According to a recently published report from investment management firm Charles Schwab, millennials invested more in Bitcoin than they did in the likes of Disney or Netflix over Q3 of this year.

The figures come from the quarterly Schwab Report , which benchmarks the activity of retirement plan investors within self-directed brokerage accounts.

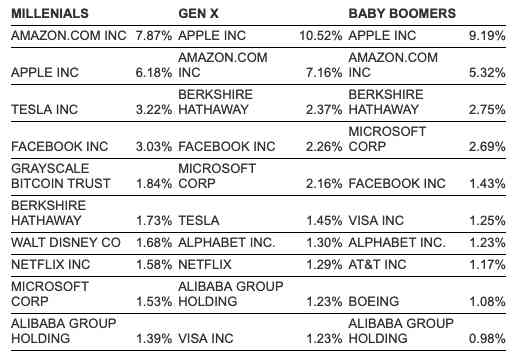

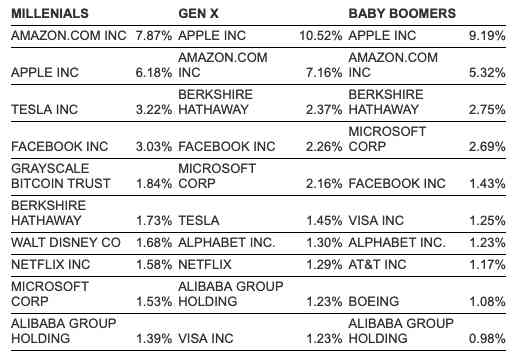

Schwab’s figures show that millennials (25-39 years old) hold 1.84 percent of their assets in the Grayscale Bitcoin Trust (GBTC). The GBTC is an investment product — from Digital Currency Group — that sells shares in the fund to accredited investors. The fund is managed for investors by Grayscale and trades and holds Bitcoin directly.

In comparison, millennials reportedly hold 1.58 percent of their assets in Netflix stocks and 1.68 percent in Walt Disney Co.

Gen X and Baby Boomers, on the other hand, do not appear to rate Bitcoin that highly. Grayscale’s Bitcoin investment product doesn’t feature in the top 10 equity holdings for either of these generational groups.

These elder generations tend to favor more mainstream investments in companies like Apple, Amazon, and Berkshire Hathaway — Warren Buffet‘s famed holding company.

Given the relative newness of Bitcoin, it’s not surprising that it’s more popular among younger investors, who are often considered to have a greater appetite for risk .

Alleged BTC-e boss will be extradited to France over cryptocurrency fraud

The man thought to be behind notorious cryptocurrency exchange BTC-e, which is involved in a multi-billion Bitcoin fraud case , will be extradited to France .

According to a Greek news report , Alexander Vinnik is facing allegations of laundering at least $4 billion through the cryptocurrency exchange.

The extradition comes after a Greek court reportedly gave the go -ahead.

Vinnik’s lawyer Zoi Konstandopoulou said he had been flown to France just hours the court ruling. The lawyer said he had been taken to hospital as he was on the 35th day of a hunger strike in protest of his prospective extradition to the European country, The New York Times (NYT) reports .

However, NYT notes that Greek authorities were unable to confirm on Thursday whether Vinnik had already left Greece.

France reportedly wants to trial Vinnik for alleged cybercrime, money laundering, belonging to a criminal organization, and extortion.

As previously reported by Hard Fork , Vinnik was arrested by Greek authorities in July 2017 while he was holidaying in the country with his family.

The arrest came after Russia , France , and the US all issued international warrants for his arrest .

Vinnik has maintained his innocence throughout saying : “I do not consider myself guilty […] The fact that I worked for BTC-e and did my job , and it’s not justifiable to accuse me of it. I found out about the charge about a month after I was taken into custody. This was told to me by my Russian lawyer.”

Founded in 2011, BTC-e is reported to have handled almost 5 percent of Bitcoin ’s trading volume at one point. However, subsequent research showed that as much 95 percent of ransomware-related cashouts took place through its platform.

An attempt to shut down the exchange was made by the US Justice Department after they charged Vinnik (and BTC-e) with allegedly running an international money laundering operation featuring stolen funds from Mt. Gox .

CRISPR’s Nobel Prize sent gene-editing stocks into overdrive

Biotech stocks continued to surge on Wednesday after two scientists responsible for gene-editing tool CRISPR received this year’s Nobel Prize for Chemistry.

CRISPR-powered stocks Intellia Therapeutics (NTLA), Editas Medicine (EDIT), and Beam Therapeutics (BEAM) have now jumped 13%, 11%, and 6% respectively.

CRISPR Therapeutics (CRSP), co-founded by one of the Nobel winners Emmanuelle Charpentier, is also up more than 11% since Wednesday morning.

Collectively, these four CRISPR stocks are now worth nearly $12.2 billion — up from $6.5 billion in February with nearly $430 million added to their market values overnight.

Now valued beyond $7.1 billion, CRSP is by far the biggest CRISPR-centric company on the market. And it’s the best performing of the four above, having returned 65% so far. Tennessee-headquartered NTLA is second with 63%.

Wall Street rates CRISPR-powered stocks

CRISPR offers a relatively cheap and relatively method of editing practically any kind of DNA (animal or otherwise).

As one might expect, it’s already triggered a myriad of moral, ethical, and legal troubles for scientists, but researchers say the tool could lead to cures for a wide array of genetic diseases.

[

For what it’s worth, Bank of America (BoA) finds the hype justified, at least in the short-term. BoA analysts reportedly issued their first rating to CRSP earlier this week: “Buy” with a price target of $110 (current price $96).

Goldman Sachs also rated NTLA for the first time last month when it labelled it a “Buy” and set its price target to $33 (current price $23), according to finance portal Finviz .

None of this is investment advice. Don’t pretend it is, because it’s not. Always do your own research.