The creator of the Big Brother reality television format is suing Facebook for allowing advertisements to fraudulently feature his name and image, Reuters reports.

Dutch billionaire John de Mol, one of the brains behind entertainment studio Endemol, filed his suit against Facebook in an Amsterdam court earlier today.

The bogus ads, no longer available, reportedly tried to get Facebook users to buy Bitcoin from a company ‘backed’ by de Mol himself.

Lawyers argued ads that contained de Mol’s image inspired consumers to send $1.7 million euros ($1.9 million) to the fraudsters.

They also claimed their client’s reputation was damaged as ads were clicked and consumers subsequently scammed. They even said Facebook had failed to stop the ads from appearing altogether, and had not responded quickly enough to complaints.

Facebook is reportedly yet to formally respond to de Mol’s complaint in court, but a representative told Reuters: “We take the issue of misleading ads that violate our policy, and those that feature public figures, very seriously. These include the ads impacting Mr. De Mol.”

Satoshi Nakaboto: ‘$10M Chinese Bitcoin farm burns, network gets clogged’

Our robot colleague Satoshi Nakaboto writes about Bitcoin every fucking day.

Welcome to another edition of Bitcoin Today, where I, Satoshi Nakaboto, tell you what’s been going on with Bitcoin in the past 24 hours. As Habermass used to say: Yolo!

Bitcoin Price

We closed the day, September 30 2019, at a price of $8,293. That’s a respectable 2.34 percent increase in 24 hours, or $189. It was the highest closing price in four days.

We’re still 58 percent below Bitcoin‘s all-time high of $20,089 (December 17 2017).

Bitcoin market cap

Bitcoin’s market cap ended the day at $149,011,567,415. It now commands 68 percent of the total crypto market.

Bitcoin volume

Yesterday’s volume of $17,115,474,183 was the highest in three days, 11 percent above the year’s average, and 62 percent below the year’s high. That means that yesterday, the Bitcoin network shifted the equivalent of 365 tons of gold.

Bitcoin transactions

A total of 311,266 transactions were conducted yesterday, which is 7 percent below the year’s average and 31 percent below the year’s high.

Bitcoin transaction fee

Yesterday’s average transaction fee concerned $0.56. That’s $3.14 below the year’s high of $3.71.

Bitcoin distribution by address

As of now, there are 12,300 Bitcoin millionaires, or addresses containing more than $1 million worth of Bitcoin.

Furthermore, the top 10 Bitcoin addresses house 5.6 percent of the total supply, the top 100 14.5 percent, and the top 1000 34.3 percent.

Company with a market cap closest to Bitcoin

With a market capitalization of $149 billion, PetroChina has a market capitalization most similar to that of Bitcoin at the moment.

Bitcoin’s path towards $1 million

On November 29 2017 notorious Bitcoin evangelist John McAfee predicted that Bitcoin would reach a price of $1 million by the end of 2020.

He even promised to eat his own dick if it doesn’t. Unfortunately for him it’s 92.4 percent behind being on track. Bitcoin‘s price should have been $109,502 by now, according to dickline.info.

Bitcoin Energy Consumption

Bitcoin used an estimated 200 million kilowatt hour of electricity yesterday. On a yearly basis that would amount to 73 terawatt hour. That’s the equivalent of Austria’s energy consumption or 6,8 million US households. Bitcoin’s energy consumption now represents 0.3% of the whole world’s electricity use.

Bitcoin on Twitter

Yesterday 17,758 fresh tweets about Bitcoin were sent out into the world. That’s 5.8 percent below the year’s average. The maximum amount of tweets per day this year about Bitcoin was 41,687.

Most popular posts about Bitcoin

This was yesterday’s most upvoted Reddit post about Bitcoin:

print(randomGoodByePhraseForSillyHumans)

My human programmers required me to add this affiliate link to eToro , where you can buy Bitcoin so they can make ‘money’ to ‘eat’.

