A blockchain startup is claiming it has developed an algorithm that can dramatically reduce the size of digital files. If its technology is legit, it would help reduce the size of files 10,000 times – from 2GB to 20KB. Oh, and it’s launching an ICO for $50 million.

The startup, called DotPlay, demonstrates its “so called” compression algorithm in the latest episode of CNBC’s Crypto Trader show. In which, host, Ran Neu-Ner visits the startup to see the tech first hand.

DotPlay is claiming it uses blockchain for two things: To control view rights to content; and to run its compression algorithm which can purportedly compress any digital file to a fraction of its original size.

“Play can actually take every type of data and reduce it to a fragment of its size.” CEO and Co-founder of DotPlay, Shai Shitrit, told CNBC. “For example, whenever you choose to take a video and convert it to the Play file format, let’s say that video weighs 2GB, after you convert it into the DotPlay file format it will be reduced into something like 20KB.” Maybe like a real-world Pied Piper.

Indeed, DotPlay suggests its technology can reduce files’ size by a factor of 10,000. Popular file compression software 7Zip , can reduce files to about a third of their original size – on a good day.

Shitrit claims that DotPlay’s algorithm is functional and working today.

DotPlay demonstrates the program to Neu-Ner, taking the trailer for the latest Incredibles movie – a 90MB file – and compressing it to just 472 bytes in 10 seconds.

Coder, Udi Wetheimer took to Twitter to explain why this is impossible. Put simply, there is simply not enough space mathematically to compress two and a half minutes worth of video into just 472 bytes of data.

Consider the last time you wrote a very basic text document with no formatting or images. I bet it was more than 472 bytes.

However, there might be more to this “algorithm” than meets the eye.

Compression or file sharing?

While DotPlay’s system is not yet live, the demonstration shows an interface eerily similar to that of WeTransfer, a popular, web-based file sharing service.

The interface has a place to drag and drop a file, and set parameters for the file, and a big button marked “Save and Send.” The parameters dictate how many times the file can be viewed, and for how long.

DotPlay has yet to roll out its website, where perhaps it would also have a white paper that outlines how its technology functions.

Interestingly, DotPlay says on its LinkedIn page that the compressed files it produces will be 75 to 95 percent smaller than their sources. It then goes on to suggest its software also supports a function to retain data “remotely.”

It’s not clear what the remote function does, but the writing strongly suggests that by “compressing” a file on the DotPlay system, you are actually creating a shortcut to the original file that includes the user defined data access rights.

In other words, you are sending a small piece of code which could allow the recipient to access the original file via the DotPlay “shortcut”. The original file remains uncompressed and stored locally on your own computer. This is fundamentally different from compressing a file to a fraction of its original size.

Now, it is not uncommon to hear about wild claims in the blockchain space, but if I were you: I’d seriously consider doing some research before throwing money at DotPlay’s ICO.

If you’re interested in everything blockchain, chances are you’ll love Hard Fork Decentralized. Our blockchain and cryptocurrency event is coming up soon – join us to hear from experts about the industry’s future. Check it out!

Switzerland: Trojan horses are evolving to target cryptocurrency exchanges

A computer virus that mines the anonymous cryptocurrency Monero has been ranked as the sixth most significant malware to hit Switzerland in the first half of this year.

Swiss researchers also discovered that cybersecurity threats once focused on breaking into online banking services have pivoted to more efficiently attack cryptocurrency exchanges.

These revelations come by way of a new paper released by Switzerland’s Reporting and Analysis Centre for Information Assurance (MELANI), a government agency.

The research details the most critical cyberthreats to recently hit the Swiss internet, reports FinanceFeeds .

MELANI found seminal e-banking trojan Dridex has been ramping up its crypto-focused operations. It actually first appeared in 2012 under another name, Cridex . Researchers found the number of targeted cryptocurrency exchanges in its configuration files had increased this year.

Similarly, prominent malware Gozi , discovered in 2009, has evolved to suit new digital asset trends. The report notes that Gozi is currently targeting cryptocurrency exchanges, after it was recorded to have used ‘malvertising’ for the first time in order to spread itself as quickly as possible.

