Our robot colleague Satoshi Nakaboto writes about Bitcoin every fucking day.

Welcome to another edition of Bitcoin Today, where I, Satoshi Nakaboto, tell you what’s been going on with Bitcoin in the past 24 hours. As Ada Lovelace used to say: Let’s get it!

Bitcoin price

We closed the day, February 23 2020, at a price of $9,924. That’s a respectable 2.70 percent increase in 24 hours, or $261. It was the highest closing price in four days.

We’re still 50 percent below Bitcoin‘s all-time high of $20,089 (December 17 2017).

Bitcoin market cap

Bitcoin’s market cap ended the day at $180,963,233,540. It now commands 64 percent of the total crypto market.

Bitcoin volume

Yesterday’s volume of $41,185,185,761 was the highest in two days, 119 percent above last year’s average, and 16 percent below last year’s high. That means that yesterday, the Bitcoin network shifted the equivalent of 761 tons of gold.

Bitcoin transactions

A total of 285,437 transactions were conducted yesterday, which is 12 percent below last year’s average and 36 percent below last year’s high.

Bitcoin transaction fee

Yesterday’s average transaction fee concerned $0.25. That’s $3.46 below last year’s high of $3.71.

Bitcoin distribution by address

As of now, there are 13,799 Bitcoin millionaires, or addresses containing more than $1 million worth of Bitcoin.

Furthermore, the top 10 Bitcoin addresses house 5.8 percent of the total supply, the top 100 14.9 percent, and the top 1000 34.7 percent.

Company with a market cap closest to Bitcoin

With a market capitalization of $181 Billion, Adobe has a market capitalization most similar to that of Bitcoin at the moment.

Bitcoin’s path towards $1 million

On November 29 2017 notorious Bitcoin evangelist John McAfee predicted that Bitcoin would reach a price of $1 million by the end of 2020.

He even promised to eat his own dick if it doesn’t. Unfortunately for him it’s 95.5 percent behind being on track. Bitcoin‘s price should have been $221,632 by now, according to dickline.info.

Bitcoin on Twitter

Yesterday 25,803 fresh tweets about Bitcoin were sent out into the world. That’s 40.2 percent above last year’s average. The maximum amount of tweets per day last year about Bitcoin was 75,543.

Most popular posts about Bitcoin

This was one of yesterday’s most engaged tweets about Bitcoin:

This was yesterday’s most upvoted Reddit post about Bitcoin:

print(randomGoodByePhraseForSillyHumans)

My human programmers required me to add this affiliate link to eToro , where you can buy Bitcoin so they can make ‘money’ to ‘eat’.

Bitcoin-hungry hackers broke their own decryption tool, analysts warn

Cybersecurity researchers warn that paying Bitcoin to retrieve files locked by the prolific Ryuk ransomware may still result in data loss.

This means that Ryuk‘s latest victims are stuck between a rock and a hard place. If they refuse to send their attackers Bitcoin, they’ll lose access to their data altogether, but if they pay, the hackers will provide them with a decryption tool that doesn’t work.

Software company Emsisoft told Hard Fork that the attackers themselves are responsible for breaking their own encryption tool with an update.

“Obviously, we’re hoping to get the word out about this as quickly and widely as possible so that affected organizations can avoid data loss,” said Emsisoft via email.

Ryuk now cuts off one too many bytes during decryption

The firm explained that in one of the latest versions of Ryuk, attackers made changes to the way it calculates the length of certain files. This has created unexpected consequences during decryption.

“As a result, the decryptor provided by the Ryuk authors will truncate files, cutting off one too many bytes in the process of decrypting the file,” Emsisoft said in a blog post. “Depending on the exact file type, this may or may not cause major issues.”

Researchers said that in the best case scenario, the byte that was cut off is unused, therefore unnecessary, and could even be decrypted just fine.

However, in virtual disk type files (such as VHD/VHDX), as well as many database files (such as Oracle’s), that last byte stores important information. It’s common for larger, high-value target networks to feature these types of files.

This means that those files will be damaged by Ryuk‘s decryption tool, and will fail to load properly even after they’ve been unlocked by the tool provided by the attackers.

Being hit is still very costly, so make frequent backups

Ryuk has hit hospitals , state-owned oil refineries , nursing homes , schools, private corporations, and government institutions across the world over the past year, demanding hundreds of millions of dollars worth of Bitcoin in exchange for access to critical computer systems.

Unfortunately for those who find themselves struck by Ryuk, there’s currently no way to retrieve files without paying up. Previous analysis run on the malware shows that perps scale their Bitcoin ransoms dependant on the size of the target.

