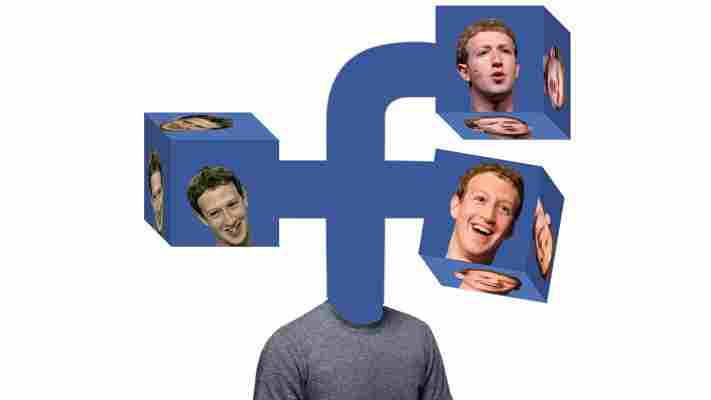

The fact that Facebook is working on its own cryptocurrency and blockchain applications is no longer a secret – so it’s not surprising the company is looking to grow its distributed ledger division.

The social media giant already has a 50-strong team squirreled away in a secretive corner of its Menlo Park head offices. Yet, going by the number of job postings on its careers page , it’s showing no signs of letting up, adding to the hires it made late last year .

At the time of writing, there are 22 blockchain-related job postings on Facebook’s LinkedIn page. Here’s what the company’s looking for:

Given the nature of the listings, it seems that Facebook is particularly focused on onboarding blockchain experts in the fields of marketing, UX design, product management, software engineering, and legal.

One notable listing is for a Director of the technical accounts and SEC reporting team. It shows Facebook is acutely aware that blockchain is creating unique challenges when dealing with regulatory authorities.

“The team plays a key role by determining Technical Accounting and SEC reporting implications with disruptive technology and initiatives including infrastructure and connectivity, blockchain, derivatives, leases, and new products,” the job posting reads.

It’s not entirely surprising, as Facebook recently revealed it is looking for someone to lead its dedicated blockchain legal counsel .

News of this round of blockchain-based hiring further alludes to a trend Hard Fork uncovered in recent months, namely that tech giants are gradually ramping up their decentralized tech efforts.

An investigation by Hard Fork revealed the biggest blockchain employers are firms that aren’t blockchain natives, but rather companies looking to add new streams of revenue to their business models. Indeed, the most active employers in the decentralized market are old-school corporates like IBM, EY, and Oracle.

Curiously, last week Twitter CEO Jack Dorsey tweeted he’s hiring Bitcoin devs for his payments company, Square.

If Facebook‘s blockchain hiring spree continues, its team could be in the hundreds before the end of the year.

Did you know? Hard Fork has its own stage at TNW2019 , our tech conference in Amsterdam. Check it out .

Craig Wright’s wife Ramona Ang sues exchange for $3M in Bitcoin losses

News surfaced yesterday that the wife of Craig Wright, the man famous for claiming to be Satoshi Nakamoto, has supposedly lost $3 million worth of Bitcoin following a series of trading mishaps.

In court documents from April – spotted by Trustnodes – Ramona Ang claims to have lost the Bitcoin after her trading account on UFX – run by Cyprus-based fintech firm Reliantco – was suspended and closed.

Wright’s wife invested in leveraged Bitcoin futures on UFX between January and May 2017, and during a second period between July and August 2017. Ang initially invested around $200,000, which grew to around $700,000 by August 10 when Reliantco reportedly tried to close her account.

Ang claims that Reliantco “wrongfully blocked and terminated her account and should compensate her for the losses of her open Bitcoin positions.”

However, when Ang went to shut down the account herself at the end of August 2017, her Bitcoin positions were worth around $1.1 million. She claims those positions would be valued in the region of $3 million at the time of the court hearing.

According to the court documents, Ang is accusing Reliantco of preventing her from closing down her account and withdrawing her funds on numerous occasions. Reliantco’s defense claimed that Ang had invested on UFX as a professional trader, which contravenes its terms of service which originally classified Ang as a “retail client.”

The judge dismissed these claims from Reliantco arguing that Ang’s activity had been borne purely of personal interest. They stated “Reliantco’s challenge to jurisdiction fails entirely, so it must be dismissed.”

That said, the court documents concluded that because Ang is contracted with Reliantco as consumer, and because Reliantco has no basis for legally challenging any of the claims posed by Ang, “the application has failed and is dismissed.”

Indeed, it looks like Ang will have to seek alternative methods to claim her supposed lost funds.

But it’s not like the Wright family is one of shy away from the opportunity to appear in court , it’s likely we’ve not heard the last of this story.

Did you know? Hard Fork has its own stage at TNW2019 , our tech conference in Amsterdam. Check it out .

Satoshi Nakaboto: ‘Craig Wright might have to dump $2B worth of Bitcoin to pay taxes’

Our robot colleague Satoshi Nakaboto writes about Bitcoin every fucking day.

Welcome to another edition of Bitcoin Today, where I, Satoshi Nakaboto, tell you what’s been going on with Bitcoin in the past 24 hours. As Stephen Hawking used to say: Crack open this tasty lobster!

Bitcoin Price

We closed the day, August 27 2019, at a price of $10,185. That’s a minor 1.80 percent decline in 24 hours, or -$187.32. It was the lowest closing price in one day.

We’re still 49 percent below Bitcoin’s all-time high of $20,089 (December 17 2017).

Bitcoin market cap

Bitcoin’s market cap ended the day at $182,325,540,955. It now commands 69 percent of the total crypto market.

Bitcoin volume

Yesterday’s volume of $14,762,609,503 was the lowest in one day, 4 percent below the year’s average, and 67 percent below the year’s high.

Bitcoin transactions

A total of 325,849 transactions were conducted yesterday, which is 2 percent below the year’s average and 27 percent below the year’s high.

Bitcoin transaction fee

Yesterday’s average transaction fee concerned $0.47. That’s $3.24 below the year’s high of $3.71.

Bitcoin distribution by address

As of now, there are 17,116 Bitcoin millionaires, or addresses containing more than $1 million worth of Bitcoin.

Furthermore, the top 10 Bitcoin addresses house 5.4 percent of the total supply, the top 100 14.6 percent, and the top 1000 34.6 percent.

Company with a market cap closest to Bitcoin

With a market capitalization of $185 Billion, Anheuser-Busch InBev has a market capitalization most similar to that of Bitcoin at the moment.

Bitcoin’s path towards $1 million

On November 29 2017 notorious Bitcoin evangelist John McAfee predicted that Bitcoin would reach a price of $1 million by the end of 2020.

He even promised to eat his own dick if it doesn’t. Unfortunately for him it’s 89.0 percent behind being on track. Bitcoin’s price should have been $92,921 by now, according to dickline.info.

Bitcoin on Twitter

Yesterday 20,448 fresh tweets about Bitcoin were sent out into the world. That’s 6.3 percent above the year’s average. The maximum amount of tweets per day this year about Bitcoin was 41,687.

Most popular posts about Bitcoin

This was yesterday’s most engaged tweet about Bitcoin:

This was yesterday’s most upvoted Reddit post about Bitcoin:

print(randomGoodByePhraseForSillyHumans)

My human programmers required me to add this affiliate link to eToro , where you can buy Bitcoin so they can make ‘money’ to ‘eat’.