At TNW2019, Francis Pouliot, CEO and co-founder of Bitcoin exchange BullBitcoin, gave a technical overview of the cryptocurrency’s network, focusing on how it works, and what it’s capable of.

During his presentation, Pouliot rounded up Bitcoin’s core value and primary directives.

In terms of emergent properties, Pouliot spoke about Bitcoin’s immutability, censorship-resistance, trustless validation, and self sovereignty.

He also highlighted the cryptocurrency’s monetary properties, focusing on its decentralized digital scarcity, fungibility, and liquidity.

Additionally, Pouliot chatted about the platform’s properties, including security, smart contracts, integration usability, and payments.

Pouliot wrapped his talk by clarifying his own stance on the cryptocurrency and its underlying technology.

“I do not consider Bitcoin to be part of the blockchain space. I consider the two to be different,” he stated.

There’s plenty more where that came from. Check out the official schedule to discover the keynotes you don’t want to miss, and watch them on our live streams .

Fixing the financial literacy gap will attract more women to Bitcoin

The blockchain and cryptocurrency industry is dominated by men – fact.

There are many reasons as to why this could be the case – namely a pipeline problem or the rhetoric that men are typically (and allegedly!) more interested in technology – but a recent study has posed an interesting question.

What if the cryptocurrency industry’s lack of diversity was down to women being less financially literate than men?

Perhaps there is more to cryptocurrency’s diversity problem than women simply not being interested in the technology.

The findings

The study documented a significant gender gap in Bitcoin literacy in the US, suggesting that women’s knowledge about the cryptocurrency is lower than that of men.

Socio-demographics and personality traits, the study says, only explain part of the gap.

Actual and perceived financial literacy, however, accounts for around 40 percent of the gender gap in Bitcoin literacy.

Overall, the report notes that closing gender gaps in financial literacy is important, but protecting financial wellbeing in increasingly digital financial systems is even more complicated.

Unequal access to the financial system

On another note, a study released by cryptocurrency exchange Coinbase today revealed some interesting insights.

The company surveyed more than 6,000 adults in the UK and US. Some 82 percent of women surveyed across all age ranges and education levels in the US and the UK — compared to 65 percent of men — think financial independence for women is very important.

But nearly one-third of college-educated females surveyed said they didn’t think they had equal access to the financial system in their own country.

Coinbase’s survey found that 39 percent of millennial women would be interested in cryptocurrency if they knew it could make finance more accessible.

Another report showed that 77 percent of affluent millennials in the US believe the current financial system is designed to favor the rich and powerful in detriment of ordinary people.

Unfortunately, global data tells a similar story. According to the World Bank’s 2017 Global Findex Database, 65 percent of women globally have a bank account compared to 72 percent of men.

This exactly highlights why getting women to care about the power of decentralized finance is so critical – because it has the power to provide access to a financial landscape that’s typically inaccessible.

Problems with cryptocurrency and blockchain

We all know the blockchain and cryptocurrency industry suck at diversity , but what are we doing about it?

I’m all for highlighting women‘s amazing work in the industry and celebrating their success, but I understand why some women, myself included, get frustrated with the rhetoric at time s.

In my opinion, we need to take things back to basics and first fix the fact that many women feel they don’t have equal access to finance, or that they can’t access it as easily as men.

Much of the mistrust of the financial system transcends into the cryptocurrency and blockchain space. Similarly to how the aforementioned results showed many believed financial institutions exist to protect the wealthy and powerful, one could also argue Bitcoin and other cryptocurrencies are mostly attractive to those who have sizable disposable incomes to invest in inherently volatile assets.

It’s not uncommon for Bitcoin to be touted as a viable solution for the world’s developing countries – where many women (and men!) lack access to basic financial instruments – but how does it currently benefit people with fewer resources?

Another use-case for those in developing (and hyperinflating) economies is leveraging cryptocurrency as a hedge against devaluing local currencies – again, do those who are most in need in these dire situations have access to the technology (and internet connection) required to safely use Bitcoin and get the most out of it?

I feel it’s important to address these issues before we move on to fix the broken pipeline. Yes, we need to attract more women to the industry, but for that to happen, the industry needs to take a hard look at itself and change the way things are done, the language that’s used, and figure out how to make finance more relatable for those still uninitiated.

In the meantime, let’s celebrate International Women’s Day, and not waste the opportunity to think about how we can avoid women being forgotten in the new financial world that’s quickly emerging.

