Embattled cryptocurrency exchange Bitpoint has revealed that roughly half of its 110,000 users were affected by last week’s $3.02 billion yen ($28 million) hack, reports The Mainchi .

Speaking at a Tokyo press conference, Bitpoint president Genki Oda noted that of the 3.02 billion yen stolen, customers owned 2.06 billion yen ($19 million), while 960 million yen ($8.9 million) consisted of the company’s own holdings.

According to Oda, customer losses represented 13 percent of the total amount of cryptocurrency users had kept on Bitpoint. He also pledged to repay victims (in cryptocurrency) once standard trade resumes.

The theft, which included sums of Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and Ripple, was disclosed last Thursday. Originally reported to have totalled $32 million, those losses were later revised to a slightly smaller number of $28 million.

To find success, hackers were said to have targeted Bitpoint’s “ hot wallets ,” a term for internet-connected cryptocurrency storage software.

Oda then confirmed the discovery of an additional 250 million yen ($2.3 million) worth of stolen funds that were taken from overseas exchanges using Bitpoint software.

This directly contradicts apparently incorrect media reports that indicated a fraction of the stolen funds had been recovered.

An estimate for when Bitpoint will resume standard trade is yet to be determined, as official investigations are reportedly ongoing.

Fellow Japanese cryptocurrency exchange Zaif was ransacked by hackers last September, who stole $60 million worth of cryptocurrency in a seemingly similar raid.

UK ad watchdog scorns BitMEX over Bitcoin’s 10th birthday ‘celebration’

The UK ‘s advertising watchdog has upheld its complaint about a Bitcoin newspaper ad from cryptocurrency derivatives exchange BitMEX.

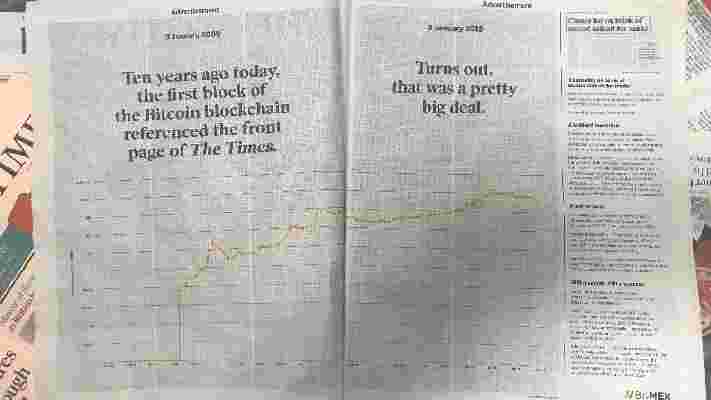

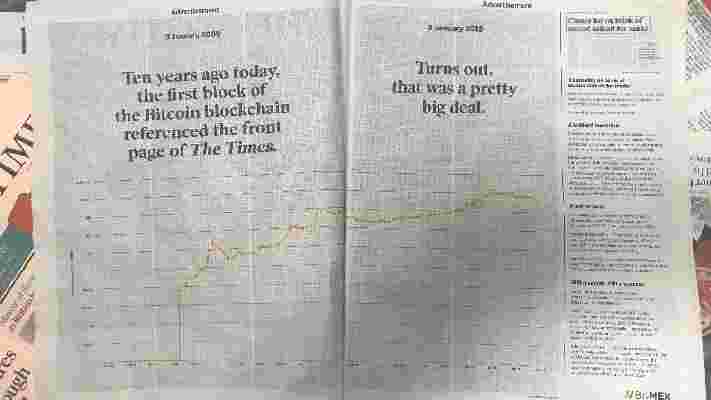

The Advertising Standards Authority (ASA) explained in a blog post that it took issue with an ad published on January 3, 2019, depicting a graph of Bitcoin ‘s price performance .

“The ad showed a graph spread across two pages. The horizontal axis was divided and labeled into six-month units showing dates between January 2009 and January 2019,” the blog post reads, “The vertical axis was labeled ‘ Bitcoin Price In US Dollars ‘ separated by decimal point value increments from $0.0001 to $100,000. The graph depicted a sudden rise in the value of Bitcoin after July 2010.”

“The highest value recorded on the graph was of more than $10,000 between July 2017 and Jan 2018. Text at the top of the left page stated ‘3 January 2009. Ten years ago today, the first block of the Bitcoin blockchain referenced the front page of The Times.’ Text at the top of the right page stated ‘3 January 2019. Turns out, that was a pretty big deal.’ Text in the bottom right corner of the graph stated “Source:Blockchainom,” it adds.

ASA received four complaints, all of which accused the ad of being misleading on the basis of either exaggerating the return on an investment in Bitcoin or failing to illustrate the risks of an investment in the cryptocurrency .

In response, BitMEX said the purpose of the graph was to inform, not to sell or advertise the cryptocurrency , or any other of its products . The advertisement, the company added, was part of a campaign to celebrate Bitcoin ‘s 10th anniversary.

Nevertheless, ASA believes the scale used in the graph could be misinterpreted by a wide audience lacking in specialist knowledge . It also said BitMEX CEO Arthur Hayes’ references to Bitcoin being “still very much an experiment ” and other statements insufficient to illustrate the investment risks entailed.

As such, ASA has stated that the ad breached several codes and as such ruled it must not appear again in its current form.

It’s not the first time the cryptocurrency and advertising worlds collide.

Facebook banned cryptocurrency-related ads in January last year and fellow tech giant Google followed suit announcing its intention to enforce a ban in March.

Twitter has also banned initial coin offering advertisements.

British Bitcoin scammer nets $50M running fake Bitcoin trading site

A British Bitcoin scammer has admitted to a con that duped people, all over the world, out of $50 million.

In US courts last week, the perpetrator, identified as 50-year old Renwick Haddow, admitted to running a fake Bitcoin trading platform that defrauded hundreds of investors form around the globe.

It’s also recently come to light that some 150 victims came from the UAE, and were hit for around $15 million, Arabian Business reports .

Haddow was apprehended in Morocco in 2017 and extradited to the US. Alongside operating a fake Bitcoin trading platform, the perp was also selling office spaces that didn’t actually exist.

According to the report, Haddow admitted to two charges of wire fraud in both of his deceptive businesses. As it stands, the 50-year-old faces up to 40 years in prison for his crimes, but is yet to be officially sentenced. No date for his sentencing has been set.

It seems Haddow’s nefarious exploits have finally come to a head.

The former accountant is known for running investment scams, having previously been banned by British regulators for scamming the publishing house of Cosmopolitan magazine. He’s also changed used the alias “Jonathan Black” to cover his ties to his previous cons.

Financial regulators have previously ordered Haddow and his accomplices to pay over £16 million ($20 million) for their roles in a number of other investment scams.

Sadly, Bitcoin investment scams are nothing new.

Earlier this year, a man from the English channel island Jersey lost $1.5 million – his entire life savings – by investing in fake Bitcoin trades.

It’s also not the first time that the UAE has witnessed heinous Bitcoin crimes. Back in March, crooks stole over $250,000 from a group of unsuspecting Chinese businessmen in Dubai who were lured in by Facebook adverts offering cryptocurrency for sale.