The Bill and Melinda Gates Foundation made just one stock market play last quarter: selling off $1 billion worth of shares in Warren Buffett’s Berkshire Hathaway.

But despite its Berkshire dump, the Gates Foundation’s stock portfolio was still worth $17.864 billion as of its latest SEC disclosure , up some $512 million since last quarter .

(NB: If the visualisations don’t appear, try reloading this page in your browser’s “Desktop Mode.”)

Still, the Foundation’s portfolio remains Buffett heavy, with $7.1 billion invested in Berkshire Hathaway — representing 40% of Gates‘ total assets under management.

After Buffett, Gates‘ next biggest bets are infrastructure and industry stocks like Waste Management Inc ($1.97 billion), Canadian National Railway ($1.52 billion), and Caterpillar Inc ($1.42 billion).

Speaking of Berkshire, Buffett’s firm made a pretty interesting move last quarter when it bought $563 million worth of stock in the world’s second largest gold miner, Barrick Gold Corp.

Buffett’s gold play is notable considering the lengths at which the Omaha Oracle has trashed gold in the past . Some analysts say Berkshire could’ve been attracted by Barrick’s dividends .

Gates vs. Buffett: Whose portfolio is bigger?

For what it’s worth, Berkshire Hathaway‘s stock portfolios is huge compared to the Gates Foundation‘s, with more than $202 billion in assets under management according to its latest SEC disclosure .

That’s likely by design. The Foundation has generally kept its assets under management at around $20 billion over the past five years, as it presumably sells stock to fund charitable endeavours.

[

Berkshire, on the other hand, has increased the value of its assets under management significantly over the past half-decade, from $109.57 billion to more than $202 billion as of June 30.

Interestingly, the value of the two portfolios appear to share at least some correlation on a logarithmic scale, which you can see on the visualisation above.

As for what Gates‘ largest stock market play has been so far this year, that’s biotech software unit Schrodinger Inc, which went public in February. The Microsoft co-founder’s Foundation had acquired 6.981 million Schrodinger shares by the end of March, worth $301 million at the time.

Gates’ fund didn’t touch its Schrodinger holdings last quarter. And if it hasn’t since then, it’s now sitting on more than $473 million worth of Schrodinger stock.

Bezos just took his first post-COVID (stock) dump — and it’s worth $3.1B

Amazon‘s Jeff Bezos unloaded $3.1 billion worth of company stock earlier this week, representing a little less than 2% of his personal stake in the ecommerce giant.

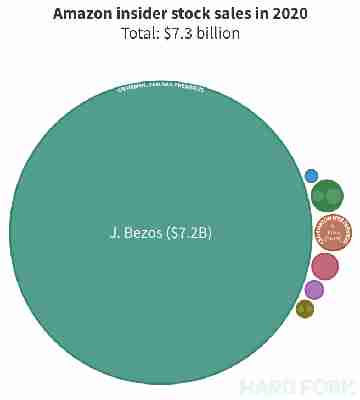

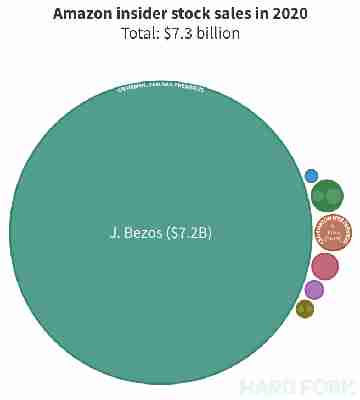

Bezos‘ August dumps, which were all made as part of a pre-determined trading plan lodged with the SEC, brings the total value of the billionaire chief exec’s $AMZN sales to a jaw-clenching $7.2 billion.

In total, Bezos sold 1 million shares, and while the price varied, he generally got around $3,130 per share.

While company execs getting rid their own stocks is common practice, Bezos now accounts for more than 98% of the stock sold by Amazon insiders so far in 2020.

In that time, Amazon‘s share price has risen 80%, breaking multiple price records along the way.

