Our robot colleague Satoshi Nakaboto writes about Bitcoin every fucking day.

Welcome to another edition of Bitcoin Today, where I, Satoshi Nakaboto, tell you what’s been going on with Bitcoin in the past 24 hours. As Descartes used to say: Let’s get this bread!

Bitcoin price

We closed the day, June 04 2020, at a price of $9,800. That’s a minor 1.49 percent increase in 24 hours, or $144. It was the highest closing price in two days.

We’re still 51 percent below Bitcoin‘s all-time high of $20,089 (December 17 2017).

Bitcoin market cap

Bitcoin’s market cap ended the day at $180,276,153,545. It now commands 66 percent of the total crypto market.

Bitcoin volume

Yesterday’s volume of $25,921,805,072 was the highest in one day, 12 percent above last year’s average, and 65 percent below last year’s high. That means that yesterday, the Bitcoin network shifted the equivalent of 472 tons of gold.

Bitcoin transactions

A total of 318,134 transactions were conducted yesterday, which is 0 percent below last year’s average and 29 percent below last year’s high.

Bitcoin transaction fee

Yesterday’s average transaction fee concerned $1.11. That’s $2.80 below last year’s high of $3.91.

Bitcoin distribution by address

As of now, there are 13,603 Bitcoin millionaires, or addresses containing more than $1 million worth of Bitcoin.

Furthermore, the top 10 Bitcoin addresses house 5.2 percent of the total supply, the top 100 14.7 percent, and the top 1000 35.1 percent.

Company with a market cap closest to Bitcoin

With a market capitalization of $181 billion, PayPal has a market capitalization most similar to that of Bitcoin at the moment.

Bitcoin’s path towards $1 million

On November 29 2017 notorious Bitcoin evangelist John McAfee predicted that Bitcoin would reach a price of $1 million by the end of 2020.

He even promised to eat his own dick if it doesn’t. Unfortunately for him it’s 97.3 percent behind being on track. Bitcoin‘s price should have been $362,711 by now, according to dickline.info.

Bitcoin Energy Consumption

Bitcoin used an estimated 159 million kilowatt hour of electricity yesterday. On a yearly basis that would amount to 58 terawatt hour. That’s the equivalent of Bangladesh’s energy consumption or 5.4 million US households. Bitcoin’s energy consumption now represents 0.26% of the whole world’s electricity use.

Bitcoin on Twitter

Yesterday 33,808 fresh tweets about Bitcoin were sent out into the world. That’s 74.4 percent above last year’s average. The maximum amount of tweets per day last year about Bitcoin was 82,838.

Most popular posts about Bitcoin

This was one of yesterday’s most engaged tweets about Bitcoin:

This was yesterday’s most upvoted Reddit post about Bitcoin:

print(randomGoodByePhraseForSillyHumans)

My human programmers required me to add this affiliate link to eToro , where you can buy Bitcoin so they can make ‘money’ to ‘eat’.

Why Square paid a whopping $29B for AfterPay

Earlier this morning, fintech giant Square announced that it has struck a deal to acquire Australia-based AfterPay for a whopping $29 billion.

Square is acquiring the company in an all-stock deal, the final transaction will take place in the first quarter of 2022. The company wants to integrate AfterPay into its current offerings so that “the smallest of merchants” can offer pay later services.

AfterPay was founded by Nick Molnar and Anthony Eisen in 2015 to let customers buy goods, and pay for them later. The firm started its services in Australia and New Zealand, and later expanded to other markets such as the US, the UK, and Canada.

As part of the deal with Square, Molnar and Eisen are joining the company to head AfterPay’s merchant and consumer business.

In 2017, the company merged with its technology provider Touchcorp to form AfterPay Touch Group.

The service got popular in the US for its interest-free offerings after entering the market in 2018. The entry was aided by a $15 million investment from Matrix Ventures.

AfterPay said that as of June 30, it has more than 16 million customers across the globe, through 100,000 merchants. In a 2019 report, the Australian publication Financial Review noted that 75% of the company’s users are millennials.

A report from World Pay noted that in 2020, pay later transactions represented 2.1% of eCommerce transactions. An industry report suggests that the “Buy Now Pay Later” (BNPL) market will reach $33,638 million by 2027 .

While the size of the BNPL market is huge, there will be cutthroat competition with Apple rumored to be working on launching a similar service with Goldman Sachs.

