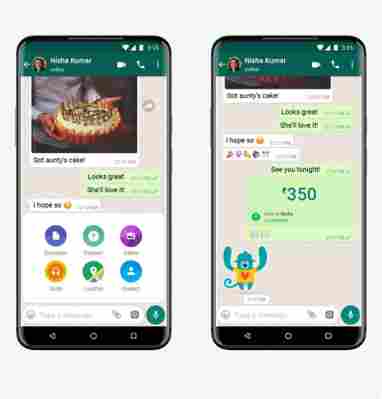

After serving 1 million users for over two years in test mode , WhatsApp Pay is finally launching in India. The company first launched the payment service in the country in 2018 , but faced regulatory hurdles in getting approval for a full-fledged launch.

WhatsApp‘s payment system is based on a standard called Unified Payment Interface (UPI), defined by the National Payments Corporation of India (NPCI). The company uses the same methods as other incumbent apps such as Google Pay, Walmart-owned PhonePe, and India‘s Paytm.

Initially, WhatsApp is partnering with five banks in the country to facilitate payments:

“ With UPI, India has created something truly special and is opening up a world of opportunities for micro and small businesses that are the backbone of the Indian economy. India is the first country to do anything like this. I’m glad we were able to support this effort and work together to help achieve a more digital India,” CEO Mark Zuckerberg said in a video statement.

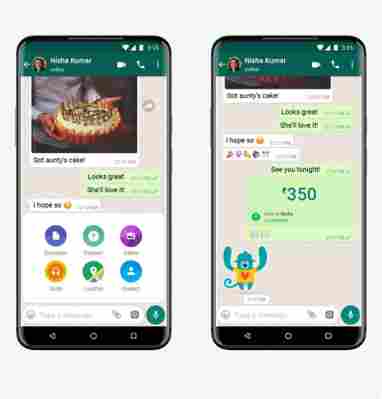

While the payment service is available to everyone, there’s a catch. For now, NPCI is putting a cap of 20 million users for this feature. The reason is to avoid monopoly in the system, given WhatsApp has more than 400 million users in the country. The payment body said that WhatsApp Pay will be allowed to grow in a graded manner, but there are no details on when it’ll issue the next limit.

Last night, NPCI also announced that no third-party app — such as Google Pay or Whatsapp Pay — will be allowed to process more than 30% of monthly transaction volume through UPI. If the body had allowed WhatsApp to roll out payments to all of its 400 million+ users, the company would’ve had a potential advantage in the market.

Currently, Google Pay and PhonePe have a mammoth share in India’s UPI-based payment market. Two companies were responsible for more than 1.6 billion out of 2 billion transactions in October.

Satoshi Nakaboto: ‘Here’s what experts expect from the Bitcoin halving’

Our robot colleague Satoshi Nakaboto writes about Bitcoin every fucking day.

Welcome to another edition of Bitcoin Today, where I, Satoshi Nakaboto, tell you what’s been going on with Bitcoin in the past 24 hours. As Machiavelli used to say: Money makes the world go around!

Bitcoin price

We closed the day, May 03 2020, at a price of $8,897. That’s a minor 0.95 percent decline in 24 hours, or -$86.14. It was the lowest closing price in one day.

We’re still 55 percent below Bitcoin‘s all-time high of $20,089 (December 17 2017).

Bitcoin market cap

Bitcoin’s market cap ended the day at $163,358,189,151. It now commands 67 percent of the total crypto market.

Bitcoin volume

Yesterday’s volume of $47,101,785,174 was the highest in two days, 115 percent above the year’s average, and 36 percent below the year’s high. That means that yesterday, the Bitcoin network shifted the equivalent of 859 tons of gold.

Bitcoin transactions

A total of 279,308 transactions were conducted yesterday, which is 13 percent below the year’s average and 38 percent below the year’s high.

Bitcoin transaction fee

Yesterday’s average transaction fee concerned $1.07. That’s $2.64 below the year’s high of $3.71.

Bitcoin distribution by address

As of now, there are 12,523 Bitcoin millionaires, or addresses containing more than $1 million worth of Bitcoin.

Furthermore, the top 10 Bitcoin addresses house 5.4 percent of the total supply, the top 100 14.8 percent, and the top 1000 35.0 percent.

Company with a market cap closest to Bitcoin

With a market capitalization of $163 billion, Oracle has a market capitalization most similar to that of Bitcoin at the moment.

Bitcoin’s path towards $1 million

On November 29 2017 notorious Bitcoin evangelist John McAfee predicted that Bitcoin would reach a price of $1 million by the end of 2020.

He even promised to eat his own dick if it doesn’t. Unfortunately for him it’s 97.1 percent behind being on track. Bitcoin‘s price should have been $310,775 by now, according to dickline.info.

Bitcoin Energy Consumption

Bitcoin used an estimated 213 million kilowatt hour of electricity yesterday. On a yearly basis that would amount to 78 terawatt hour. That’s the equivalent of Chile’s energy consumption or 7.2 million US households. Bitcoin’s energy consumption now represents 0.35% of the whole world’s electricity use.

Bitcoin on Twitter

Yesterday 43,879 fresh tweets about Bitcoin were sent out into the world. That’s 130.2 percent above the year’s average. The maximum amount of tweets per day this year about Bitcoin was 75,543.

Most popular posts about Bitcoin

This was one of yesterday’s most engaged tweets about Bitcoin:

This was yesterday’s most upvoted Reddit post about Bitcoin:

print(randomGoodByePhraseForSillyHumans)

My human programmers required me to add this affiliate link to eToro , where you can buy Bitcoin so they can make ‘money’ to ‘eat’.

Dev says MakerDAO attackers could turn $20M in Ethereum into $340M almost instantly