The head of cryptocurrency exchange Binance responded to a 7,000 BTC ($40 million) hack with an outlandish idea: take over the entire Bitcoin blockchain and cancel the transactions.

A major digital asset exchange openly colluding with cryptocurrency mining pools to reverse transactions would certainly be bad for PR.

It would also critically undermine Bitcoin‘s primary value proposition: that its transactions are effectively immutable and censorship-resistant.

Binance CEO Changpeng Zhao conceded this reality by announcing he’s dropped the idea after consulting with advisors, among them Jihan Wu of the infamous cryptocurrency mining firm Bitmain .

“One, we may damage credibility of Bitcoin,” Zhao tweeted . “Two, we may cause a split in both the Bitcoin network and community. Both of these damages seems to outweigh $40 million revenge […].”

Bitcoin incentivizes censorship-resistance, not bailouts

It is hypothetically possible to roll-back the Bitcoin blockchain through ‘ block re-organization ,’ which is often associated with ‘ 51-percent attacks .’

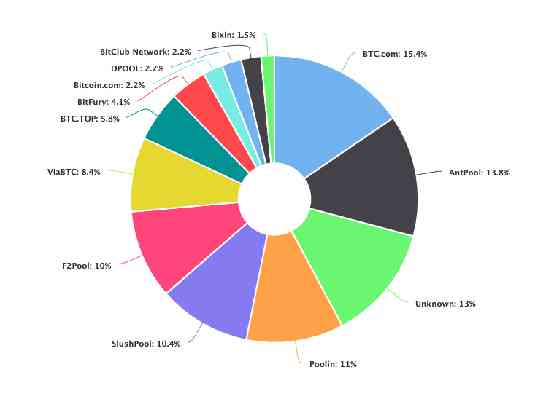

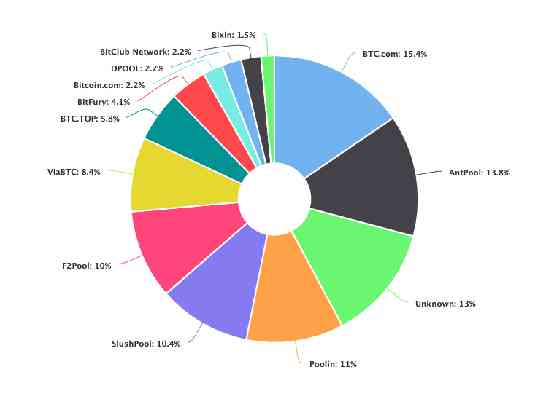

For Zhao to cancel transactions, he would need to convince Bitcoin’s mining pools to agree that working with an alternate version of Bitcoin is in their best interests, starting from just before the attack happened.

In reality, this would be a very tough sell for Zhao. Bitcoin currently rewards miners for adding blocks to its blockchain with 12.5 BTC ($72.8K).

Deleting past blocks would mean giving up those lucrative rewards, as well as the associated transaction fee revenue .

Bitcoin also adds blocks every 10 minutes, so the cost of re-organizing its blockchain grows very quickly. It even depends on how many mining pools agree to the plan.

Prominent Bitcoin developer Jimmy Song explained via Twitter that the amount of time it takes to create a secondary, hack-free blockchain is reduced as more hash rate is collected.

This makes for less mining revenue sacrificed during a re-organizaton. Basically, more mining pools can roll-back Bitcoin for cheap when compared to fewer colluding parties.

Still, just hours after the attack, Song roughly calculated that even if Zhao was to convince 55 percent of the hashing power to re-organize the blockchain, the cost of doing so had already outstripped the amount lost in the hack.

“[…] And really, if you do this, you end up taking the money from the thieves and giving it to miners. Binance doesn’t benefit that much,” he added , as mining pools would more-than-likely charge premiums for taking on so much risk.

Zhao ultimately agreed he simply doesn’t have the power to “unhack” the $40 million worth of Bitcoin stolen, albeit after being educated on the matter by those close to him.

It should also be made clear that the cost of re-organizing Bitcoin does not define the security of the Bitcoin blockchain entirely.

In fact, the value of Bitcoin really comes from the impossibility of schemes like the one proposed by Zhao.

It just so happens that the entire network is incentivized against working in unison to bail out a single cryptocurrency exchange. For that, we can thank Satoshi .

All you need to know about Bitcoin network nodes

Welcome to Hard Fork Basics, a collection of tips, tricks, guides, and advice to keep you up to date in the cryptocurrency and blockchain world.

The Bitcoin network is often touted as one of the most revolutionary forms of decentralized technology the world has ever seen. But for it to be decentralized, it needs a globally distributed network of connected computers or nodes.

It sounds simple enough, but there isn’t one type of node, and each type has a different role to play in helping the blockchain network function correctly. In this article, we’re going to break down the different types of node and what they do.

