The United Nations is exploring blockchain to boost its efforts in developing nations.

The intergovernmental body announced the news at the 73rd edition of the UN General Assembly in New York. The initiative will be developed as part of the United Nationas Development Programme (UNDP), which aims to support developing nations with resources to improve the lives of citizens.

“We believe that blockchain is a technology that can have a huge impact in the developing world in numerous ways,” stated Haoliang Xu, Assistant Secretary General of the United Nations.

The UN has teamed up with the Blockchain Charity Foundation (BCF) for this initiative. “We are excited to see the strong commitment from BCF to work with UNDP to explore how blockchain technology can help develop solutions to some of the most difficult development challenges in Asia and the Pacific,” Xu added.

Earlier this year, cryptocurrency exchange Binance shook hands with the Maltese Preisdent’s Trust to found BCF as a non-profit organization; the BCF aims to explore blockchain tech as a solution to social problems.

“We firmly believe that blockchain technology will bring transformative solutions to social problems, and help bridge the UN Sustainable Development Goals funding gap in fast and innovative ways,” said BCF head Helen Hai.

How blockchain will be used to bridge funding gaps has not yet been explained.

At the event the BCF announced its decentralized charity platform, which allows donations to be tracked from source to end beneficiary.

Presumably, the use of blockchain means there must be a coin or token associated to this platform. Using such tools for fundraising could be hazardous. The volatility of cryptocurrency could potentially negatively affect the value of donations made through the platform.

The announcement didn’t address such potential problems, but hopefully there are some safeguards in place to protect against volatility.

Hard Fork reached out to the BCF for further details of the specifics of its blockchain implementations. We’ll update this piece as we learn more.

Just last week, it was announced that devs had managed to create an entirely off-grid blockchain-based communication tool. While it can be used to make cryptocurrency transactions it can also provide a secure and immutable method of communication with the outside world in times of natural disaster.

If you’re interested in everything blockchain, chances are you’ll love Hard Fork Decentralized. Our blockchain and cryptocurrency event is coming up soon – join us to hear from experts about the industry’s future. Check it out!

Binance will launch its first cryptocurrency-to-fiat trading pairs in Uganda

After a registration process lasting some four months , Binance will finally offer fiat-to-cryptocurrency trading pairs through its new Uganda exchange, with deposits opening on Wednesday.

Announced via press release , Ugandans are now able to fully submit identity documents and begin depositing fiat ahead of live trade, something expected to start in two weeks.

Binance Uganda will initially allow verified users to trade Ugandan Shillings for Bitcoin and Ethereum, but it promises to add more cryptocurrency pairs in the future.

Wei Zhou, Binance’s chief finance officer, called the trading pairs an “innovation,” and commented they are the “first step” of its efforts to use blockchain tech to “support sustainable economic development in Africa.”

Binance looks to support Ugandan innovation

Binance is the most popular online cryptocurrency exchange, and has been using its influence to spur economic development in Uganda.

In particular, it has partnered with local non-profits Made in Africa and Msingi in a bid to create opportunities for local entrepreneurs.

The initiative aims to use blockchain as a bedrock for potential startups whose goal is to improve the lives of regular Ugandans.

It has certainly been a long wait for Binance to support fiat trading pairs. In the absence of legitimate banking partners, the exchange has long relied on controversial “stablecoins” as a replacement.

The patience of cryptocurrency traders has been wearing thin of late though, with fears circulating a heavy reliance on unregulated stablecoins could be be damaging to the wider digital asset market.

If you’re looking for the latest blockchain news, why not attend Hard Fork Decentralized? Our three-day event is all about discussing the industry’s future. Find out more on our website !

EOS startup utilizes backdoor to access user wallets, retrieve airdropped tokens

An EOS-powered decentralized app (dApp) has come under fire, having severely botched an airdrop . After erroneously distributing too many tokens to its users, blockchain-powered content ecosystem Trybe had to access user wallets to reverse transactions.

Trybe developers mistakenly awarded more than 100 EOS accounts with up to four times the amount originally designated. Game developer Russell “castle” Meakim shared his disbelief on social media, after discovering a large amount TRYBE tokens in his EOS account that shouldn’t have been there.

