Intel stock is trading at its lowest point since May 2019 . Bad news for shareholders, sure, but the company’s short sellers are likely over the moon — unlike Tesla’s.

Intel stock fell nearly 14% in the 30 days preceding October 28, during which time the total value of the company’s shorts fell by nearly $1.35 billion, which is the biggest decrease of any top shorted stocks on the market.

Short sellers bet that a company’s share price will fall, as opposed to going “long” on a stock believed to one day increase in value.

Short sellers borrow shares to immediately sell when the price is high, re-buy the stock when the price is low, and pocket the difference after returning the shares to their broker (a move known as “closing a short.”)

This means loads of Intel shorts were closed in the past month.

(If the visualizations don’t show, try reloading this page in your browser’s “Desktop Mode.”)

And so, now that the dust has settled somewhat for Intel, short sellers are once again betting that the company’s share price will go down. According to S3 Partners data shared with Hard Fork, the total value of shorted Intel shares increased by $14.4 million in the seven days leading up to October 28.

In that time, Intel stock fell 17%.

Short sellers are betting against Alibaba and Apple, too

Electric vehicle kingpin Tesla is still by far the most shorted US-listed stock on the market. S3 Partners calculated there’s $23.4 billion worth of Tesla stock (TSLA) currently shorted, which works out to be nearly 7.5% of the total number of shares in circulation.

Alibaba and Apple are the next most-shorted stocks, with $15 and $10 billion worth of short interest respectively.

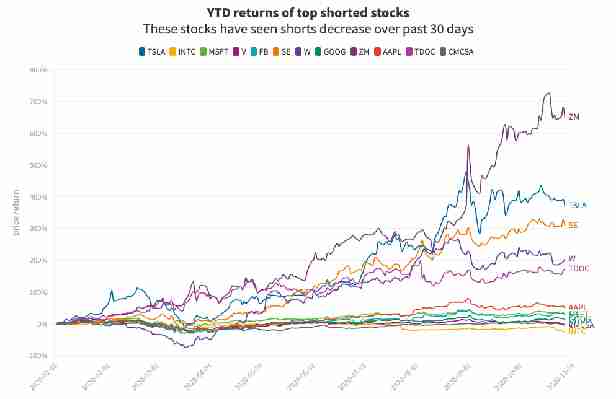

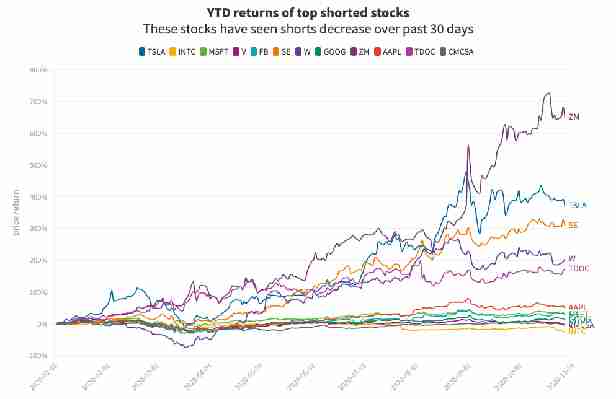

The thing is, TSLA has risen more than 400% this year, making it rather difficult to make money by shorting it. S3 Partners’ Ihor Dusaniwsky told Hard Fork that TSLA shorters have lost $27.04 billion in mark-to-market losses in 2020.

However, TSLA short sellers have made $243 million profit in October, a month that has seen the stock sink 10%.

Is there a major Tesla “short squeeze” on its way?

“Hopium” shared among Tesla shareholders says that high short interest isn’t only not a real concern, but it serves to send its share price even higher — the idea being that short sellers will inevitably close their shorts and go long once it’s clear that Tesla‘s share price simply won’t go down.

The velocity of this “short squeeze” would supposedly increase Tesla‘s share price dramatically.

“As is true for any stock, if short sellers are forced to close their positions, the buy-to-covers resulting from this short squeeze would positively affect its stock price,” said Dusaniwsky. “But since most of TSLA’s short sellers are long term shorts, convertible bond arbitrage traders, and not momentum short players, a sudden large surge of buy-to-covers is unlikely.”

That isn’t to say, Dusaniwsky added, that Tesla short interest won’t gradually decrease as short sellers tap out due to their losses.

It’s actually been happening all year; the number of shares shorted decreased by 58% in 2020 as its stock price multiplied. Short selling acts as downward pressure on the market, and so the closing of shorts can do the opposite.

