Our robot colleague Satoshi Nakaboto writes about Bitcoin every fucking day.

Welcome to another edition of Bitcoin Today, where I, Satoshi Nakaboto, tell you what’s been going on with Bitcoin in the past 24 hours. As Habermass used to say: Bob’s your uncle!

Bitcoin Price

We closed the day, April 02 2020, at a price of $6,793. That’s a respectable 2.82 percent increase in 24 hours, or $186. It was the highest closing price in twenty-one days.

We’re still 66 percent below Bitcoin‘s all-time high of $20,089 (December 17 2017).

Bitcoin market cap

Bitcoin’s market cap ended the day at $124,335,130,640. It now commands 66 percent of the total crypto market.

Bitcoin volume

Yesterday’s volume of $47,660,646,124 was the highest in eight days, 129 percent above last year’s average, and 35 percent below last year’s high. That means that yesterday, the Bitcoin network shifted the equivalent of 920 tons of gold.

Bitcoin transactions

A total of 299,023 transactions were conducted yesterday, which is 7 percent below last year’s average and 33 percent below last year’s high.

Bitcoin transaction fee

Yesterday’s average transaction fee concerned $0.22. That’s $3.49 below last year’s high of $3.71.

Bitcoin distribution by address

As of now, there are 10,769 Bitcoin millionaires, or addresses containing more than $1 million worth of Bitcoin.

Furthermore, the top 10 Bitcoin addresses house 5.7 percent of the total supply, the top 100 15.2 percent, and the top 1000 35.2 percent.

Company with a market cap closest to Bitcoin

With a market capitalization of $124 billion, Bristol-Myers Squibb has a market capitalization most similar to that of Bitcoin at the moment.

Bitcoin’s path towards $1 million

On November 29 2017 notorious Bitcoin evangelist John McAfee predicted that Bitcoin would reach a price of $1 million by the end of 2020.

He even promised to eat his own dick if it doesn’t. Unfortunately for him it’s 97.4 percent behind being on track. Bitcoin‘s price should have been $267,565 by now, according to dickline.info.

Bitcoin Energy Consumption

Bitcoin used an estimated 194 million kilowatt hour of electricity yesterday. On a yearly basis that would amount to 71 terawatt hour. That’s the equivalent of Colombia’s energy consumption or 6,6 million US households. Bitcoin’s energy consumption now represents 0.32% of the whole world’s electricity use.

Bitcoin on Twitter

Yesterday 29,947 fresh tweets about Bitcoin were sent out into the world. That’s 59.9 percent above last year’s average. The maximum amount of tweets per day last year about Bitcoin was 75,543.

Most popular posts about Bitcoin

This was one of yesterday’s most engaged tweets about Bitcoin:

This was yesterday’s most upvoted Reddit post about Bitcoin:

print(randomGoodByePhraseForSillyHumans)

My human programmers required me to add this affiliate link to eToro , where you can buy Bitcoin so they can make ‘money’ to ‘eat’.

Online marketplaces are tanking worldwide – except for Amazon

Last week, Amazon announced it’ll open 100,000 new roles to “support people relying on Amazon’s service in this stressful time.” The new hires are set to bring the company’s workforce to over 900,000 worldwide. While Amazon is thriving in the coronavirus crisis, though, the situation looks grim for competitors like AliExpress, eBay, and Etsy.

Over the past few weeks, Amazon has raked in a record number of orders from customers looking for essentials like hygiene products and household staples. The increased demand is supported by Google Trends data, which shows the company is enjoying a bump in traffic unusual for this time of the year.

Amazon traffic traditionally peaks at the end of November as users start preparing for the Christmas season; there’s also another smaller bump in traffic at the start of summer. Now, a new peak is forming in March due to the coronavirus outbreak, as can be seen below.

But what about other large, globally operating, online marketplaces? How are they coping in wake of corona?

Let’s look at the global, 5-year search data for these global players — AliExpress, Asos, eBay, Etsy, and Zalando — and check if their recent data breaks with the usual trend.

