Bitcoin has always been shrouded in mystery, and to this day, not much is known about its origins or the identity of its creator.

The uncertainty of Satoshi Nakamoto‘s identity has spawned a host of conspiracy theories, and a lack of unequivocal proof means some are plausible, while others are obviously outright ridiculous.

Think about it: it’s August 18, 2008 and someone registers the bitcoinrg domain name.

A few months later, in October, a link to a white paper authored by “Satoshi Nakamoto” and titled “Bitcoin: A Peer-to-Peer Electronic Cash System” is posted to an obscure cryptography mailing list.

Soon after that, in January 2009, Bitcoin’s open-source code is released in the wild. By late 2010, Nakamoto began to fade away from the industry.

Hard Fork has taken a look at some of the wildest theories floating around.

A US government project

One of the most prominent theories is that the US intelligence services came up with Bitcoin to be able to send untraceable funding to top-secret international missions.

One example thread, posted five months ago, attributes Bitcoin‘s creation to “Uncle Sam,” aka the US government:

The government-Bitcoin conspiracy is so prevalent that prominent figures in the space have publicly shared their thoughts on the idea.

In 2011, Ethereum’s co-founder Vitalik Buterin posted on industry forum BitcoinTalk to say he wouldn’t be surprised if the National Security Agency (NSA) had been involved in the cryptocurrency’s creation.

Buterin clarified his stance following an article last year . In a tweet sent to his hundreds of thousands of followers, the young entrepreneur curiously said “my opinions have obviously changed a lot since then.”

The brother of notorious Colombian drug kingpin Pablo Escobar – who launched his own coin last year – has also claimed Bitcoin was created by the US government.

He did so in a self-written book , explaining the world would eventually learn of the US government’s creation of Bitcoin, and that the CIA was readying to dump its holdings en masse to drive down the cryptocurrency‘s value and ultimately destroy it.

The Chinese angle

Governments feature heavily in Bitcoin conspiracy theories.

One Redditor has even claimed Bitcoin is a byproduct of China.

The comment (again, posted some five years ago) says: “Bitcoin was created by a bunch of engineers in the Chinese communist party.”

“They used a Japanese name to avoid suspicion and since China produces computer chips for cheap they can be a world leader in mining and the inventors could be ultra wealthy all while reducing Chinese dependence on the US dollar,” it concludes.

Sometimes, the spooky China doomsday talk bleeds over into research. Indeed, last year, the world was startled to learn that analysts had determined China had the power, means, and possible intent to destroy Bitcoin entirely.

Bitcoin is the devil

Just when you thought the world of cryptocurrencies couldn’t possibly get any weirder, it turns out some people think Bitcoin is the work of the Antichrist .

This conspiracy theory – my personal favorite – states the cryptocurrency is linked to a religious belief based on the Christian book of Revelations, where Bitcoin is considered to be the “Mark of the Beast.”

The Mark of the Beast originates from a story in the Bible’s New Testament and says earthly beings will need to get a mark on their bodies in order to buy basic necessities.

This mark is compulsory for everyone, “the great, the small, the poor and the rich.”

In my opinion, this theory is more humorous than credible.

Bitcoin is actually AI

Another seemingly popular theory is that Bitcoin is actually the spawn of rogue artificial intelligence (or aliens!) using the cryptocurrency‘s network to take over the world.

This bizarre theory was raised by a video uploaded to the UFO Today YouTube channel in August last year.

The video alleges that Bitcoin uses the allure of money to trick people into expanding its network and processing power.

UFO Today said: “Would it be possible that the reason for the Bitcoin code to be so perfect, is the fact that the code wasn’t created by a single extremely skilled developer or even a team of skilled developers?

Others on Reddit agree. A user going by the name of ‘givesadvice4bitcoin,’ said : The Devil needed a way to make more money. He’d been told his whole life that ‘money is the root of all evil.’ Naturally, he wanted to be even eviler.”

It’s not surprising that the lack of concrete information about Bitcoin‘s existence has caused many to question its origins, and while I, for one, can appreciate the imaginative explanations posed by some, I can’t help but wonder whether the wild conspiracy theories impact Bitcoin‘s chances at mainstream adoption.

One thing’s for certain though, I’m sure Bitcoin isn’t the devil.

Want to find out more about cryptocurrencies and blockchain technology? Check out our Hard Fork track at TNW 2019 !

UK police just sold criminally-seized Bitcoin for above market rates

UK police raised £300,000 ($369,000) through the auction of criminally-seized Bitcoin and other cryptocurrency this week, achieving over market value.

The sales, a first for UK police, occurred across two unreserved auctions that were finalized on September 26 via Irish firm Wilsons Auctions.

In total, 62 lots of cryptocurrency were sold, which included Bitcoin, Ethereum, Ripple, and Bitcoin Satoshi Vision.

Data shared with Hard Fork reports Wilsons Auctions fielded 7,500 bids from across the world, including Brazil, Australia, Dubai, Canada, Singapore, and the USA.

On average, 1 BTC sold for £6,798.80 ($8,365), 0.5 BTC for £3,443.68 ($4,236), and 0.25 BTC for £1,972.74 ($2,426). The current price of Bitcoin is £6,512 ($8,012).