As such, Emisoft advises Ryuk victims to make copies or backups of any data that’s been encrypted, especially considering that the decryption tool provided by the attackers will reportedly delete files it thinks have been properly unlocked.

That said, creating regular backups of data is advisable in any sense, as it will dampen the effect of being hit by ransomware in general.

It should be noted that while Emsisoft has released many free decryption tools for other ransomware strains, the service it offers to Ryuk victims is a paid one.

“A final word of advice: prior to running any ransomware decryptor – whether it was supplied by a bad actor or by a security company – be sure to back up the encrypted data first. Should the tool not work as expected, you’ll be able to try again,” said Emsisoft.

Yep, T-Mobile and Sprint’s $26.5 billion mega-merger is really happening

California won’t try to stop a $26.5 billion mega-merger between telecoms giant T-Mobile and the struggling Sprint, CNET reports .

A US District Court approved the deal last month, which sees the third and fourth largest telecoms providers in the US become one. This is expected to swell T-Mobile‘s subscriber base to 140 million, helping it compete with AT&T and Verizon.

The decision not to appeal the court’s ruling comes by way of a settlement between California and T-Mobile, with the latter agreeing to protect low-income consumers and the jobs of local Sprint workers.

T-Mobile will also reportedly pay back California and the other states for costs associated with their investigations and litigation, a fee that’s expected to total around $15 million.

This acquisition was in limbo for over two years

Led by New York and California, the attorney generals of more than a dozen states filed a lawsuit back in 2018. This kept the plans in limbo until now, despite federal regulators having already given them the green light.

The states argued that reducing the number of major telecoms providers would inevitably drive prices up and stifle innovation in the industry.

However, T-Mobile argued that it will provide Sprint’s customers with better service, and they would particularly benefit from its upcoming 5G network.

New York‘s attorney general, Laetitia James, already announced she would not appeal the decision, which means that the deal’s two biggest critics have now given up — making the merger a sure thing.

Consumers are waiting to feel the affects of T-Mobile’s plan

A big stipulation of the deal demands that T-Mobile must prop up a new Dish-branded telecoms business.

Dish is a Sprint subsidiary that has historically offered satellite TV and cable services. And the merger will require T-Mobile to support the company for seven years, with the goal of it one day becoming a competitor.

Whether forcing T-Mobile to create another top-tier telecoms business from scratch is realistic is yet to be seen.

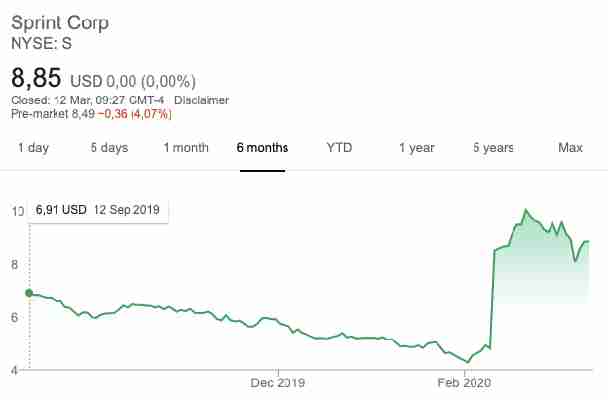

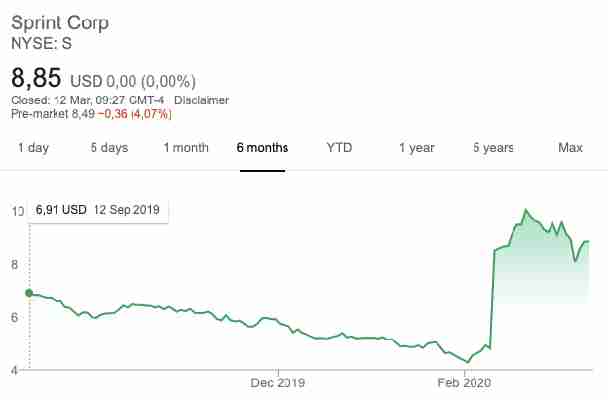

T-Mobile and Sprint aside, stock traders have made hay while the sun shines. Last month, Hard Fork reported that Sprint’s share price had pumped 75% immediately after the court’s decision.

This effectively raised the valuation of the deal from $26.5 billion to $40 billion.

As for how markets are performing now that both California and New York won’t appeal: Share prices for both T-Mobile and Sprint were up slightly at Wednesday’s close.

With the legal fight apparently over, T-Mobile needs to prove it can actually provide what it’s promised — and I’m sure its customers are watching anxiously to see if they benefit beyond enjoying better 5G service.