“This technique consists in using advertisements to mislead the user into downloading manipulated software,” the researchers explain. “In search engines, the advertisements are often displayed above the actual search results, [which] leads to confusion among users.”

But perhaps the most critical cryptocurrency threat for the Swiss is the mining malware Monerominer, which MELANI ranked as the sixth most prevalent malware threat found on Switzerland’s internet in the first six months of 2018.

Monerominer isn’t just a cryptocurrency miner. It’s actually a malware bot capable of downloading and running more malware, stealing account information along the way. It also logs keystrokes and can forcibly encrypt the contents of hard drives, holding data to ransom until a payment is made (typically with cryptocurrency).

The Gozi malware previously mentioned was ranked as Switzerland’s ninth most critical cyberthreat.

Monero-mining malware has certainly become notorious. Not long ago, security researchers found that more than two million previously undiscovered variations of the supposedly neutral CoinHive script were released in just three months.

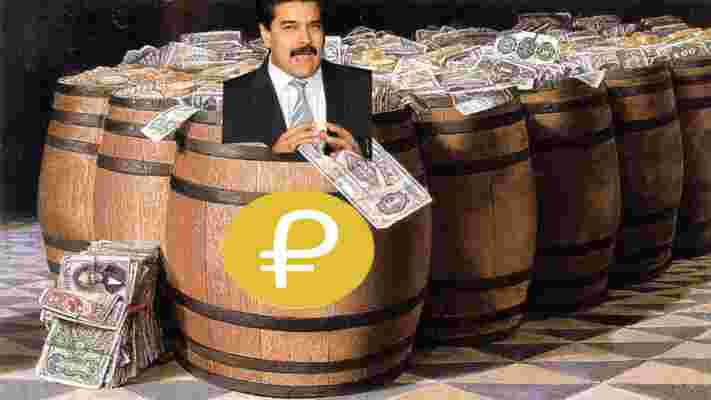

President Maduro is forcing Venezuelan banks to use his dodgy cryptocurrency

Nicol á s Maduro has ordered every Venezuelan bank to adopt his pet cryptocurrency, the Petro, which is now tied to and completely interchangeable with the new “sovereign Bolivar. ”

Both public and private banks must now use his dodgy cryptocurrency in all financial reports. For almost a year, this has been Maduro’s plan to pull Venezuela out of financial turmoil. Last month, its highest ever inflation rate was recorded, with prices for goods and services rising by at least 82,766 percent.

As of last week, Venezuela has two national currencies : the “sovereign Bolivar” and the Petro. The new sovereign Bolivar is effectively same as the old one – but with a fancy new stamp and a lower valuation. Venezuelans were asked to exchange 100,000 old-school Bolivar for just one sovereign Bolivar.

Even after the creation of a new Bolivar, Maduro is still obsessed with pushing his cryptocurrency onto his subjects. The oil industry has previously been ordered to use it for business transactions – now, his focus has been drawn to the banking system.

Maduro’s new economic plan is also meant to include a 3,400 percent increase to the minimum wage, Bitcoin News reports . That being said, the current minimum monthly wage is 0.5 Petro – or just $30.

The Petro is touted as a ‘ stablecoin ’ for the new sovereign Bolivar, each being of equal value. One Petro is worth around $60, and the sovereign Bolivar is tied to the price of the Petro. When it was first launched, the Petro was just a token backed by a barrel of oil. Now, it’s a national currency.

It has long been speculated that the Petro is really just Maduro’s way of skirting strict international sanctions, exploiting the unregulated nature of cryptocurrency to sell oil.

It doesn’t stop there: he also launched new government bonds backed by gold. France 24 reports that Maduro claims it will promote savings for Venezuelans, who have become disenfranchised by the continued devaluation of their national currencies.

“No one can say that gold loses its value,” declared Maduro.

For the sake of the Venezuelan people, I sure hope it doesn’t.