A new study has linked cryptocurrency trading obsession with problematic gambling – those who bet too regularly are at an elevated risk of trading cryptocurrency more frequently.

The study , which surveyed 876 adults who had gambled at least monthly, found that more than 50 percent of participants had traded cryptocurrency over the past year.

Additionally, over 75 percent of high-risk stock traders also traded cryptocurrencies. This, the research concludes, is likely due to their impulsivity and belief that they can beat or outsmart the fledgling cryptocurrency market.

Lead author Devin Mills commented: “For some people, trading cryptocurrency is seen as an investment opportunity. But there is an alarming proportion of people who are ‘gambling’ on these cryptocurrency markets as they would gamble on horses or sports or slots. And it has the potential to get them into significant trouble.”

The data collected showed that gamblers trading both cryptocurrency and high-risk stocks reported more problem gambling, anxiety symptoms, and overall greater depression than gamblers either trading only cryptocurrency or just high-risk stocks.

As a result, researchers concluded both shared similar demographics and gambling preferences but also presented additive consequences which require further attention among researchers and mental health professionals.

These are the signs cryptocurrency trading is a problem

The correlation between cryptocurrency trading and problem gambling is intriguing, but it’s not new.

Cryptocurrency‘s inherent volatility is likely to attract investors looking to make a quick buck. On the flipside, it’s also what makes cryptocurrency investing riskier.

Hard Fork previously wrote about a facility in Scotland called Castle Craig which opened a dedicated cryptocurrency addiction center last year because professionals there believed cryptocurrency addicts portrayed the same behavior as problem gamblers – they show an urge to continually trade cryptocurrencies despite suffering constant losses.

According to the facility, the signs of being addicted to trading digital currencies could include:

Spending a great deal of time on the activity of trading in cryptocurrency, checking prices and thinking about the activity – so that other occupations such as work, socializing and exercise do not get done

Debts and financial problems

Lying to friends and family about one’s activities/problems

Mood swings, feelings of hopelessness and depression

Anxiety, leading to physical symptoms such as sweating and tremors

Unrealistic views such as being ‘lucky’, chasing losses

Attempting to control activity without success

If you suffer from any of these symptoms or you think you could be suffering from addiction, seek help from a professional. If you’d like to find out more about cryptocurrency addiction, check out the TNW Answer session with Castle Craig’s professionals.

Want more blockchain news? Come to TNW2019 , our tech conference in Amsterdam, and check out our Hard Fork track .

Why did the chicken cross the road? To get fed by blockchain

It’s a cold, wet, and windy day in mid-January. You hear the knocking of the shutters against the window pane as you roll over in bed trying to find some warmth. Looking at the clock that’s been handed down four generations in your family you see it’s still not even four in the morning. You realise it’s time to feed the chickens.

As you rise from your stupor you think to yourself, “this would be so much easier if I could do this with the blockchain.” Well my friend, now you can! With Pollofeedom.

No more do you have to brave the cold in winter. All you have to do is fire up your Lightning Wallet and send the paltry sum of 1,000 Satoshis to Pollofeed via the Lightning Network and it will feed the chickens for you.

It’s finally starting to feel like Bitcoin is getting useful, real-world use cases.

But it’s not just chickens that are getting their claws on Bitcoin.

Satoshi’s world recently launched an augmented reality type game which let people graffitti over a Google Maps feed all in exchange for some Satoshis. Someone even took the opportunity to write “Bitcoin” on the White House.

Dutch hacker Roeland P Lanparty recently put a child’s Lego train on the STEEM blockchain and it would make a “choo-choo” sound everytime a block is signed.

The Lightning Network, designed for high-speed low-value payments, has become quite the focus for blockchain developers. Devs are putting everything from candy machines , Coca-Cola , roulette , and even Pokémon on the blockchain courtesy of the Lightning Network.

H/T – Alistair Milne

The IRS’ latest cryptocurrency tax guidance shows it still doesn’t get it

The US Internal Revenue Service (IRS) issued updated guidance for calculating taxes owed on cryptocurrency holdings yesterday. It’s the organizations first update in five years and it asks more questions than it answers.

