Update: After the publishing of this article, the GameStop story has taken wild turns. You can catch up with that with our handy reading list .

In an unusual event, video gaming company GameStop’s shares touched a record-high price of $76.76 — thanks to a battle between Redditors and short sellers.

Just to give you an idea of this bizarre growth, GameStop’s shares were trading between $3-$4 this time last year.

All of this began when short selling company Citron was scheduled to explain its stance on Gamestop on a live stream last Thursday. However, the company said it had to cancel the event because of too many hacking attempts on its Twitter account .

Meanwhile, members of r/WallStreetBets started to buy GameStop shares for cheap prices, forcing Citron to buy its own quota of stocks that it needed to return to its lenders. This resulted in a tug-of-war that drove the company’s stock up.

GameStop had a tough 2020 because of it s general business direction as a company with several physical locations selling video games and the pandemic. According to a Bloomberg report, the company planned to close more than 450 of its retail locations and move its business online towards the end of the year . Earlier this month, GameStop refreshed its board with three executives from pet ecommerce company Chewy .

In an interview with Bloomberg last week, Citron’s managing partner Andrew Left said that after this unprecedented surge, the electronics company’s shares will return to the $20 price mark soon .

If you want to know more about the battle between Citron and r/WallStreetBets, Ars Technica has a handy explainer .

Elon Musk eclipses Bill Gates to become the world’s second richest person

Elon Musk is now worth more than $128 billion, making him the second richest person in the world behind Amazon bald-king Jeff Bezos.

Tesla’s chief exec barely eclipsed Microsoft’s Bill Gates to claim the number two position overnight, according to Bloomberg’s Billionaire Index .

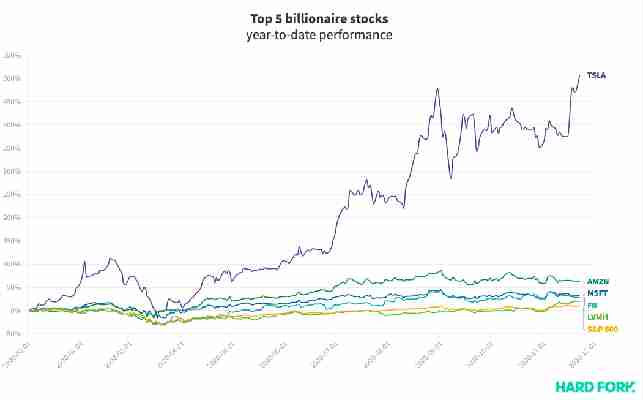

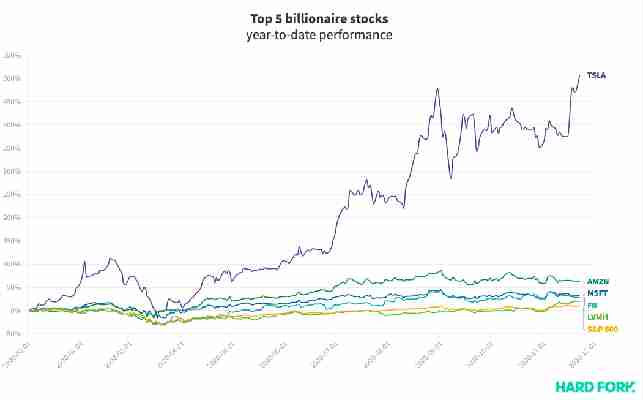

Mostly, Musk’s gains can be attributed to Tesla‘s rampaging share price. Musk owns around 20% of all Tesla shares, meaning that when Tesla stock pumps, so does his paper fortune.

Indeed, the enigmatic billionaire has added over $100 billion to his on-paper net worth in 2020, during which time Tesla stock absurdly returned more than 500%.

This makes Musk the number one earning billionaire for this year. He’s $33 billion ahead of Bezos, and $75 billion ahead of Facebook’s Mark Zuckerberg in 2020.

After Gates, Musk only has Bezos to go

The thing is, Musk is on path to get even richer , thanks to his enormous executive compensation package with Tesla, which is the biggest of its kind in history. Estimates put the eventual total value of those stock rewards at $55 billion.

(If the visualization below doesn’t show, try reloading this page in your browser’s “Desktop Mode”.)