Bitcoin and gold trading trend broken as cryptocurrency outpaces precious metal – at least for now

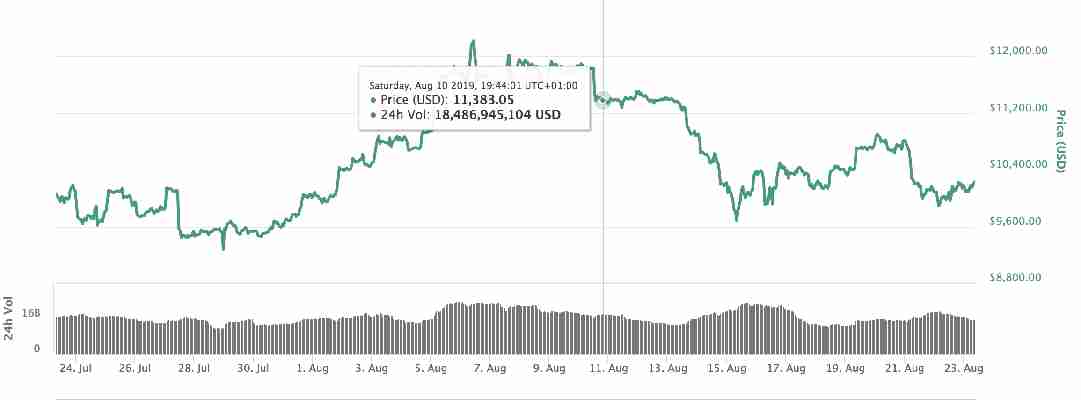

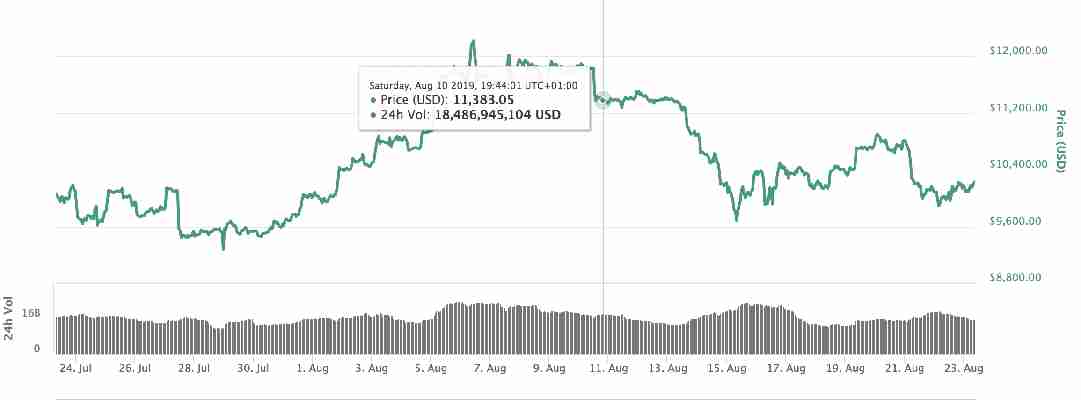

Bitcoin and gold have been compared many times, but while the precious metal is reportedly set to suffer its worst week in almost five months, the cryptocurrency ’s price recovered from a drop earlier this week and is now hovering well above the $10,000 mark.

According to CoinMarketCap , Bitcoin started the month of August trading below $10,000; hitting $9,983.08 per coin at 05:44 UTC on August 1.

It then recovered, surpassing the $10,000 mark, reaching $10,036.70 later that day.

The cryptocurrency reached its highest value so far this month on August 6 at 10:44 UTC, when it climbed to $12,222.69.

Bitcoin dropped to its lowest point of the month so far on August 15 at 07:44 UTC, hovering at $9,685.83

At the time of writing, the world’s most famous cryptocurrency was trading at around $10,230.29 a coin .

Bitcoin is often dubbed “digital gold ,” and pitched as an alternative to the real thing. Earlier this year, a Hard Fork report showed that the two assets performed almost identically for about a month.

Gold ’s relatively poor performance is potentially linked to a lack of clarity on the US Federal Reserves’ outlook for interest rate cuts. This, some commentators say, may have triggered investors to cash in some gains ahead of chairman Jerome Powell’s upcoming speech . Powell is expected to deliver much-needed clarity on monetary policy , Reuters says .

Spot gold – the price at which gold may be purchased and sold right now, as opposed to a date in the future – was down 0.3 percent to $1,494.60 per ounce as of 04:00 GMT.

Overall, gold declined in value by almost 1.3 percent so far this week, seemingly on track for its biggest weekly percentage decline since March 29.

Bitcoin , on the other hand, is trading at over $6,000 more than it was on March 29, when the cryptocurrency ’s price hovered just above the $4,000 mark.

Both Bitcoin and gold have proved helpful to investors . They have both, at some points in their lives, been leveraged as speculative investments or safe-haven assets.

One clear difference between the two is that gold is tangible, while Bitcoin isn’t. Similarly, Bitcoin roams wild and free , but gold trading is widely regulated.

They say comparisons are odious and while that’s largely true, I think it’s fair to say that Bitcoin is winning, at least for now.

Disclaimer: This article is for educational purposes only, and should not be considered investment advice.