Our robot colleague Satoshi Nakaboto writes about Bitcoin every fucking day.

Welcome to another edition of Bitcoin Today, where I, Satoshi Nakaboto, tell you what’s been going on with Bitcoin in the past 24 hours. As Kierkegaard used to say: If you love yourself, you won’t do drugs!

Bitcoin Price

We closed the day, September 16 2019, at a price of $10,276. That’s a minor 0.68 percent decline in 24 hours, or -$70.42. It was the lowest closing price in four days.

We’re still 48 percent below Bitcoin‘s all-time high of $20,089 (December 17 2017).

Bitcoin market cap

Bitcoin’s market cap ended the day at $184,366,827,555. It now commands 69 percent of the total crypto market.

Bitcoin volume

Yesterday’s volume of $15,160,167,779 was the highest in three days, 1 percent below the year’s average, and 66 percent below the year’s high.

Bitcoin transactions

A total of 347,178 transactions were conducted yesterday, which is 3 percent above the year’s average and 23 percent below the year’s high.

Bitcoin transaction fee

Yesterday’s average transaction fee concerned $0.30. That’s $3.41 below the year’s high of $3.71.

Bitcoin distribution by address

As of now, there are 17,273 Bitcoin millionaires, or addresses containing more than $1 million worth of Bitcoin.

Furthermore, the top 10 Bitcoin addresses house 5.5 percent of the total supply, the top 100 14.5 percent, and the top 1000 34.4 percent.

Company with a market cap closest to Bitcoin

With a market capitalization of $188 Billion, Anheuser-Busch InBev has a market capitalization most similar to that of Bitcoin at the moment.

Bitcoin’s path towards $1 million

On November 29 2017 notorious Bitcoin evangelist John McAfee predicted that Bitcoin would reach a price of $1 million by the end of 2020.

He even promised to eat his own dick if it doesn’t. Unfortunately for him it’s 89.9 percent behind being on track. Bitcoin‘s price should have been $102,343 by now, according to dickline.info.

Bitcoin Energy Consumption

Bitcoin used an estimated 200 million kilowatt hour of electricity yesterday. On a yearly basis that would amount to 73 terawatt hour. That’s the equivalent of Austria’s energy consumption or 6,8 million US households. Bitcoin’s energy consumption now represents 0.3% of the whole world’s electricity use.

Bitcoin on Twitter

Yesterday 16,491 fresh tweets about Bitcoin were sent out into the world. That’s 13.2 percent below the year’s average. The maximum amount of tweets per day this year about Bitcoin was 41,687.

Most popular posts about Bitcoin

This was yesterday’s most engaged tweet about Bitcoin:

This was yesterday’s most upvoted Reddit post about Bitcoin:

print(randomGoodByePhraseForSillyHumans)

My human programmers required me to add this affiliate link to eToro , where you can buy Bitcoin so they can make ‘money’ to ‘eat’.

