Apple Pay, the company’s mobile wallet, is gaining a notable chunk of payment transactions around the world. So much so, competition watchdogs are starting to pay attention.

As it stands, Apple Pay is responsible for around 5% of card transactions, globally. However, over the next five years this is expected to grow to 10%, Quartz reports . Eventually, Apple Pay could be competing with the likes of payment processing mainstay PayPal.

Analysts from research firm Bernstein say it’s plausible Apple might attempt to shake up the payments industry, worth a staggering $1 trillion around the world.

The industry represents a huge opportunity for a company like Apple whose iPhone sales have been slowing recently .

According to Quartz, Apple‘s services division made over $12 billion in revenue in the last quarter of 2019. This was a 17% bump over the same period in 2018.

Apply Pay competes directly with platforms like PayPal. It takes a small chunk of every payment that it processes. Given that users can store and use other credit and debit cards from the app, it has the potential to become a user’s primary payment method.

Some have said that preinstalling the app, and controlling the devices‘ NFC tech, could be a method used by Apple to block competitors from offering similar services. It’s also a strategy that has no doubt led to its growing popularity.

On one hand, as Apple says, strict governance over its devices‘ NFC tech is used for security and to protect users. On the other, Apple could argue that competitor apps don’t meet its security standards to block their development and maintain its market position.

If Apple does attempt to block competitor apps on these grounds, you can bet we’ll hear about it. The phone maker has already been accused of putting a strangle hold on competitors in the sector.

For now though, it looks like Apple will continue to grow its market share in global digital payments.

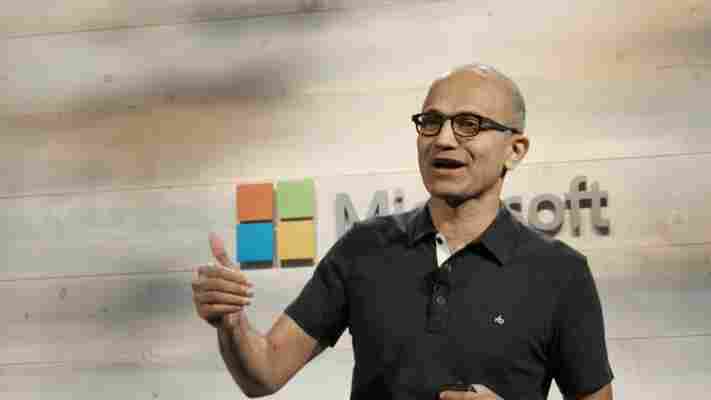

Microsoft reportedly plans to invest in India’s payments giant Paytm

Microsoft might be looking to pump some money in India’s payment sector through a potential investment in the country’s fintech giant Paytm. According to a report from the Economic Times, Paytm is looking to add an extended $100 million to its series-G round worth $1 billion , which was announced last year.

A person familiar with the discussion told ET that talks with Microsoft “began last year when Paytm was in the middle of raising funds. While Microsoft could not participate in the funding then, it is likely to pump in cash now.”

A Paytm spokesperson told TNW, ”We do not comment on market speculations.”

Until now, Microsoft has made only cloud-related deals with major startups in India. In 2017, it announced a strategic partnership with now Walmart-owned ecommerce giant Flipkart to use Azure as an exclusive public could platform.

Last year, India‘s largest carrier Reliance Jio signed a deal with the Seattle-based company to use the Azure cloud platform to develop solutions for large enterprises. Plus, it agreed to use Microsoft’s cognitive language services for its device ecosystem, to provide support for 13 Indic languages.

As TechCrunch noted in a report published last month, mobile payment firms are struggling to make money after raising billions of dollars in funding rounds. Paytm registered a loss of $549 million for the financial year ending March 2019.

However, Microsoft’s interest in India‘s mobile payments market is not misplaced. According to a report published by Assocham-PWC, the country’s digital payments industry will clock $135.2 billion by 2023 .

NY watchdog attacks Twitter over ‘jarringly easy’ Bitcoin scam hack

The New York Department of Financial Services (DFS) has called on the government to regulate social media giants in response to July’s dramatic Bitcoin-themed Twitter hack.

“Given that Twitter is a publicly traded, $37 billion technology company, it was surprising how easily the [h]ackers were able to penetrate Twitter’s network and gain access to internal tools allowing them to take over any Twitter user’s account,” said the DFS in a report published Wednesday.

The DFS urged policymakers to consider regulating social media giants for their cybersecurity on top of antitrust matters and content moderation processes. This would bring Twitter and Facebook in line with critical infrastructure such as utilities, telecoms, and finance.

Twitter stock slipped up to 2% in the moments after release of the DFS report, but so had the tech-heavy NASDAQ 100 index.

Social media hackers could influence markets, says the DFS

Back in July, hackers leveraged accounts belonging to major celebrities like Barack Obama and Elon Musk to promote a “double your Bitcoin” scam in an attack that lasted hours. The DFS’s own Twitter account was also reportedly compromised.

Two weeks later, authorities arrested an alleged 17-year-old Florida teen mastermind and two others, reportedly slapping the former (as an adult) with 30 felony charges including fraud. He’s had one court appearance so far, which reportedly faced constant interruptions by porn-peddling Zoombombers posing as CNN and BBC News employees.

Related Bitcoin wallet addresses suggest the hackers managed to swindle roughly $110,000 from unsuspecting users.

“The implications of the Twitter Hack extend far beyond this garden-variety fraud,” said the DFS. “There are well-documented examples of social media being used to manipulate markets and interfere with elections, often with the simple use of a single compromised account or a group of fake accounts. In the hands of a dangerous adversary, the same access obtained by the [h]ackers – the ability to take control of any Twitter users’ account – could cause even greater harm.”

[

For what it’s worth, the market did react to the attack; Twitter stock opened 4% lower the following morning, representing $1 billion in market value lost.

However, Twitter‘s share price quickly recovered throughout the course of the day’s trade. It remains more than 40% up for the year, tracking just ahead of the NASDAQ 100.

“The Twitter Hack demonstrates, more than anything, the risk to society when systemically important institutions are left to regulate themselves. Protecting systemically important social media against misuse is crucial for all of us–consumers, voters, government, and industry. The time for government action is now,” concluded the DFS.