It appears that contrary to its marketing promises, Tether – a cryptocurrency pegged to the US dollar – used some of its dollar reserves to buy Bitcoin.

The stablecoin issuer, which shares management and ownership with cryptocurrency exchange service Bitfinex, has admitted it used its reserves to invest in Bitcoin and other “assets,” according to court transcripts obtained by The Block .

The court documents further show New York Supreme Court Judge Joel M. Cohen is growing increasingly suspicious of Bitfinex’s and Tether’s dealings – especially after the companies recently admitted the stablecoin is not entirely backed by cash (which is Tether’s main marketing claim).

“Tether sounded to me like sort of the calm in the storm of cryptocurrency trading. And so if Tether is backed by Bitcoin, how is that consistent,” Cohen remarked. “If some of your assets are in a volatile currency that Tether is supposed to somehow modulate, that seems like it’s playing into what they are saying.”

The news comes after the New York Attorney General initiated court proceedings against Bitfinex and Tether earlier in April. At the time, court documents shined a light on the companies’ troubled banking relationships, including the cover-up of an $850-million loss of funds.

As a result, Tether’s general counsel Stuart Hoegner came out to say that its reserves are only 74 percent backed by cash and equivalents.

“ As of the date [April 30] I am signing this affidavit, Tether has cash and cash equivalents (short term securities) on hand totalling approximately $2.1 billion, representing approximately 74 percent of the current outstanding tethers,” said Hoegner.

Prior to that, Tether had vehemently maintained its stablecoin is 100 percent backed by cash in its marketing materials.

Mt. Gox’s Mark Karpelès could avoid prison, despite faking financial records

Mark Karpelès, the head of defunct cryptocurrency exchange Mt. Gox , has been found guilty of tampering with financial records, but thanks to a suspended sentence will probably avoid prison.

Today, some five years after being ransacked by hackers, a Japanese court found Karpelès combined his personal finances with user funds kept on Mt. Gox in a bid to obfuscate the losses. He was handed a 33-month suspended sentence, Bloomberg reports .

The Tokyo District Court also found the Frenchman ‘not-guilty’ of embezzlement, after it decided he had committed those crimes without ill intent.

Mt. Gox was once the world’s most popular cryptocurrency exchange . It was rendered insolvent after losing 850,000 Bitcoins (then $500M, today $3.3B) in 2014, which Karpelès claimed to be the fault of hackers.

Not long after, Mt. Gox actually “found” 200,000 of the “lost” Bitcoins . Today’s court decision relates specifically to Karpelès methods of covering up the extent of Mt. Gox’s losses.

He has maintained his innocence the entire time, even in the face of today’s impending court decision . He is likely to avoid prison, unless he commits another crime in the next four years. Karpelès reportedly spent roughly one year under arrest before authorities released him on bail.

So far, a trustee in charge of distributing what’s left of Mt. Gox’s coffers is estimated to have sold around $300 million worth of cryptocurrency as a means to repay some of the stolen money.

Karpelès ‘ case reportedly has no bearing on those efforts. You can read a brief history of the Mt. Gox tragedy here .

While this doesn’t resolve exactly who hacked Mt. Gox, those involved now inch a little closer to closure, regardless of how hard stomaching today’s ruling might be.

Did you know? Hard Fork has its own stage at TNW2019 , our tech conference in Amsterdam. Check it out .

Big, greedy Ethereum whales account for 33 percent of cryptocurrency’s supply

Ethereum whales account for just 7 percent of transaction activity in the market – but they control a third of the cryptocurrency’s entire circulating supply.

That’s according to a new study by Chainanalysis which found that although these whales don’t have a sizeable impact on Ether’s price, their large sell-offs do make the market more volatile on a daily basis.

For context, whales are defined as the top 500 cryptocurrencies excluding services, who keep their coins off exchanges.

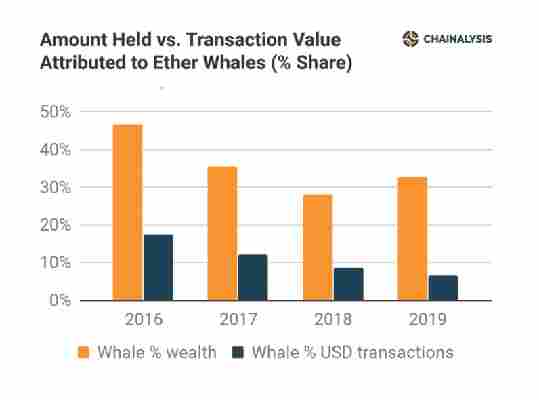

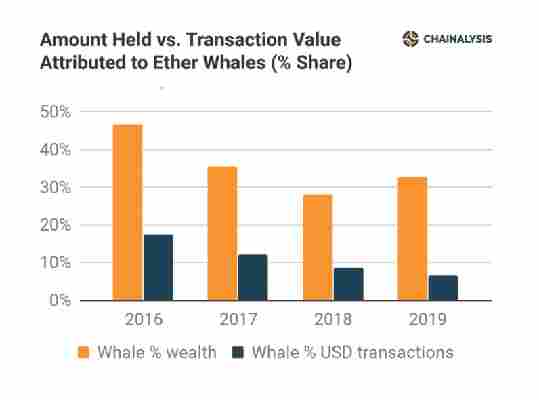

As of May 1, 2019, Chainalaysis’ research showed that out of the top 500 holders, 124 were services and the remaining 376 were individual whales, which controlled 33 percent of the circulating supply in 2019. This, however, represented a decrease in comparison to 2016 when they controlled 47 percent of the market.

The study shows that whales consistently hold 25 to 40 percent of Ether’s circulating supply, but only account for between 5 and 18 percent of economic transaction volume.

This is largely attributed to the fact that most whales (approximately 60 percent) hold on to their coins or refrain from trading with exchanges on a regular basis.

As past of its study, Chainanalysis also explored the possible correlation between Bitcoin‘s and Ether’s price.

The firm used a VAR model, a method commonly used in financial time series analysis, and looked at the impact on Ether’s price and intraday volatility by focusing on Bitcoin‘s price and the activity caused by whales sending funds to and receiving funds from exchanges.

The analysis focused on the period of 2016 to 2019, and tackled three assumptions:

Ether prices follow Bitcoin prices. On average, a 1-percent increase in Bitcoin prices yesterday leads to a 1.1-percent increase in Ether prices today. The firm found, just like previous studies have suggested , that there is no statistically significant impact of Bitcoin prices on Ether’s intraday volatility.

Funds sent impact volatility but not price. Funds sent to exchanges by whales don’t directly impact Ether price but do contribute to price volatility. On average, a whale that sent $1 million worth of Ether two days ago leads to a 0.1 unit increase in intraday volatility today, which is relatively small considering values of intraday volatility range from 0.02 minimum to 417 maximum.

Funds received have no impact. Funds that whales receive from exchanges don’t impact Ether’s prices, nor intraday volatility.

Overall, Chainanlysis’ findings fall in line with the literature on stock market prices, and volatility.

In any case, Chainanlysis draws a positive spin on this noting, it’s “certainly encouraging that the cryptocurrency market is behaving in a way that is consistent with stock market fundamentals.”

“Although it seems that concerns about the impact of whales on market prices have been overstated, there are still important caveats to our research. We cannot rule out the possibility that whales can impact price changes within single days based on outlier events. Our research analyzed the general impact of flows from Ether whales, and did not exclusively look at the impact of outlier events,” it adds.

If the cryptocurrency market operating in a similar way to the traditional stock market is a good thing or not, that’s entirely up for discussion.

But, perhaps it’s a sign that things are really maturing?