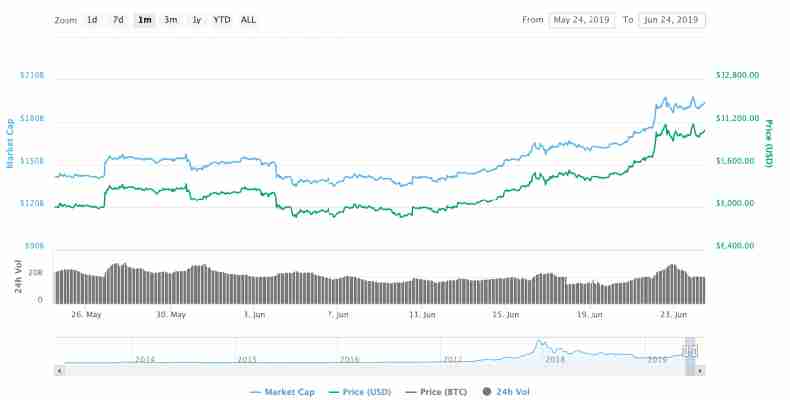

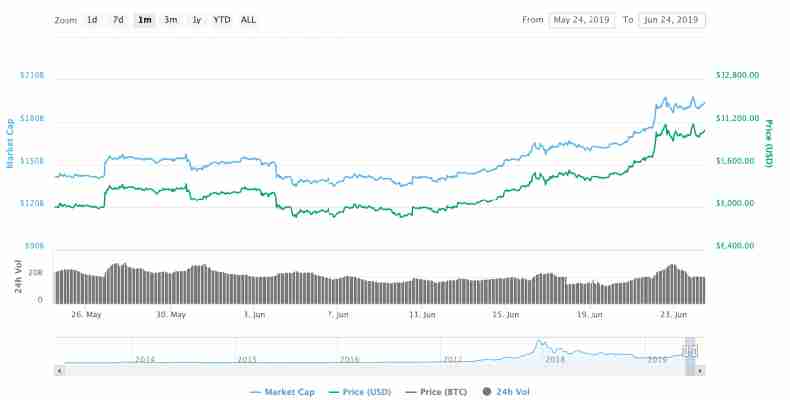

Bitcoin price rises past $11,000 following Facebook’s Libra announcement

Bitcoin’s price continues to rally surpassing the $11,000 mark over the weekend for the first time in 15 months.

At the time of writing, Bitcoin‘s price had decreased by approximately 1.15 percent, with each coin being worth $10,873.04 , according to Coinmarketcap .

Bitcoin’s rise in value comes after Facebook announced the launch of Libra its contentious ‘cryptocurrency.’

In fact, Google Trends data shows that interest in the cryptocurrency increased after the tech giant’s announcement.

The world’s most famous cryptocurrency surpassed the $9,000 threshold for the first time in 2019 last week, amid rumours that the tech giant was getting ready to go public with its project.

It also soared past the $8,000 for the first time approximately five weeks ago.

Bitcoin‘s price also made headlines when it pushed above $5,600 , at the time setting a 2019-high for the third time in less than a month.

It’s often difficult to explain Bitcoin‘s price movements, but this doesn’t stop speculation mounting.

In this instance, some experts are attributing the price jump to Facebook‘s announcement, which has already unsettled politicians and bankers across the globe.

Disclaimer: This is not investment advice. Readers are advised to do their own research before investing in any kind of digital asset or cryptocurrency.

eToro now lets users hold shares, ETFs, and cryptocurrencies in one portfolio

eToro is making it easier to diversify your investments. The social trading platform has announced users can now directly invest in shares. This will make it possible to hold shares, cryptocurrencies, exchange-traded funds (ETFs), and other financial assets all in the same portfolio.

Previously, eToro allowed investing in shares via contracts of difference (CFD). Unlike CFD investments though, buying shares essentially gives users the option to own the actual asset.

“eToro enables people to invest in the assets they want to own, from newly available assets such as cryptocurrencies, to more traditional options like shares,” said CEO and founder Yoni Assia. “We want investors to be able to hold all these assets in a single portfolio.”

Aside from the updated portfolio service, eToro said it will cover any stamp duty costs for UK users buying shares from its platform. For context, British tax law stipulates share purchases be taxed with additional 0.5-percent stamp duty.

Users buying shares will also be exempt from ticket and management fees. That being said, UK customers can still expect to be charged the platform’s standard fees for trading and investing, which amount to about 0.09 percent per side, according to eToro.

It is worth pointing out the company reserves the right to withdraw its practice of absorbing stamp duty in the future, so you might want to take advantage of this deal now.

eToro has been getting busy over the past several months.

Shortly after securing $100 million in private funding from SBI Group, Korea Investment Partners and The World-Wide Investment Company Limited at a valuation of $800 million, the company announced plans to open a cryptocurrency-only exchange desk and expand its operation to the US later this year.

In addition to the new exchange desk, the company said it will also be rolling out its own cryptocurrency mobile wallet.

eToro currently supports 11 cryptocurrencies. But during an interview at TNW Conference earlier in May, Assia told Hard Fork that more trading options will be added to the platform as part of its US expansion. For the time being though, the company is focused on ensuring its US operation is fully compliant with local regulations.