Know your nodes

Generally speaking, a node is a piece of computer equipment attached to a network. In the context of the internet and your household, your phone is a node, your laptop is a node, your router is a node, and that wireless IP camera, yep, that’s a node too.

Nodes can take many shapes, sizes, and forms. Each one plays a different – yet vital – role in the functioning of your household.

In the case of the Bitcoin blockchain, there are four main types of node: full nodes, super nodes, light nodes, and mining nodes. Full, super, and light nodes perform similar functions, while mining nodes perform a different function entirely.

Before diving into what these nodes are and what they do, it’s best to think of the blockchain is fundamentally a ledger or list of transactions – for this case at least. All types of nodes contribute in someway to building or maintaining that list.

Mining Nodes

There’s plenty written about what mining is and how it works , but for the sake of this article, think of mining nodes simply as the nodes that produce the blocks for the blockchain.

It’s mining nodes that confirm the blocks that should be put into that “list,” in a process known as “mining.” When people talk about the Bitcoin network, particularly in the context of its energy consumption, they are often referring to the network of miners and ASIC (application specific integrated devices) machines.

Mining nodes aren’t actually responsible for maintaining the blockchain, they are only responsible for creating blocks to add to it. After these blocks are created, they are sent over the network to full nodes which validate them and add them to the blockchain.

Full and Super Nodes

As their name suggests, full nodes are responsible for holding and distributing copies of the entire blockchain ledger. As such, they play a vital role in the network as they are the go-to point for validating the history of the blockchain.

The full node is able to validate transactions all the way back to the genesis block, at the time of publishing, the entire blockchain is getting on for 200GB in size. Some estimate that there are over 10,000 operational full nodes on the Bitcoin network.

These nodes then propagate the blockchain to all other nodes on the network to ensure the most trusted blockchain is maintained. The more nodes, the more decentralized the network, and the harder it is to hack.

Depending on the number of incoming and outgoing connections a full node has, it can also be referred to as a super node or listening nodes.

Super nodes generally operate around the clock to help connect other full nodes to each other and spread the blockchain across the entire network. They serve as information or redistribution relays to ensure everyone has the right copy of the blockchain.

Light Nodes

Light nodes – or thin nodes – perform a similar function to full nodes, but rather than holding an entire copy of the blockchain, they only contain a portion of it.

Light nodes only download the block header of previous transactions, to confirm the validity of the blockchain, and to pass this information on to other nodes. The block header is a summary of a given block, it includes information about the previous block to which it is hashed, the time it was mined, and a unique identifying number, called a nonce .

Generally speaking, light nodes connect to a parent node, usually a full node; which does maintain a complete copy of the blockchain. As light nodes process less of the blockchain and aren’t helping propagate large volumes of data through the network, they don’t need to be as powerful and are much cheaper to own and maintain than full or super nodes.

That said, if a full node is hacked and holds an incorrect copy of the blockchain, the light nodes can serve to dismiss this blockchain as false, and confirm to the full node the correct blockchain it should be maintaining. Think of a group of light nodes as a bunch of supportive friends helping keep a full node on the straight and narrow.

Using light nodes helps to further decentralize the blockchain network, and spread the true ledger across a greater distance for a lower cost compared to full nodes.

Validation is not consensus

Nodes validate the blockchain by following a number of rules. When the entire network follows these rules, all nodes should help to produce the same blockchain. It should be noted that validation actually occurs before a block is mined; validation is not the same as consensus. Consensus is reached when the mining nodes agree on the order of transactions, not on what transactions are valid.

Imagine I have 1BTC and transfer 0.25BTC to my colleague Yessi . She currently has 0.25BTC in her wallet. To confirm this is valid, the Bitcoin network will “ask” the full nodes to confirm I have enough coins and how much Yessi will have after the transaction. Once valid, the transaction will be snapped up by miners to add to a block and verify by Proof-of-Work – in Bitcoin‘s case at least. But how that happens is a whole different kettle of fish – and worth a read .

This is, of course, a highly simplified look at nodes; network structure can get much more complicated. But now that you’ve got to grips with the basics of what nodes make up the Bitcoin blockchain network, why not read up on how Proof-of-Work or mining pools work?

Ripple Q2: Market share is down, but price is up – here’s what happened

Cryptocurrency and blockchain were built to usurp centralized authorities like governments and banks. And then came Ripple, a corporate and institutional reimagining of what a digital currency should be and do.

Ripple has managed to make cryptocurrencies and corporate institutions play nice, and is developing distributed ledger (DLT) technologies for such clients. It has often drawn criticism for ‘not being a real cryptocurrency’ and not being truly decentralized.

This criticism comes from the fact that Ripple’s blockchain doesn’t have any miners, and access to it is heavily permissioned . It’s a far cry from open and censorship-resistant platforms, like Bitcoin. However, the Ripple team has repeatedly assured holders that XRP and the network will continue to exist, even if Ripple shuts down.