“[…] There was a short while where I was literally looking at 8,740 TRYBE sitting on my account and wondering what the hell happened. I was looking at [the price] and I guess I could have just sold it all. I just assumed that I was supposed to get that many. I guess it’s a good thing I didn’t sell […],” Meakim wrote.

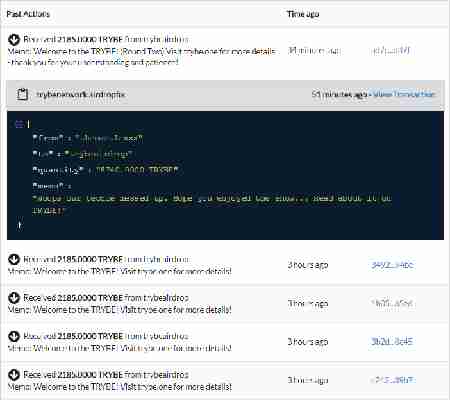

Here’s a screenshot of the transactions in question, in reverse chronological order. Trybe developers made the initial four deposits in error.

The small piece of smart contract code above shows the intervention of Trybe developers. Note, the devs removed the mistakenly distributed cryptocurrency – 8,740 TRYBE ($60) – without authorization. The user wasn’t even notified.

In fact, this is by design. Developers often market this as a feature of the EOS blockchain to set it apart from direct competitors.

Ethereum, for example, features immutable smart contracts. Ethereum dApp developers must hard fork their cryptocurrencies in order to correct errors in smart contracts.

Hard forking splits a cryptocurrency into two, shedding the buggy version for a patched one. Trybe developers simply fixed problems on the fly.

This is because, unlike Ethereum’s smart contracts, EOS-based ones are mutable .

Let me make this completely clear: all smart contracts deployed on the EOS blockchain can be edited, updated, and changed after they are deployed, at any time, without notice (though it appears that some Ethereum-based startups like Bancor have chosen to build similar backdoors into their own smart contracts.)

It is entirely up to the user to protect themselves against malicious updates to EOS smart contracts by auditing the code themselves.

The Trybe development team confirmed this in a Reddit post , where founder Tom Norwood admitted to freezing all token activity, accessing user wallets, and taking back excess funds.

“Although maybe we were a little bit negligent in relying on the [EOS library] to work as it was supposed to work, the fact that it didn’t is not exactly our fault,” Norwood wrote. “However, this is very new software, as you are probably aware, and the fact that it doesn’t have more bugs is a miracle in itself.”

“If you’d prefer just to attack us, or to attack EOS itself because yes, EOS (unlike most blockchains) does have options available when things don’t go exactly according to plan, then feel free,” Norwood continued. “We are comfortable in our decision to reverse transactions in this instance rather than leaving huge amounts of tokens in a few people’s wallets […]. What we did, by the way, is not just a function of the TRYBE token but of any token built on EOS, and to be honest, I was VERY GLAD that it was […].”

This is a great time to point out that this happens on the EOS blockchain, a lot . Block producers have frozen EOS accounts without approval in the past. Most notably, seven EOS wallets were accessed illegitimately in order to retrieve funds believed to be stolen.

Nathan Rempel, Trybe lead developer, floated the idea of autonomous communities (DAOs) in a blog post titled “ Hard day at the office – what happened with the TRYBE airdrop?” DAOs painstakingly delegate decisions to stakeholders. Rempel thinks this would help users to trust EOS dApps, now that we are aware of their absolute power.

“Does this allow for centralized control? Yes. Is centralized control always a bad thing? No. Decentralizing control of mutable things will become the key to trusting mutability,” reads his official statement. “When the entire community can take part in the decision making process to create something wonderful (or fix something that went wrong), they are more likely to trust those decisions.”

All this is certainly well and good, but only if we ignore how terrible DAOs can be .

Inevitably, this leads to discussions of decentralization. Immutability of smart contracts essentially enforces it. Removing the ability to edit smart contract code on the fly admits that no individual should wield the power to make changes to a cryptocurrency directly.

In fact, stubborn immutability is the reason for millions of dollars in Ethereum being stuck in smart-contract powered wallet Parity, almost a year after accounts were frozen.

This means that, at least for Ethereum, the decentralization of decision-making is more valuable than millions of digital dollars stuck in cyberspace. For Trybe, I guess it’s worth around $60.