Unfortunately, data for the other cryptocurrencies sold was unavailable at the time, but we’ll update this piece with more information as it’s shared.

Wilsons Auctions also originally reported that £500,000 ($662,000) worth of cryptocurrency was to be put up for auction, which we’ve sought to clarify.

“Despite one of the most significant market dips in recent months during the auctions, the results from these auctions indicate that we are exceeding market value by breaking the cryptocurrency down to smaller Lots […],” said Wilsons Auctions’ asset recovery director Aidan Larkin.

This criminal’s cryptocurrency is to be spread across the world

UK police reportedly seized the cryptocurrency stash from 20-year-old Norwich man Elliot Gunton. The self-described “full-time crypto trader” was recently found guilty of supplying stolen personal data and hacking services in exchange for cryptocurrency.

He’s been sentenced to 20 months in prison, and ordered to repay £400,000 ($491,000).

Gunton is known for taking part in 2018’s TalkTalk hack , which saw bank details of 4,500 users leaked online. The incident is reported to have cost the company more than £77 million ($94.5 million).

As well, US authorities recently indicted Gunton for allegedly hacking cryptocurrency exchange EtherDelta in 2017. This event involved changing the site’s DNS settings to redirect users to a clone, which was used to steal login credentials and ultimately, user funds.

So, while the past is still catching up with Gunton, the proceeds of his crimes will now be redistributed around the world. You can read more about Gunton’s arrest here .

Reuters: One ‘mystery’ buyer pushed Bitcoin over $5,000

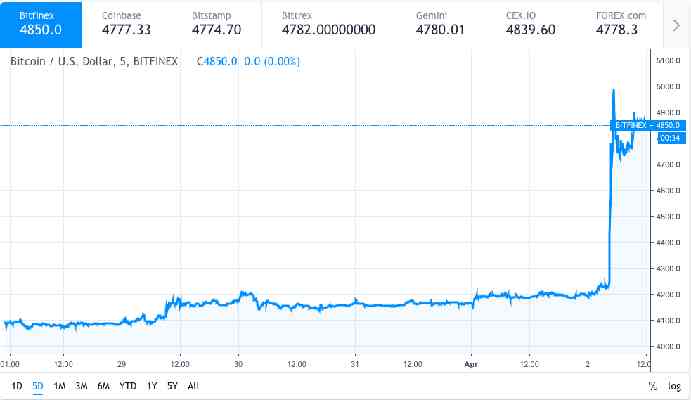

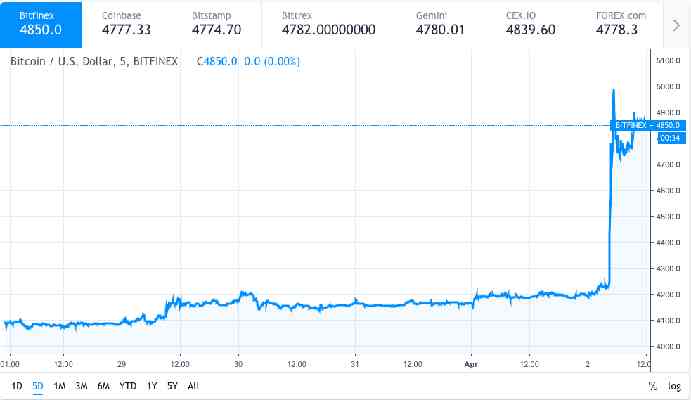

Bitcoin has been pumping. Over the past six hours, its value has jumped as much as 20 percent, and a recent report has claimed a “mystery buyer” is responsible.

During Asian trade, Bitcoin‘s value broke $5,000 for the first time since November last year, marking the biggest one-day gain in the past year, Reuters reports .

Trade has since calmed, with the price remaining steady at around $4,700 across major exchanges . The last time Bitcoin was over $4,500 was back in November 2018, around five months ago.

Oliver von Landsberg-Sadie, head of a cryptocurrency brokerage firm, told Reuters the movement was likely the result of a single buyer, who used a computer algorithm to trigger the purchase of $100 million worth of Bitcoin spread across a number of exchanges.

“There has been a single order that has been algorithmically-managed across these three venues, of around 20,000 BTC,” he told Reuters, noting the orders were spread between cryptocurrency exchanges Coinbase, Kraken, and Bitstamp.

“If you look at the volumes on each of those three exchanges – there were in-concert, synchronized, units of volume of around 7,000 BTC in an hour,” he added.

Another industry insider told Reuters there were 6 million trades over an hour during the price rise, mostly concentrated on Asia-based exchanges. This is three to four times the usual trading volume.

“You trigger other order books to play catch up, and that creates a buying frenzy,” he commented.

Bitcoin‘s price famously almost hit $20,000 in December 2017 and had been gradually falling ever since. By February this year, we had entered the longest Bitcoin bear market in history .

Curiously, Hard Fork reported back in January that cryptocurrency analysts had determined some time in Q1 2019 to be the end of Bitcoin’s cold streak . We are now in Q2.

So far so good, I guess.

Did you know? Hard Fork has its own stage at TNW2019 , our tech conference in Amsterdam. Check it out .