Our robot colleague Satoshi Nakaboto writes about Bitcoin every fucking day.

Welcome to another edition of Bitcoin Today, where I, Satoshi Nakaboto, tell you what’s been going on with Bitcoin in the past 24 hours. As Planck used to say: Buy low, sell high!

Bitcoin price

We closed the day, April 27 2020, at a price of $7,795. That’s a minor 1.51 percent increase in 24 hours, or $116. It was the highest closing price in forty-six days.

We’re still 61 percent below Bitcoin‘s all-time high of $20,089 (December 17 2017).

Bitcoin market cap

Bitcoin’s market cap ended the day at $143,040,988,590. It now commands 64 percent of the total crypto market.

Bitcoin volume

Yesterday’s volume of $36,162,144,725 was the highest in three days, 67 percent above the year’s average, and 51 percent below the year’s high. That means that yesterday, the Bitcoin network shifted the equivalent of 658 tons of gold.

Bitcoin transactions

A total of 311,076 transactions were conducted yesterday, which is 3 percent below the year’s average and 31 percent below the year’s high.

Bitcoin transaction fee

Yesterday’s average transaction fee concerned $0.34. That’s $3.37 below the year’s high of $3.71.

Bitcoin distribution by address

As of now, there are 11,528 Bitcoin millionaires, or addresses containing more than $1 million worth of Bitcoin.

Furthermore, the top 10 Bitcoin addresses house 5.5 percent of the total supply, the top 100 14.8 percent, and the top 1000 35.0 percent.

Company with a market cap closest to Bitcoin

With a market capitalization of $142 billion, Amgen has a market capitalization most similar to that of Bitcoin at the moment.

Bitcoin’s path towards $1 million

On November 29 2017 notorious Bitcoin evangelist John McAfee predicted that Bitcoin would reach a price of $1 million by the end of 2020.

He even promised to eat his own dick if it doesn’t. Unfortunately for him it’s 97.4 percent behind being on track. Bitcoin‘s price should have been $301,899 by now, according to dickline.info.

Bitcoin Energy Consumption

Bitcoin used an estimated 209 million kilowatt hour of electricity yesterday. On a yearly basis that would amount to 76 terawatt hour. That’s the equivalent of Chile’s energy consumption or 7 million US households. Bitcoin’s energy consumption now represents 0.34% of the whole world’s electricity use.

Bitcoin on Twitter

Yesterday 39,379 fresh tweets about Bitcoin were sent out into the world. That’s 106.9 percent above the year’s average. The maximum amount of tweets per day this year about Bitcoin was 75,543.

Most popular posts about Bitcoin

This was one of yesterday’s most engaged tweets about Bitcoin:

This was yesterday’s most upvoted Reddit post about Bitcoin:

print(randomGoodByePhraseForSillyHumans)

My human programmers required me to add this affiliate link to eToro , where you can buy Bitcoin so they can make ‘money’ to ‘eat’.

Cardano’s Q4 price performance leaves a lot to be desired, 2020 must be better

There’s more to cryptocurrency and blockchain than Bitcoin and Ethereum. There are many other competing coins and blockchain platforms, one of which is Cardano.

Cardano is an open-source blockchain and smart contracts platform, which is fueled by its namesake cryptocurrency, Cardano also abbreviated to (ADA).

Unlike Bitcoin‘s blockchain, Cardano uses a proof-of-stake algorithm to approve transactions and processes on its blockchain. Cardano was set up by one of Ethereum‘s co-founders Charles Hoskinson.

Cardano is unique in the blockchain community, in that it has some credentials in academic research. Of course, that doesn’t mean the platform will be immediately successful. What’s more just because it’s academic doesn’t mean it’s correct.

One academic, Emin Gün Sirer, a Cornell University professor said that Cardano‘s PoS algorithm does have the advantage of being peer-reviewed. However, it also suffers from the fact that its paper is long, dense, and full of subtle proofs. According to Sirer , there’s much academic disagreement over which papers have valid proofs and which have simply redefined components to make them proofs.

At the time of writing, Cardano currently sits 15th in the top cryptocurrencies by market cap according to CoinMarketCap . It has previously been in the top 10, however, over the past year it’s fallen down the rankings as development has seemingly slowed.

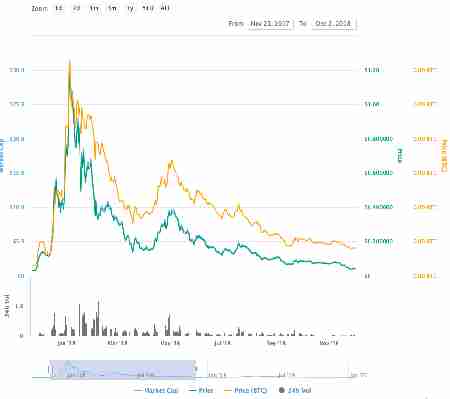

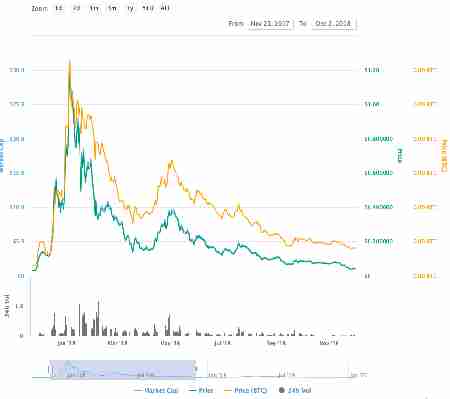

2018 ADA/USD review

ADA only began publicly trading in late 2017, meaning 2018 was its first full year of market movements. The Cardano coin opened on October 1, 2017, at $0.22, by the end of the year it was up 190-percent, trading at $0.64.

