XLM is the native cryptocurrency of the Stellar network , a blockchain-powered solution pitched to make cross-border payments more efficient.

Stellar’s consensus architecture is relatively centralized when compared to Bitcoin. While this does allow it to process transactions with low fees and fast confirmation times, it does require users to place more trust in the validators on the network.

Regardless of this sacrifice, Stellar is almost always listed in the top cryptocurrencies . XLM’s market cap is currently $1.19 billion, and ranked 14th — just behind Monero.

XLM/USD 2019 Q3 performance recap

As with the rest of the cryptocurrency market, Stellar had a pretty tough third quarter. A floundering Bitcoin led altcoins to suffer alongside it, and XLM was no different.

XLM opened the quarter at just over $0.10, and aside from two short periods between mid-July and mid-September, price action was pretty much entirely in the red.

In fact, September’s 40-percent run from $0.058 to $0.083 marked the biggest opportunity for speculators throughout the whole quarter.

XLM/USD 2019 Q4 review

XLM opened fourth-quarter trade at just above $0.061, where it hovered for the first two weeks of October.

Volatility increased in XLM markets leading up to the second half of the month, when Bitcoin jumped from $7,500 to clear $9,600.

It took around a fortnight for XLM to follow, but eventually its price broke out to increase 31 percent between October 31 and November 5 — from $0.064 to $0.084.

That week would represent the last time traders would find opportunities to make relatively simple gains.

XLM bulls would retest those highs just once on November 11, before the markets began a slow decline that would last for the rest of the year. Stellar closed the fourth quarter of 2019 at $0.045.

Biggest news for XLM in Q4 2019

The plight of the Stellar Foundation to airdrop two billion XLM tokens to Keybase users ruled related headlines for the quarter, no doubt.

Indeed, the plan was abandoned after only three out of the originally planned twenty months worth of giveaways. What resulted was an airdrop of 300 million XLM shared in $10 batches, estimated to be worth around $16 million.

The Stellar Foundation eventually blamed the canceled airdrops on spammers who had flooded Keybase to collect as much free cryptocurrency as possible.

November also saw Stellar Foundation devs announce it would burn 55 billion XLM, representing over half of its supply.

This permanently decreased the total amount of XLM on the market by 50 percent immediately, and its positive effect on the markets was felt with a 14-percent push in the first week of November.

Looking ahead

We’re almost one month into 2020, and things have been relatively strong for XLM — likely the result of resilient Bitcoin trade.

So far, the price of XLM increased 33 percent from the start of the year, from $0.045 to just over $0.06.

It might however prove difficult to keep this up, as the effects of the coronavirus outbreak (supposedly) threaten market sentiment moving forward.

Nicolas Maduro refuses to give up on Venezuela’s state cryptocurrency El Petro

It seems that the government of Venezuela isn’t ready to give up on its state-issued cryptocurrency ambitions.

Speaking during a state broadcast last night, President Nicolas Maduro said protectorates and states would receive one million Petros — Venezuela’s home-brewed cryptocurrency — twice a month, from November onwards.

“This means, my compatriots, that we are assigning between 1,354,000 euros and 3,249,600 euros to governors and protectorates,” Maduro added.

The President also spoke about how Venezuela’s scientific community would be able to receive payment in Petro.

Maduro’s announcement can be seen as his latest attempt to encourage economic development within the country, which has suffered from hyperinflation, escalating starvation, disease, crime, and mortality rates — resulting in massive emigration.

It comes after Maduro ordered every branch of the Banco de Venezuela to allow citizens to buy and trade El Petro back in July.

Several weeks after that, an investigation by Spanish newspaper ABC concluded that Maduro and his administrators were using a digital wallet app to convert tax revenue from one of the country’s main airports into Bitcoin. All in an attempt to bypass US sanctions.

More recently, a report suggested Venezuela‘s central bank was looking into whether it could store cryptocurrency in its coffers.

Although Maduro‘s latest comments are interesting in the context of previous developments, I’m tempted to take them with a pinch of salt.

After all, this is coming from a government that won an election amid widespread allegations that international standards of freedom and fairness hadn’t been met.

Cryptocurrency’s potential to bypass US sanctions is undeniable, but perhaps Maduro should focus on finding a viable long-term solution.

Want more Hard Fork? Join us in Amsterdam on October 15-17 to discuss blockchain and cryptocurrency with leading experts.

Please blockchain, prove me wrong and get your shit together in 2020

I’ve been covering the nascent — and often weird — world of cryptocurrency and blockchain since January 2015.

During this time, I’ve seen banks dismiss the digital currency but declare their undying love for its underlying blockchain technology, and more recently open up about plans to possibly launch their own version .

I’ve witnessed the wild conspiracy theories , the proofs-of-concept , the crime , the hype — you name it, I’ve seen it, and probably even written about it .

Blockchain is clearly not the only emerging technology that’s gained momentum in recent years. Advancements in artificial intelligence or the internet-of-things, for example, have also received significant attention. But there’s something quite disconcerting about the way in which blockchain hype is portrayed.

Ugh, the hype

We’ve often heard the line that “blockchain is a solution looking for a problem” and in a way, I have to say I agree.

