Unlike those who recently attempted to con victims out of cryptocurrency with fake sales of Facebook’s Libra token , when the real thing hasn’t even launched yet.

Come say hi to the Hard Fork team at our blockchain event . On October 15-17 in Amsterdam, hear from top experts as they discuss the industry’s future.

H/T Finance Magnates

WeChat quietly bans cryptocurrency fundraising

The Chinese equivalent of WhatsApp, WeChat, has updated its terms of service to ban merchants from fundraising by using tokens or cryptocurrencies.

The Tencent-operated chat messaging app quietly revised its policy last month; the new policy will take effect on May 31. Merchants violating the update will have their accounts terminated.

A Google-translated version of its new policy states that WeChat users must not “engage in token issuing financing and virtual currency trading platforms directly or in disguise.” The update also forbids users from investing in precious metals (via trading platforms), as well as illegal securities and futures.

Tough times for Tencent

WeChat’s parent company, Tencent, has also been hit by China’s stringent cryptocurrency laws over the last 12 months.

Last year, WeChat had to ban at least eight cryptocurrency media outlets for violating Chinese law by publishing virtual currency trading information and hyping up initial coin offerings (ICOs).

Last year, Tencent also banned cryptocurrency trading on WeChat, it began monitoring accounts to block any cryptocurrency related activity in real-time.

Did you know? Hard Fork has its own stage at TNW2019 , our tech conference in Amsterdam. Check it out .

Yet another reason to dislike Tether: 300 addresses hold 80% of the ‘stablecoin’

Infamous stablecoin and pseudo currency Tether (USDT) doesn’t exactly have the cleanest of rap sheets, and if you needed another reason not to trust it, keep reading.

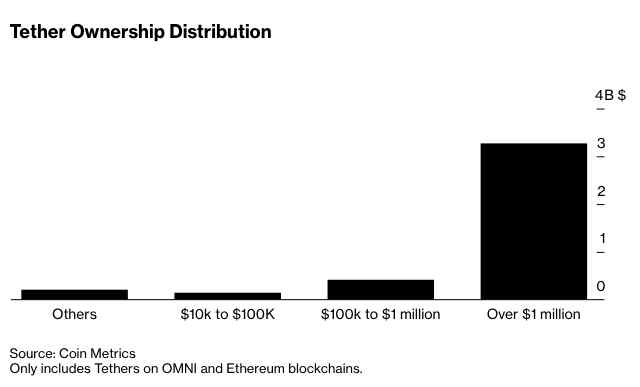

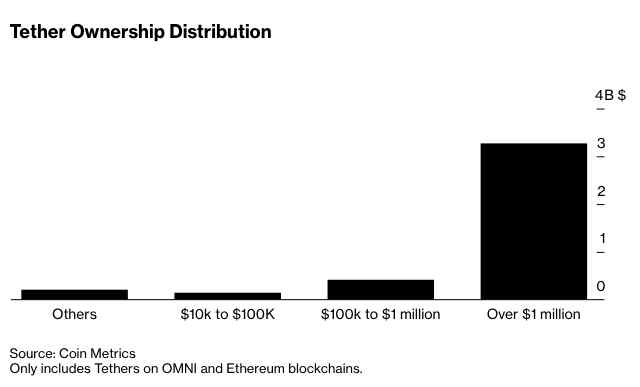

According to recent findings from cryptocurrency researchers at Coin Metrics, around 300 entities hold about 80 percent of the Tether currently in circulation, Bloomberg reports .

The figures show that 318 addresses hold $1 million or more in Tether. Compared to Bitcoin, where over 20,000 addresses hold at least $1 million, Tether appears much more centralized.

“The concentration of Tether suggests that control of [the stablecoin] is in the hands of a few central players who can swing Bitcoin prices, and have a vested interest in doing so,” John Griffin, a finance professor at University of Texas at Austin, told Bloomberg.

In theory the stablecoin sounds like a good idea. It creates a supposedly stable asset that can be used to trade cryptocurrencies on supporting exchanges.

The idea goes that the stablecoin is pegged to the US Dollar, giving investors reassurance that their USDT assets remain stable. In principle, it gives traders access to greater liquidity. The thing is, it’s not actually that stable.

A website that tracks the price of Tether compared to US Dollars found the digital asset can swing to as little as $0.95. That might not sound like much, but in big trades the different could add up quite quickly.

Then there are Tether’s legal wranglings.

In June 2018, a Bloomberg report suggested Tether was being used for wash trading on cryptocurrency exchange Kraken . Later in the year, in November, the US Department of Justice and Commodity Futures Trading Commission (CFTC) were said to be investigating Tether for market manipulation .

Back in April this year, the New York State Attorney General (NYSAG) was building a case to sue Tether and its partner exchange Bitfinex. The case came after investigators discovered the companies tried to cover up the loss of $850 million from one its banking partners . The funds were supposed to secure US Dollar assets to back the stablecoin.

Tether has long claimed it secures the value of its asset with equivalent reserves of US Dollars. However, back in early May, an affidavit from the company’s lawyer admitted that only 74 percent of Tether in circulation is actually backed by cash reserves.

If that wasn’t bad enough, recent court documents showed Tether had used its reserve to invest in Bitcoin and other “assets” – and we all know how volatile Bitcoin can be.

Maybe it’s just me, but Bitcoin wouldn’t be my first choice of investment if stability of value was high on my list of priorities.