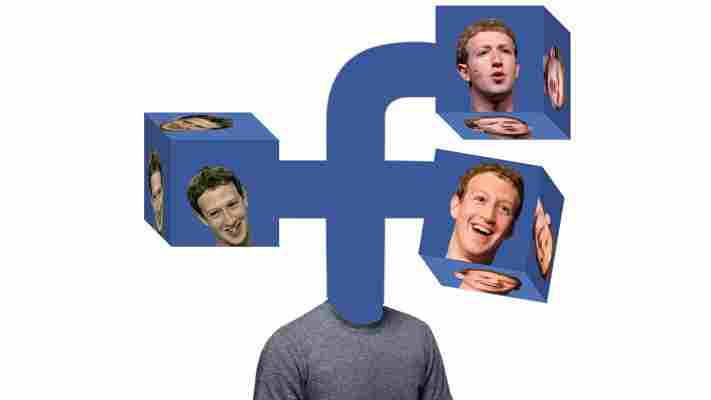

Given its history of managing our data, it shouldn’t take much to convince you that Facebook managing our money is probably a terrible idea. That said, it seems the social media giant is actually aware of that particular challenge.

Facebook plans to relinquish control of its upcoming cryptocurrency GlobalCoin to external companies, The Information reports . It will officially unveil its digital currency later this month.

The social media giant has been courting financial institutions and other tech companies to form an independent foundation to govern the digital asset.

Before you think this is going to create some kind of democratic representation of the people, think again. There’s no mention if Facebook/GlobalCoin users will be represented in the foundation.

Facebook is also going to charge firms $10 million each to run a node for the GlobalCoin network. All node operators will be allowed to have a representation in the foundation.

The Big F wants to launch 100 nodes to generate $1 billion fees. It’s planning on using these funds to back its cryptocurrency, though; so in someway, it’s asking node operators to stake their interest and commitment, and tie them into supporting the network. But it certainly won’t be as decentralized as Bitcoin. It’s worth noting this sounds a lot like EOS’ DPoS (delegated Proof-of-Stake).

According to people in the know, Facebook will heavily market GlobalCoin to developing nations where local fiat currencies are unstable. This isn’t the first time cryptocurrency or digital tokens have promised to help those in struggling economies. It still remains to be seen if cryptocurrencies are enough to overcome complex economic and social struggles, though.

It’s often touted that Bitcoin could help those most in economic need. But in some cases, such as Argentina’s alleged influx of Bitcoin ATMs , it’s often just an exploitation of opportunity preying on the potentially vulnerable.

What’s GlobalCoin?

I’m pretty sure that most people have heard about Facebook’s foray into digital currencies – even my mum has, and that’s saying something. But here’s the TL;DR.

Facebook has been hiring blockchain developers left right and center over the last 12 months. While its kept its blockchain division separate from the rest of the company, it was clear Facebook was working on something cryptocurrency-related.

Earlier this year, rumors and speculation that Facebook was working on a cryptocurrency started to spread . Some reports suggested the social media company was working on a stablecoin, though nothing was confirmed.

Then last month, Facebook announced it was indeed working on a fiat-backed stablecoin called GlobalCoin. It even registered a new company in Switzerland to handle its upcoming cryptocurrency.

Reports suggest the company is focusing on the regulatory challenges facing its coin. Zuckerberg has met with the Bank of England governor Mark Carney, and representatives from Winklevi led Wall St. crypto-firm Gemini.

GlobalCoin was initially pegged for a trial roll out in early 2020. As for what Facebook will officially announce later this month? Watch this space.

Court rules Bitfinex’ info on $850M Tether black hole unnecessary – for now

Cryptocurrency exchange Bitfinex can now stop sharing documents about its use of Tether with the New York Attorney General (NYSAG) after winning a motion in the appellate division of the New York Supreme Court over an alleged $850 million cover-up .

Tether is a controversial ‘stablecoin’ issued by Tether Limited, which formerly claimed each token was backed by one US dollar. However, as previously reported by Hard Fork , an affidavit submitted in May showed that it is only 74 percent backed by cash and equivalents.

The case first exploded in early April after NYSAG Letitia James began to build a case to sue Bitfinex and Tether.

At the time, James claimed the company behind Tether had minted as much as $900 million worth of the cryptocurrency for Bitfinex .

Yesterday’s court order is being touted as a win, but a source close to the case told Forbes it was only a partial victory.

For clarity, the motion means that both companies can stop providing paperwork about their relationship to investigators until a final decision on an appeal to dismiss the entire casee is reached. So, it could just end up being a temporary pause on the case .

But let’s not forget that back in August, a New York court denied Bitfinex and Tether’s motion to avoid the legal clap back from its multi-million cover-up.

Canada relaxes rules for cryptocurrency exchanges despite ongoing QuadrigaCX saga

Reassurance for Canadians: Cryptocurrency exchanges across the nation will now only have to report transfers of more than CA$10,000 ($7,663).

It comes after the Canadian government relaxed some of its new anti-money laundering regulations following feedback from payment service providers and cryptocurrency exchanges.

As a result of the changes, cryptocurrency platforms, both in and outside of Canada, now classify as money service businesses (MSBs).

“MSBs will now include domestic and foreign businesses that are “dealing in virtual currency […], Canada’s government said. “As required of all MSBs, persons and entities dealing in virtual currencies would need to fulfil all obligations, including implementing a full compliance program and registering with FINTRAC,” the government said.

Back in March, reports surfaced about Canada’s tax agency reportedly cracking down on cryptocurrency investors in the country.

The agency was thought to have sent questionnaires probing investors about their bitcoin-related activity over the past 10 years.

Canada has also been rocked by the (still ongoing) QuadrigaCX saga in recent months. The cryptocurrency exchange that made headlines across the world after its founder and CEO Gerald Cotten passed away unexpectedly without giving anyone else access to the company’s cryptocurrency wallets.

“These amendments serve to mitigate the money laundering and terrorist activity financing vulnerabilities of virtual currency in a way that is consistent with the existing legal framework, while not unduly hindering innovation. For this reason, the amendments are targeted at persons or entities engaged in the business of dealing in virtual currencies, and not virtual currencies themselves,” the government added.