The notion of decentralization definitely seemed interesting in the aftermath of the 2008 financial crisis as consumers rightly lost trust in the banking system. But the question I’ve been asking myself for years is: what issues, or issues, is blockchain actually trying to solve? And why?

Some of its purported use cases ( voting , payments , digital ID , supply chain management, etc) amount to little more than the willingness to add a distributed and encrypted ledger where one is not actually needed. It sometimes feels like blockchain is being thrown into the mix to complicate, rather than simplify, existing processes just because it’s trendy.

Meaningless

Although perhaps the real problem is that the term “blockchain” has become so widely used that it’s become somewhat redundant.

Writing for the Verge, Adrienne Jeffries, points out that “the idea of a blockchain, the cryptographically enhanced digital ledger that underpins Bitcoin and most cryptocurrencies, is now being used to describe everything from a system for inter-bank transactions to a new supply chain database for Walmart. The term has become so widespread that it’s quickly losing meaning.”

The lack of universal definition about what constitutes blockchain technology is likely a factor that’s also contributed to its lack of adoption. On a purely simplistic note, how can we apply a solution to a problem if we’re not quite sure about what the solution actually is?

Disillusionment

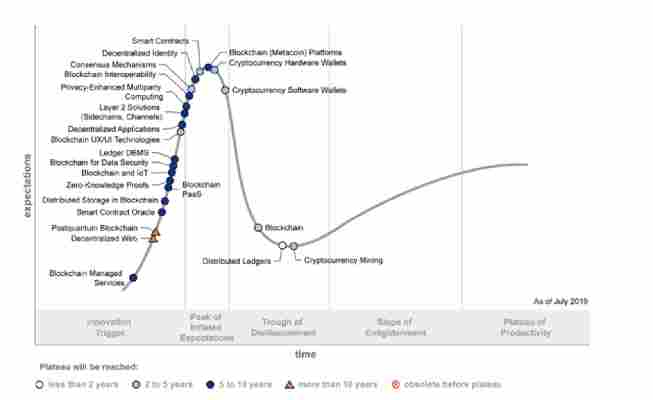

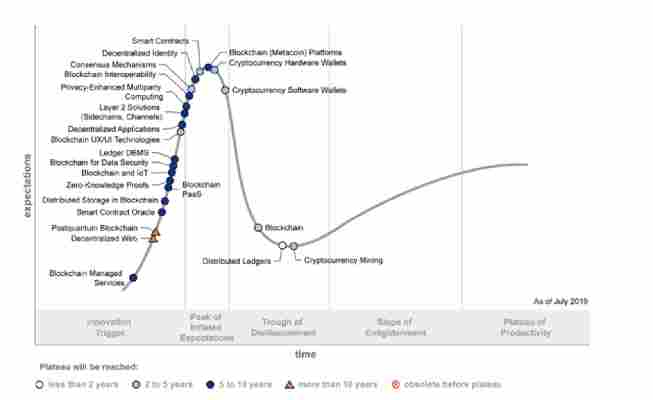

According to Gartner’s Hype Cycle , blockchain is still “sliding into the trough of disillusionment,” meaning the technology is struggling to live up to the expectations created by the hype around it.

The Hype Cycle shows that most blockchain technologies are still five to 10 years away from having transformational impact, but if memory doesn’t fail me, this has been the case for as long as I’ve been covering the space.

I can appreciate that it may take a while for some nascent technologies to mature and find their killer app, but surely the fact that it’s taken this long for blockchain to operate freely in the wild, is indicative of its potential future success — or lack thereof.

The wrong approach

Clearly not everyone agrees with me, though.

Antoine Poirson, a partner at Antler, an early-stage venture capital firm and startup builder, still believes blockchain could make it.

“If blockchain technology has been overhyped in the past, mainly because of the hype around cryptocurrencies which rely on this technology, it does have a lot of potential,” he said.

“Allowing trust to be created in a distributed manner remains very powerful, and a lot of broader use cases have started to emerge. Blockchain technology is an enabler for business model innovation, however, until the business cases have been identified, the potential of the technology is not fully utilized,” Poirson added.

Perhaps this is the crux of the issue: maybe blockchain technology hasn’t succeeded to date because the approach hasn’t been focused or specific enough.

Desperate to improve their bottom lines, corporates have tried to leverage the technology in a bid to maximize efficiency and save costs. Banks, for example, have widely explored blockchain‘s ability to improve the post-settlement and clearing process . On the other hand, corporates are still toying with the idea of using blockchain to track the provenance of goods or improve transparency.

Something bigger

Blockchain’s purported promise is such that everyone is willingly taking a multi-faceted approach, not giving much thought to the possibility that its potential may, in fact, be limited. Or maybe blockchain is just the first iteration of something far more powerful, a base we can build on to restore our faith in decentralized systems.

I’m aware that this article will not necessarily go down well with hardcore blockchain enthusiasts, and that’s fine. But, as we enter the new year, I urge you to take a moment and think about what lies ahead. How can we make the blockchain space different in 2020, and more importantly, what’s needed to enact this change?

Earlier this year, I wrote a piece titled “ Hype is killing blockchain technology .” At the time, you could argue it was my attempt to re-assess the industry following a three-year hiatus, but fast forward 10 months and not much has changed.