In May, Musk unlocked the first of 12 tranches, worth $780 million at the time. He did so by maintaining Tesla’s average market value above $100 billion for six months.

Musk then unlocked the second and third tranches a few months later, worth more than $2 billion each. By October, he’d qualified his fourth tranche, representing more than $3 billion in potential profit.

Tesla’s market value now sits at nearly $500 billion, with Musk on track to continue unlocking more billions.

For what it’s worth, Forbes ranks billionaires based on an entirely different methodology. Over on that website, Musk is only the world’s fourth richest person, behind Bezos, Gates, and Louis Vuitton Moët Hennessy’s Bernard Arnault and family.

Sodinokibi ransomware earns hacker $287K worth of Bitcoin in 3 days

Criminals who distributed the Sodinokibi ransomware threat earned a huge payday from victims who paid the requested Bitcoin ransom.

According to researchers at McAfee , who tracked down several posts published on underground forums , one particular distributor made the equivalent of $287,499 in Bitcoin in just 72 hours.

Researchers found that Sodinokibi has more than 40 active affiliates and that its creators typically get between $700 and $1,500 from every payment .

Additionally, blockchain analysis unearthed several transactions from affiliates to a wallet that contained $4.5 million worth of Bitcoin .

Some of this money was used to purchase illicit goods and services on the dark web , on marketplaces such as Hydra Market .

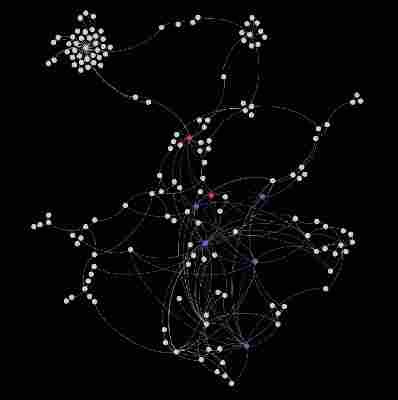

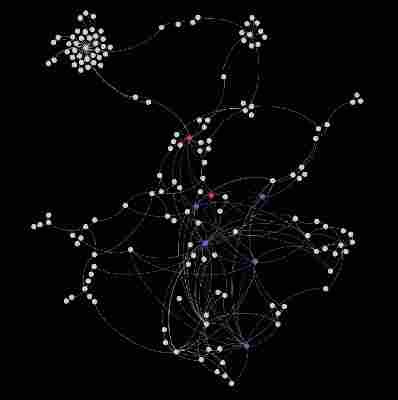

“Although it might look like spaghetti, once you dive in, very interesting patterns can be discovered. We see victims paying to their assigned wallets ; from there it takes an average of two to three transactions before it goes to an ‘affiliate’ or ‘distribution’ wallet ,” the researchers explain.

“From that wallet we see the split happening as the moniker ‘UNKN’ mentioned in his forum post we started this article with. The 60 or 70 percent stays with the affiliate and the remaining 40/30 percent is forwarded in multiple transactions towards the actors behind Sodinokibi,” they add.

How does Sodinokibi work?

Unleashed in April this year, Sodinokibi, otherwise known as REvil, is a serious threat .

Initially, the ransomware was seen propagating itself in the wild by exploiting a vulnerability in Oracle ’s WebLogic server .

Similarly to other strains of ransomware , Sodinokibi is a Ransomware -as-a-Service (RaaS), which sees a group of people maintain the code and another group , known as affiliates, spread the ransomware .

Ransomware has increasingly made headlines in recent years after several high-profile attacks . Just last week, The Next Web reported on how healthcare providers were facing an unprecedented level of social engineering-driven malware threats .

In fact, several hospitals in the US recently gave in to attackers’ demands and paid the requested ransom , most likely in cryptocurrency .

Although it’s not uncommon for organizations to cough up the funds in order to avoid prolonged disruption , sometimes attacks backfire.

Last week we saw how a ransomware victim who paid Bitcoin to unlock his files took vengeance on his attackers, by hacking them right back.

“We do understand that there are situations in which [company] executives decide to pay the ransom but, by doing that, we keep this business model alive and also fund other criminal markets ,” said McAfee ‘s researchers .

Want more Hard Fork? Join us in Amsterdam on October 15-17 to discuss blockchain and cryptocurrency with leading experts.