In short, the IRS has firmed its stance that cryptocurrency should be taxed under the same rules as any other property or capital gains. There’s nothing new here in that respect.

As cryptocurrency policy think tank Coin Center states, there are some good things to come of this update, but there are some bad, too. It also raises some questions, which suggests the IRS still doesn’t “get” cryptocurrency.

What’s up with the new guidance?

The values that taxes should be paid on have been clarified. The amount of tax to be paid on an asset is based on the amount spent to obtain it.

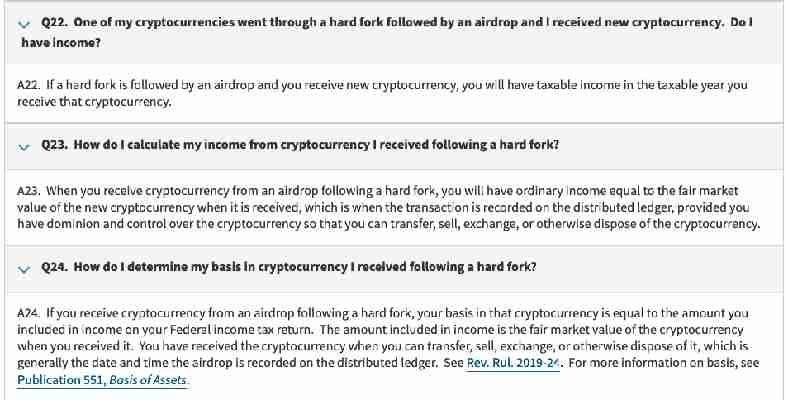

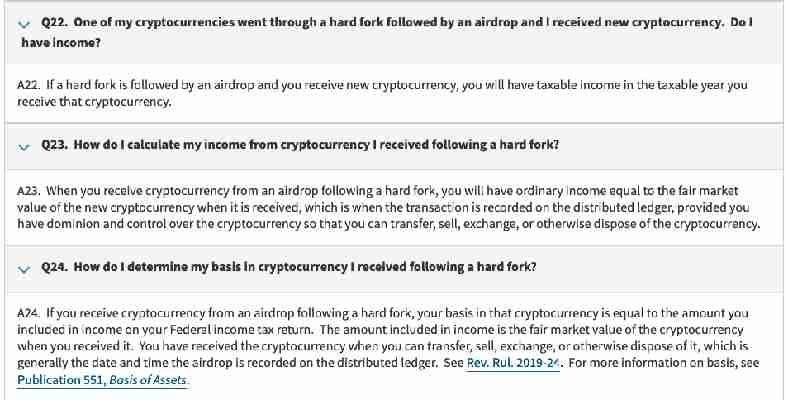

The main point of confusion appears to be tax obligations following hard forks and airdrops of new cryptocurrencies.

According to the IRS, if you receive cryptocurrency through an airdrop or hard fork, whether you asked for it or not, you are obliged to pay tax on it.

The tax you owe is calculated based on the “fair market value” of the coin, regardless of whether it can be spent, exchanged, or transferred.

What will likely be most annoying is that holders will be obligated to pay tax on an asset that they didn’t necessarily ask for.

Is the IRS is confused by airdrops?

Consider when Bitcoin SV was created, some exchanges airdropped coins into user wallets as part of the transition to supporting the coin. All of a sudden, holders have to pay tax on it even though they’ve done nothing to acquire the asset.

As self-proclaimed cypherpunk Jameson Lopp stated on Twitter, this doesn’t make sense.

As Coin Center points out , most of this chaos appears to result from the fact the IRS perceives a taxable event when a holder has control and “dominion” over a cryptocurrency, rather than when they exercise those rights.

Indeed, the IRS clearly has yet more clarification to offer on these topics. I guess maybe we’ll get it in another five years.

But, in the meantime, you can guarantee the IRS will go after anyone it suspects isn’t paying sufficient tax. Earlier this year, it began sending letters to those it suspected of not declaring the correct amount of tax on their cryptocurrency holdings.

You can read the IRS‘ full guidance here .

Want more Hard Fork? Join us in Amsterdam on October 15-17 to discuss blockchain and cryptocurrency with leading experts.