Ripple styled “cryptocurrencies” and DLTs are seemingly a growing trend too. JP Morgan has this quarter boasted that big institutions are really keen on its digital remittance asset, JPM Coin.

Whether you agree with XRP’s ideology or not is beside the point. The asset has proven itself to be a mainstay of leading cryptocurrencies by market cap. For brief moments, it even surpassed Ethereum to take second spot behind Bitcoin by market cap; currently, XRP is the third largest coin.

Here’s a look back at how Ripple got on during the first quarter of 2019.

Ripple/USD Q1 performance recap

Ripple’s XRP didn’t have the best start to the year.

It opened January 1 at $0.35 and would shortly reach $0.37 the following day, the highest trading price it would see all quarter. XRP hovered around this price into the second week of the year, but it started falling by January 9.

On January 13, XRP was trading at $0.31, and it stayed around this price for the next couple of weeks. January 25 marked the start of another sharp downward swing for the digital asset; it would eventually bottom at $0.28 at the end of the month. Thankfully though, this is the lowest price it would see all quarter.

There was a brief rally in mid-February which would see the coin hit $0.32. This might not sound far behind where it opened the year, but bear in mind this is still an 11-percent drop over where it started in January.

For the rest of the quarter, Ripple would have frequent up and down swings, none of which are particularly noteworthy. Indeed, some might call this stability, but the coin spent most of the latter half of the quarter trading around $0.30, and showed no sign that a breakout might be imminent.

Ripple went on to close the quarter trading at a hair over $30, a 16-percent drop over the quarterly-high it saw in early January.

Ripple/USD Q2

As with a number of other cryptocurrencies like Bitcoin and Ethereum, Ripple got off to a great start in Q2. It opened the quarter on April 1 at $0.3105 and swiftly headed skyward to a trading price of $0.3457 over the following 24 hours.

This swift uptick was short-lived though, and XRP would have a tough time for the next six weeks.

Ripple’s price dwindled and a market correction saw it drift from its early quarter high to trade at $0.3157 by July 15. A brief price bump saw it rise to $0.3360, but this was short-lived and XRP would end up trading at $0.2872, its lowest price since February.

For the next two weeks, between April 28 and May 10, XRP traded between this low and a max of $0.3036. The first half of Q2 for Ripple may have left a few traders with a bitter taste. However, the rest of the quarter was far sweeter.

May 10 marked the end of a two-week long stagnant period and the start of a series of positive upswings that would see XRP trade at prices that it hasn’t seen since late 2018.

The first upswing was the most dramatic of the quarter and saw Ripple’s price rise from $0.2953 to $0.4321 in the space of five days, an increase of 46 percent.

A brief market correction saw Ripple’s price retreat back down to $0.3713 over a 2-day period. This is cryptocurrency and in true volatile fashion, XRP was soon heading skyward once again.

Over the remainder of the quarter, Ripple had two more notable upswings which saw the coin’s price peak at $0.444 on May 29, and $0.4763 on June 23.

Despite having its ups and downs across the quarter XRP eventually closed Q2 29 percent up on where it opened. On the last day of Q2, the coin was trading at $0.3998.

Major events in Q2 for Ripple

According to CoinGecko’s Quarterly Report for Q2 2019 , XRP lost nearly half of its market dominance falling from 9.8 percent to 5.7 percent, decreasing by 4.1 percent overall, over the quarter.

As ever, Ripple had a quarter packed with announcements and news of banks, institutions, and corporate clients using its DLT tech.

The Spanish bank Santander announced the expansion of its reportedly Ripple-powered international payments tool One Pay FX to non-customers through its One Pay app.

Ripple made two announcements that it is expanding globally and opening more offices in what it says are key locations. In June, Ripple officially expanded in South America by opening offices in Brazil. The firm also opened offices in Switzerland , which is swiftly becoming a hot-bed for cryptocurrency and blockchain businesses.

What’s more, Ripple also signed a partnership with international payments provider Moneygram. It’s claimed the partnership will see Ripple become MoneyGram’s key partner for cross-border payment and foreign exchange settlement using digital assets.

Ripple was also voted by finance mainstay, Weiss Ratings, as the second best cryptocurrency , ahead of Bitcoin in third spot.

Looking forward to Q3 for Ripple

You can be sure that Ripple will continue signing partnerships with various corporations and institutions as the year progresses. It remains to be seen if these will lead to significant developments, though, as this has been Ripple‘s mantra since its inception and these announcements rarely lead to sustained growth.

While XRP had a good quarter overall, in comparison to other coins, its gains were somewhat lackluster. XRP was one of the worst performing cryptocurrencies over the first half of the year, perhaps thanks to its rather flat Q1.

Indeed, as we enter the Q3 and the second half of the year, XRP isn’t showing many signs of growth, with the coin tumbling from around $0.41 to under $0.33 over the firs two weeks of July. Hopefully, things will look up for the rest of the year.