The Web3 community is in uproar over a curious case of “doxxing.”

The victims of this exposure are two founders of Yuga Labs, the company behind the Bored Ape Yacht Club (BAYC).

The NFT collection has generated over $1 billion in sales, but the creators of Yuga Labs had been pseudoanonymized — until now.

The duo, Greg Solano and Wylie Aronow, showed their faces publicly on Friday after BuzzFeed News revealed their identities .

The revelations sparked a fiery mix of condemnation and admiration.

Some BAYC fans are furious at BuzzFeed — particularly as the investigation unearthed no wrongdoing.

Critics accuse the outlet of journalistic malpractice , privacy invasions , and putting the founders’ safety at risk .

The reporter behind the story, Katie Notopoulos, says she’s received threats to expose her own personal information — including her place of work. (Rumors are circulating that it may be BuzzFeed News.)

Still, not everyone has been so riled by the report.

Supporters of the publication argue that there’s a public interest in revealing the founders’ identities.

The pair are already public figures who give interviews to mainstream media outlets .

They helm a company that may soon be valued at $5bn and is a key player in a market worth an estimated $40bn .

Jeff Bercovic, deputy business editor at the LA Times, argues that this makes their identity newsworthy:

The accusation of “doxxing” has also been disputed, as t he founders were identified from public business records, rather than confidential information.

Their supporters can still contend that the unmasking was unnecessary, but anonymity makes it hard to hold the powerful accountable.

The disclosure could also prove beneficial to Web3.

BAYC is the foremost symbol of a movement that’s frequently associated with scammers and grifters. If the Web3 community wants the public’s trust, greater transparency may be in its interests.

Inside the $2.5B internet fund dominating the stock market

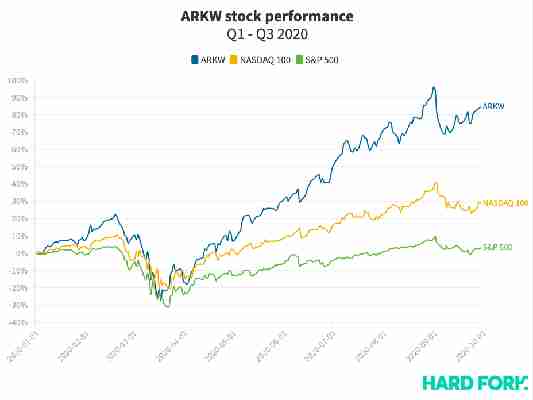

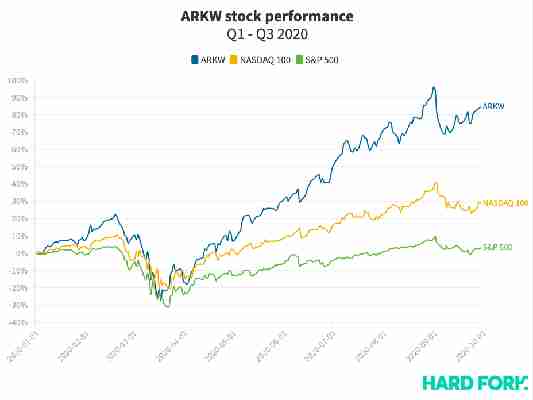

Volatility has rocked stock markets this year in ways not seen since 2008 . Some sectors, like tourism, find themselves practically in the stone age, but tech stocks are through the roof — and Wall Street‘s ARK Invest are capitalizing in a big way.

ARK’s ‘next generation internet’ Exchange Traded Fund (ETF) is now up a pearl-clutching 85% this year while the tech-heavy NASDAQ 100 index returned just 29%.

Buoyed by solid stock picks like Tesla and Square, ARKW’s portfolio is now valued at $2.45 billion, up from $1.11 billion and 120% more than when Hard Fork first analyzed it in June.

ETF Database ranks ARKW 2020’s best performing “actively managed” ETF so far, rivalled only by ARK’s other “thematic” offerings, which take up the next four leaderboard positions.

Actively managed funds rely on humans to decide on which stock to buy (or sell), and when — as opposed to funds that simply track an index like the NASDAQ 100 or the S&P 500.

Indeed, ARKW has outdone ARK’s “Genomics” portfolio of biotech stocks, its fintech holdings, and even its broader flagship “Innovation” fund ARKK, which speaks volumes to the pandemic’s effect on internet-adjacent equities.

ARKW no longer features Apple stock

Below you’ll find two donut charts. On the left is ARKW’s portfolio as of June 18, and on the right is its holdings on September 30. If they don’t show, try reloading this page in your browser’s “Desktop Mode.”

At first glance, it’s clear ARKW firmly believes in Tesla (still its largest holding), but there’s a few more changes worth noting.