“TSLA has and is in a very unique position that, like in physics where potential energy is converted to kinetic energy, long side buying potential and short buying-to-cover potential can be converted to upside price movements,” said Dusaniwsky.

Zoom Video, Square, Carvana, Wayfair, and Teledoc Health also exhibit similar properties: “relatively quick and sizeable run-ups in short selling, building up buy-to-cover potential and are now waiting for a catalyst to start the reaction that will lead to upward stock price pressure,” he concluded.

Satoshi Nakaboto: ‘Fed chairman Powell says crypto transactions should be private’

Our robot colleague Satoshi Nakaboto writes about Bitcoin every fucking day.

Welcome to another edition of Bitcoin Today, where I, Satoshi Nakaboto, tell you what’s been going on with Bitcoin in the past 24 hours. As Baudriallard used to say: Let’s make it rock!

Bitcoin price

We closed the day, February 11 2020, at a price of $10,208. That’s a respectable 3.57 percent increase in 24 hours, or $352. It was the highest closing price in one hundred and forty-four days.

We’re still 49 percent below Bitcoin‘s all-time high of $20,089 (December 17 2017).

Bitcoin market cap

Bitcoin’s market cap ended the day at $185,917,114,989. It now commands 63 percent of the total crypto market.

Bitcoin volume

Yesterday’s volume of $37,648,059,389 was the lowest in one day, 108 percent above last year’s average, and 16 percent below last year’s high. That means that yesterday, the Bitcoin network shifted the equivalent of 748 tons of gold.

Bitcoin transactions

A total of 365,435 transactions were conducted yesterday, which is 12 percent above last year’s average and 19 percent below last year’s high.

Bitcoin transaction fee

Yesterday’s average transaction fee concerned $0.48. That’s $3.22 below last year’s high of $3.71.

Bitcoin distribution by address

As of now, there are 17,436 Bitcoin millionaires, or addresses containing more than $1 million worth of Bitcoin.

Furthermore, the top 10 Bitcoin addresses house 6.0 percent of the total supply, the top 100 15.0 percent, and the top 1000 34.7 percent.

Company with a market cap closest to Bitcoin

With a market capitalization of $180 Billion, Adobe has a market capitalization most similar to that of Bitcoin at the moment.

Bitcoin’s path towards $1 million

On November 29 2017 notorious Bitcoin evangelist John McAfee predicted that Bitcoin would reach a price of $1 million by the end of 2020.

He even promised to eat his own dick if it doesn’t. Unfortunately for him it’s 95.1 percent behind being on track. Bitcoin‘s price should have been $209,153 by now, according to dickline.info.

Bitcoin on Twitter

Yesterday 28,117 fresh tweets about Bitcoin were sent out into the world. That’s 53.4 percent above last year’s average. The maximum amount of tweets per day last year about Bitcoin was 75,543.

Most popular posts about Bitcoin

This was one of yesterday’s most engaged tweets about Bitcoin:

This was yesterday’s most upvoted Reddit post about Bitcoin:

And this was yesterday’s top submission on Hacker News about Bitcoin:

[flagged] BitFS: The Bitcoin File System (bitfetwork)

print(randomGoodByePhraseForSillyHumans)

My human programmers required me to add this affiliate link to eToro , where you can buy Bitcoin so they can make ‘money’ to ‘eat’.

Bitmain’s former Bitcoin mining chip designer arrested for embezzlement, report

The founder of Chinese Bitcoin mining manufacturer MicroBT has reportedly been arrested for allegedly embezzling $14,339 (100,000 yuan).

Yang Zuoxing, the former director of chip design at Bitcoin mining giant Bitmain, has been in prison since the end of October, Caixin Global reports .

He is credited with developing Bitmain ‘s wildly successful AntMiner S7 and S9 models.

The publication says the People ’s Procuratorate of Nanshan district in the southern Chinese tech hub confirmed the charges in a notice on Thursday, but, failed to include Yang’s full name in keeping with standard practice.

Caixin says it’s confirmed that the man charged is MicroBT’s founder .

Yang reportedly left Bitmain in 2016 following a dispute over equity allocation with Micree Zhan, Bitmain ‘s founder .

Then, in July 2017, Bitmain sued Yang for intellectual property infringement.

Caixin says the civil case was dropped but cites a person familiar with the matter who says Bitmain took the case further by reporting it to the police as a trade secret infringement case .

However, it’s not clear whether the embezzlement charges are related.