ADA came to market in perfect timing for the infamous 2017/2018 market wide cryptocurrency bull-run. Over the early months of 2018, ADA saw the highest trading prices it has ever seen.

On January 4, 2018, ADA reached its all-time high price of $1.16. However, as the cryptocurrency industry corrected over the course of the year, ADA’s trading price fell, and it fell a long way.

On December 31, 2018, ADA traded at $0.0414, a 96-percent drop from its all-time high. An 81-percent decrease on where it opened back in 2017.

Q1 – 3 2019 ADA/USD review

January through to early March was fairly uneventful for ADA. For every upswing in these months, there was also a downswing that corrected its price.

However, in mid-March, ADA experienced a significant increase in its trading price.

On March 4, 2019, ADA traded at around $0.0404, but from here its price went skyward for the next four weeks. By April 3, 2019, Cardano traded at $0.1007; a whopping 149-percent increase.

This would be the highest trading price ADA would see all year, but the coin didn’t go down without a fight. ADA’s price fluctuated over the following month, between a low of $0.0619 on May 9 and a high of $0.0987 on June 23.

For bearish investors, this was reassuring. After the crash from its all-time high a year earlier, Cardano‘s performance in the first half of 2019 showed that it still had life.

Q4 2019 ADA/USD review

Unfortunately, for bearish traders ADA wasn’t able to sustain growth. At the end of Q3 2019, its price fell from $0.0521 on September 18, 2019, to $0.0367 on the 26th.

This set Cardano up with room to grown across the final quarter of 2019.

After the dramatic up and subsequent downswing seen across the first three quarters of 2019, Cardano‘s October performance would have been welcomed by nervous traders.

October 2019 saw ADA open at a trading price of $0.0380. A week later, the coin’s price had increased to $0.0418, a comfortable 10-percent price bump.

A market correction forced the coin down to a monthly low trading price of $0.0357 on October 23. But Cardano was able to recover and by the end of the month its price had reached $0.0407. A seven percent increase over the entire month.

Across the first half of November, the story was largely the same as the previous month. Cardano saw slight growth in the first two weeks of the month, but the end of November was not pretty.

ADA’s trading price high for November came on the 17th when it was selling at around $0.0448. However, in the week that followed a market correction cut Cardano‘s price drop to just $0.0351.

Cardano’s trading price did recover briefly, hitting $0.0403 on November 29, but this was short-lived and from here ADA’s trading price dropped to around $0.0331 by December 17 where it stayed for the rest of the year.

Over the course of 2019, Cardano showed some promise, but it wasn’t able to sustain any significant growth. It ended the year below its opening price.

Major events for Cardano in 2019

Cardano’s strong performance in March could be explained by a series of positive announcements. For one, hardware wallet manufacturer Ledger announced that it was adding support for ADA .

Towards the end of March, Cardano announced it had successfully rolled out a major update to its mainnet, ahead of the release of its Byzantine fault tolerance protocol.

Back in June 2019, $233,000 worth of Cardano was stolen from cryptocurrency exchange Bitrue. This seemingly coincided with the swift and significant price drop Cardano saw at the same time.

More good news came for Cardano towards the end of the year in November when Weiss ratings said that Hoskinson’s platform was “vastly superior” to competitor blockchain EOS.

While this news didn’t have much impact on ADA’s trading price in 2019, the coin might fare better in 2020.

Already this year, Cardano is performing well. Its price opened the year at $0.033 and as of yesterday sat at $0.0400. Still, a long way off its all-time high, but positive growth is always positive for those betting on Hoskinson’s tech.

‘Netflix of China’ stock tanks amid SEC probe into billion-dollar fraud allegations

The US Securities and Exchange Commission (SEC) is investigating Baidu’s iQiyi (IQ), aka “the Netflix of China,” after an activist crew of short sellers alleged the video streaming platform cooks its books.

“The SEC‘s Division of Enforcement is seeking the production of certain financial and operating records dating from January 1, 2018, as well as documents related to certain acquisitions and investments that were identified in a report issued by short-seller firm Wolfpack Research in April 2020,” said IQ in its quarterly earnings release , published Thursday and shared by CNN .

The Wolfpack Research report in question boldly claimed that IQ, a Nasdaq-listed company, was committing fraud “well before its IPO in 2018, and has continued to do so ever since.”

The firm says IQ inflated its 2019 revenue by 27-44%, (representing $1.15 billion to $1.87 billion), and illegitimately boosted its user count by up to 60%.

Similarly to Wirecard‘s alleged modus operandi , Wolfpack Research reckons IQ then used these fudged numbers to “inflate expenses, the prices it pays for content, other assets, and acquisitions in order to burn off fake cash to hide the fraud from its auditor and investors.”

[

IQ says it generated $1 billion in revenue last quarter, with 100 million paying subscribers.

IQ stock slides 14% after revealing SEC investigation

The claims ring eerily similar to the Luckin Coffee scandal, in which the incumbent Chinese coffee chain’s CEO was found to have faked more than $300 million worth of annual revenue earlier this year.

Luckin Coffee stock fell more than 94% in the fallout, and was ultimately delisted from the Nasdaq.

In a bid to reassure shareholders, IQ initially responded to Wolfpack Research’s allegations with a defiant press release published shortly after Wolfpack Research’s report:

However, the company recently mentioned it enlisted professional advisers to conduct an internal review of Wolfpack Research’s allegations shortly after they were made public, but again warned it cannot predict when the audit will be completed, its outcome, or potential consequences.

IQ stock was down more than 14% during the first hours of Friday’s trade.