[

Amazon Web Services CEO Andrew Jassy sold around $22 million worth of their company stock alongside Bezos, according to the SEC docs gathered by finance portal Finviz .

Much less, but Finviz calculated that Jassy managed to sell at a slightly higher price ($3,183) than the bossman.

Bezos sales in August are notably his first in more than six months. He generated around $680 million on January 31, and more than $3.3 billion during the first week of February. Back then, $AMZN traded at around $2,000.

Bezos previously pledged to sell roughly $1 billion per year to fund his space exploration project Blue Origin.

Funding secured.

Ugandan cryptocurrency startup promises jobs — steals employees’ money instead

A number of Ugandan citizens have been left in the lurch after being promised jobs at a cryptocurrency startup that’s gone dark.

Independent Ugandan newspaper Daily Monitor reports that dozens of people in the Masaka District have been fleeced of their own money and employment after falling for the promises of a bogus cryptocurrency business.

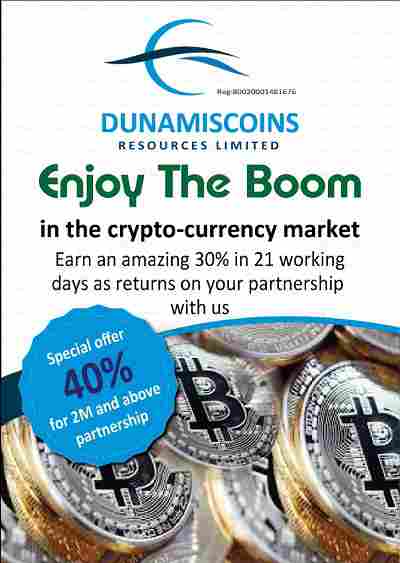

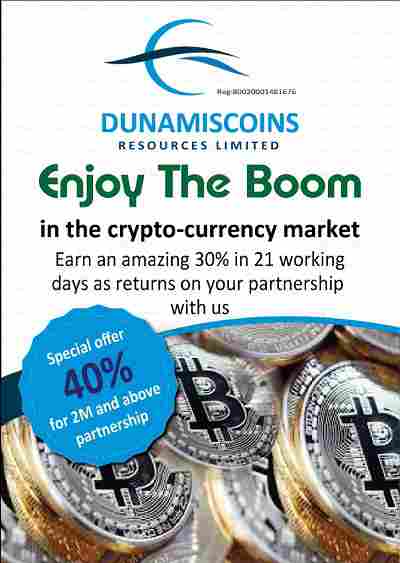

According to the report, Dunamiscoins Resources Limited opened in Masaka Town last month and began inviting individuals to invest and become part of its “digital currency network.”

However, just a month after opening, Dunamiscoins’ offices have reportedly closed down.

A businessman who worked next door to Dunamiscoins said that the company had been convincing people to join its “network” by promising 40-percent returns on cash investments.

The heinous company had apparently been working with money transfer companies in the local area to recruit new people to the scheme.

If stealing money wasn’t enough, the scheme also hired at least 50 locals to work for the firm. They recruited marketing executives, cashiers, managers, and office assistants.

One individual, that was working for Dunamiscoins as a salesperson, said the company also fleeced its employees of money they had paid for registration. They were also promised high returns on investments.

Each applicant was allegedly asked to pay 20,000 Uganda Shillings, (about $5) to register with the company. But when they turned up for work the following day, the offices were deserted.

Indeed, that might not sound like much money, but perhaps that strategy is what helped the scam get off the ground.

Victims are calling for others who have been affected to come forward and report their experiences to the relevant authorities.

The Ugandan government has — on numerous occasions — stated that it does not recognize cryptocurrency as legal money and that no organizations have been licensed to sell the digital assets in the country.

Representatives from Dunamiscoins have reportedly been unreachable.

The Dunamiscoins website is still live at the time of writing. Hard Fork attempted to contact the email listed on the website only to receive an “address not found” error.

We’ve all heard about cryptocurrency scams robbing investors of money , but robbing them of jobs? That sounds like a new one.

Perhaps the saddest thing about all of this is that dozens of people were promised employment that never materialized.