Did you know? Hard Fork has its own stage at TNW2019 , our tech conference in Amsterdam. Check it out .

PayPal snitched on bullish movie pirate who bought $1M in cryptocurrency from Coinbase

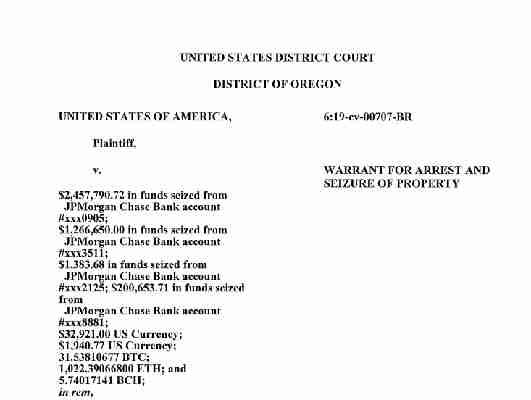

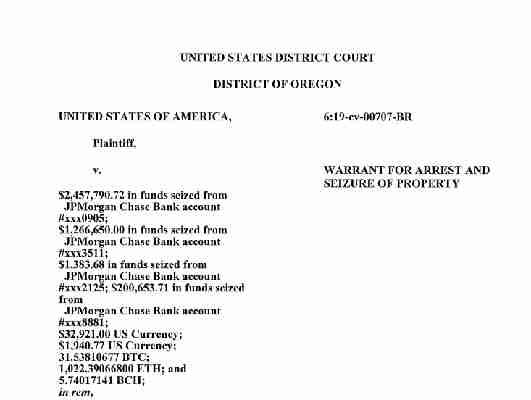

US authorities have seized over $4 million worth of cryptocurrency and cash following a movie piracy investigation conducted by Homeland Security Investigations (HSI) and Motion Picture Association of America (MPAA). But here’s the saucy part: it was PayPal that tipped off the detectives to the case.

The investigation dates back to October 2013, when PayPal pointed HSI to two supposedly illegal streaming services ( Noobroomom and Noobroom7om), TorrentFreak reports . Curiously, the owner of the pirate sites held a rather diversified portfolio of cryptocurrencies, including Bitcoin, Bitcoin Cash, Ethereum, and Litecoin.

According to court documents, an Oregon federal court is already reviewing the case. Authorities are seeking the forfeiture of all funds seized on the basis that the owner of the streaming sites conspired to commit copyright infringement and money laundering.

After the HSI reported the streaming services to the MPAA, the film industry association found that the websites illegally distributed copyrighted works. It also noted that Noobroom generated revenue by collecting subscription payments via Stripe and PayPal.

Shortly after its investigation, the MPAA sent a cease-and-desist letter to Noobroom and its associated websites.

Instead of complying with the order though, the MPAA discovered that Noobroom notified users that their accounts were being moved to a new domain, called SuperChillinom. Eventually, the MPAA linked SuperChillinom to two additional piracy portals, movieo and Sit2Plaom.

It also found the websites were managed by an individual going by the name of Talon White.

Investigators discovered that all Noobroom revenue – generated by subscription payments – was then moved from the streaming service’s Stripe account to bank accounts controlled by White.

According to court files, Noobroom and its associated websites received almost 80,000 payments of $9.99 between October 2015 and December 2016, amounting to $789,060.

The investigators also detected another 7,611 payments of $25.49 ($194,004.39) and 5,348 payments of $44.99 ($240,606.52) linked to Noobroom.

Another review of White’s Stripe transactions showed the Noobroom owner received a total of $6,373,816.57 in another 396,843 payments between October 2017 and September 2018.

After obtaining a warrant from an Oregon court, authorities seized over $4 million in cash and cryptocurrency from White.

Interestingly, the court documents note that “withdrawals from [one of White’s JP Morgan Chase bank accounts] include over $1 million used to purchase cryptocurrency through Coinbase, a virtual currency exchange.”

In addition to the $4 million found in four separate JP Morgan accounts, authorities also seized 31.53 Bitcoin ($254,964), 1,022.39 Ethereum ($211,972), and 5.74 Bitcoin Cash ($2,252) from White’s Coinbase accounts. Although not seized, court documents reveal White also purchased over $72,000 worth of Litecoin. Pretty bullish.

A court has since ordered the IRS to hold the funds until further notice.