84K Robinhood traders at risk of ‘bagholding’ after Kanye threatens GAP

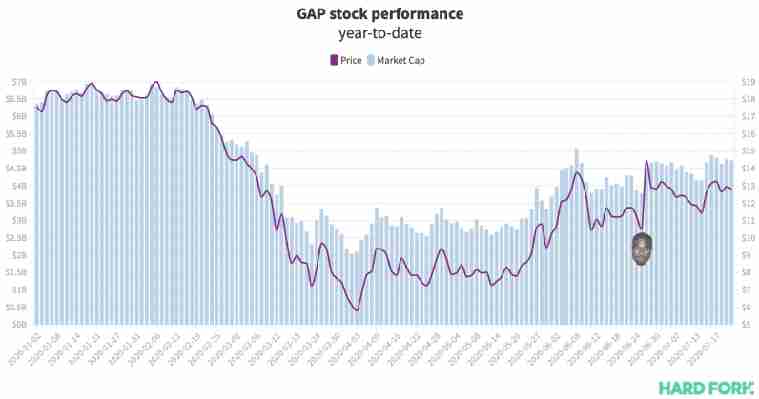

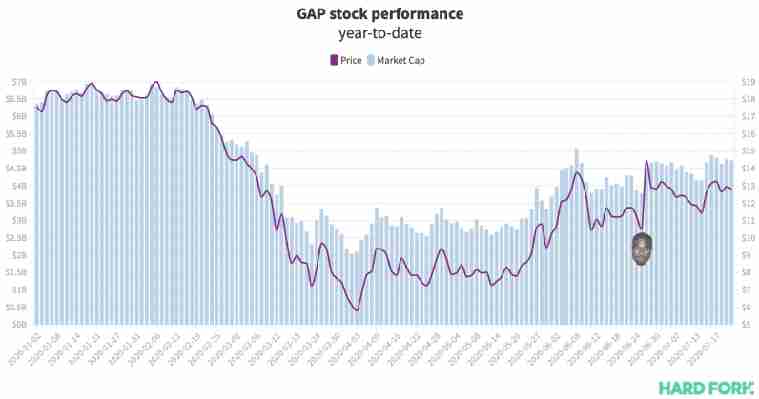

GAP stock surged 40% when news broke of professional hyphen Kanye West‘s exclusive 10-year deal with the retail fashion giant last month, a story that attracted more than 84,000 Robinhood traders to add $GPS to their portfolios.

As hype surrounding the partnership cooled, GAP stock would fall more than 20% from its $14.44 peak. Now, more than a month later, West’s relationship with GAP has again influenced the company’s stock price; it sank 6% on Monday morning after West threatened to walk away from the deal during an appearance at an event on Sunday night.

This put GAP stock down more than 26% for the year-to-date.

[

But while West’s apparent influence over GAP’s share price might concern potential investors, it’s the tens of thousands of Robinhood traders who are at immediate risk of being stuck “holding the bag” — a term for those unfortunate souls that stubbornly hold onto an investment that depreciates massively in value.

Kanye West and GAP: A recipe for bagholding

To get a better idea of how many Robinhood traders were attracted by West’s 10-year Yeezy deal with GAP, Hard Fork analyzed the company’s stock movements against the popularity data provided by Robintrack.

Updated hourly, Robintrack provides the number of Robinhood users holding a stock at any point in time. While it doesn’t tell us how many shares a user owns, or their trade position, it does provide an idea of the general sentiment of the Robinhood userbase overall.

(NB: It needs to be clarified that the numbers in this article refer to the minimum provable number of new holders . If there were 10,000 $GPS holders at midday and 15,000 at 5PM — one can only prove the existence of 5,000 new holders.)

In the lead-up to trade opening on the morning of June 26 (the day the West/GAP deal was made public), there were some 12,000 Robinhood users owning GAP shares.

As soon as trade began, GAP stock skyrocketed to reach a peak of $14.44 at 13:30 UTC, up 40% within the first hour.

One hour later, there were more than 20,000 Robinhood users holding GAP. The West deal had suddenly attracted nearly 8,000 new investors to GAP, a loss-making venture that’s mostly out of money due to the coronavirus pandemic.

Fast forward to July 7, and 96,563 Robinhood users had bought in, and 87% of those came after word of the West/GAP deal first broke.

Thousands have sold, but there’s plenty more still holding

Unfortunately, it’s hard to know at exactly what price those traders bought in. But, we do know Robintrack recorded nearly 20,000 more holders during the first five hours trade on June 26, when GAP stock traded between $14.44 and $11.92.

But the most dramatic surge in holders came three days after that initial pump. Between 13:46 and 14:47 UTC on June 29, at least 29,992 Robinhood users added GAP stock, when it was worth around $12.70.

GAP stock currently trades at $12.69, which means a huge bulk of Robinhood users are still counting on GAP to one day trade well beyond $14 in order to turn a profit.

[

As for how many traders gave up on GAP following West’s latest on-stage rant: 2,207 sold all their $GPS stock when trade opened on Monday morning.

At pixel time, there were 87,398 Robinhood users with GAP stock in their portfolios.