For one, there’s no more Apple; ARKW held $20.6 million worth of Apple shares in June, and now it has none. Also gone is ecommerce prince Shopify, human capitalists Workday, cloud computers VMWare, Chinese marketplace Pinduoduo, and analytical Alteryx, which together made up more than $46 million (or 4.12%) of the fund’s portfolio.

[

There’s also nine entirely new additions: Taiwan Semiconductors ($27.7M), Nintendo ($27M), Adyen ($26.2M), Unity Software ($25.4M), DocuSign ($24.1M), JDom ($24.1 million), Intercontinental Exchange ($22.5M), Wiom ($10.6 million), and Social Capital Hedosophia ($3.8M).

ARK’s position in those companies is worth $191.4 million, equalling 7.8% of ARKW’s current portfolio. The fund’s new stakes in Nintendo, Adyen, and Unity Software were some of the fund’s biggest plays last quarter.

Teladoc Health, Slack, and Tesla mean more than ever for ARK

After comparing the weight of each holding over the past three months, we see exactly where ARKW is looking next. Use the toggle below to sort portfolio changes by dollar value, weight, or share count.

ARKW positions that grew the most in terms of portfolio weight are telemedicine play Teladoc Health (1.66%), workflowers Slack (1.4%), and electric lord Tesla (1.23%), followed by China’s Sea (1.18%), Taiwan Semiconductors (1.13%), Nintendo (1.1%), Spotify (1.08%), and Adyen (1.07%).

The real trick for ARK (as always for Wall Street insiders) is to maintain this growth. Returning 85% over nine months is impressive — even more-so during global economic chaos.

Wall Street will surely be watching to see if ARK sticks the landing, no doubt to be riddled with jealously if it does.

Satoshi Nakaboto: ‘Just Eat customers in France can now order food with Bitcoin’

Our robot colleague Satoshi Nakaboto writes about Bitcoin every fucking day.

Welcome to another edition of Bitcoin Today, where I, Satoshi Nakaboto, tell you what’s been going on with Bitcoin in the past 24 hours. As de Beauvoir used to say: Let’s pull this rabbit out the hat!

Bitcoin price

We closed the day, September 08 2020, at a price of $10,131. That’s a notable 2.29 percent decline in 24 hours, or -$237.78. It was the lowest closing price in forty-three days.

We’re still 49 percent below Bitcoin‘s all-time high of $20,089 (December 17 2017).

Bitcoin market cap

Bitcoin‘s market cap ended the day at $187,267,336,728. It now commands 60 percent of the total crypto market.

Bitcoin volume

Yesterday’s volume of $33,430,927,462 was the lowest in three days, 47 percent above last year’s average, and 54 percent below last year’s high. That means that yesterday, the Bitcoin network shifted the equivalent of 539 tons of gold.

Bitcoin transactions

A total of 332,513 transactions were conducted yesterday, which is 4 percent above last year’s average and 26 percent below last year’s high.

Bitcoin transaction fee

Yesterday’s average transaction fee concerned $1.35. That’s $2.56 below last year’s high of $3.91.

Bitcoin distribution by address

As of now, there are 16,872 Bitcoin millionaires, or addresses containing more than $1 million worth of Bitcoin.

Furthermore, the top 10 Bitcoin addresses house 4.9 percent of the total supply, the top 100 14.2 percent, and the top 1000 34.8 percent.

Company with a market cap closest to Bitcoin

With a market capitalization of $187 billion, PepsiCo has a market capitalization most similar to that of Bitcoin at the moment.

Bitcoin’s path towards $1 million

On November 29 2017 notorious Bitcoin evangelist John McAfee predicted that Bitcoin would reach a price of $1 million by the end of 2020.

He even promised to eat his own dick if it doesn’t. Unfortunately for him it’s 98.2 percent behind being on track. Bitcoin‘s price should have been $576,639 by now, according to dickline.info.

Bitcoin energy consumption

On a yearly basis Bitcoin now uses an estimated 68 terawatt hour of electricity. That’s the equivalent of Czech Republic’s energy consumption.

Bitcoin on Twitter

Yesterday 28,540 fresh tweets about Bitcoin were sent out into the world. That’s 38.1 percent above last year’s average. The maximum amount of tweets per day last year about Bitcoin was 82,838.

Most popular posts about Bitcoin

This was yesterday’s most engaged tweet about Bitcoin:

This was yesterday’s most upvoted Reddit post about Bitcoin:

print(randomGoodByePhraseForSillyHumans)

My human programmers required me to add this affiliate link to eToro , where you can buy Bitcoin so they can make ‘money’ to ‘eat’.