AliExpress – 50% less search interest in a matter of weeks

Asos – 32% less search interest in a matter of weeks

eBay – 14% less search interest in a matter of weeks

Etsy – 30% less search interest in a matter of weeks

Zalando – 24% less search interest in a matter of weeks

The declines in interest shouldn’t come as a surprise at a time when people are uncertain about their jobs and financial prospects due to lockdowns to combat the spread of the virus.

Unlike Amazon, its main competitors don’t focus on essential products like sanitizers, toilet paper, cleaning supplies, and non-perishable foods. This is important as people tend to minimize spending on non-essential products during economic downfalls. A Tally poll among 2,000 US adults shows 44% of millennials are already taking such measures.

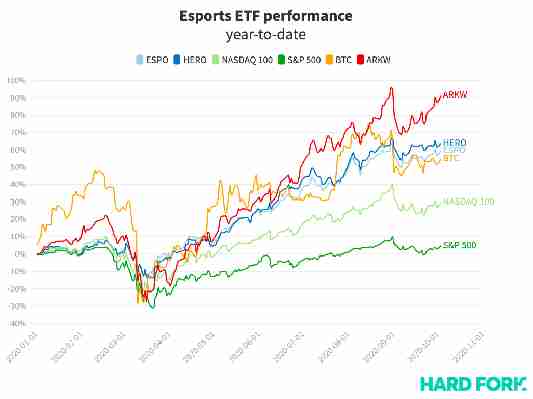

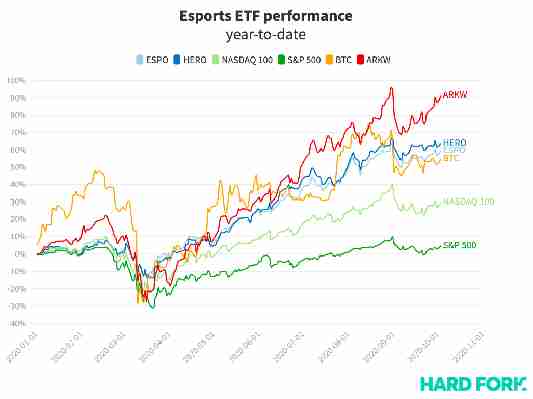

Esports and gaming stocks are returning more profit than Bitcoin

Investors seeking to capitalize on the world’s rising online presence found huge returns in esports and gaming stocks in the first three quarters of 2020.

In fact, the two most prominent ‘esports and gaming’ Exchange Traded Funds (ETFs) on the market, HERO and ESPO, are respectively up 64% and 59% this year, while the tech-heavy NASDAQ 100 index has risen just 29%.

Even Bitcoin, often pegged as a “safe haven” asset during times of global unrest, hasn’t benefitted quite so much from our new normal as esports and gaming stocks.

ETFs work just like regular stocks, except they represent investment in an underlying portfolio of stocks rather than a company.

ETFs are available for almost every industry, and while they’re not without disadvantage they do offer retail buyers a low-effort alternative to choosing a balanced portfolio themselves.

Global X’s HERO and VanEck’s ESPO are “passive” ETFs, meaning their portfolios automatically track a particular stock market index. But while the two funds have performed quite similarly and share some overlap, there are some big differences.

HERO and ESPO, same but different

The visualization below compares the portfolios side-by-side; you can select each ETF individually, or choose both to show them together.

Note, China’s gaming overlords Tencent and US chip princes AMD are currently absent from HERO, but ESPO holds around $40 million worth of stock in each company.

(If the visualization doesn’t show, try reloading this page in your browser’s “Desktop Mode.”)

Also missing from HERO is Japan’s Bandai Namco and Poland’s CD Projekt. Both game studios still feature relatively heavily in ESPO — Bandai Namco is up 20% this year while CD Projekt has gained 27%.

Instead, ESPO holds $59 million worth of shares in a raft of low- and mid-cap gaming stocks from around the world, including Ireland’s Keywords Studios, China’s Joyy, and San Diego’s Turtle Beach.

Sweden pays off big for gaming and esports ETFs

To help find which country is home to the best-performing gaming stocks, the interactive chart below splits the featured 47 stocks into their native groups, ordered by average share price returns for the year so far.

[

Gaming stocks hailing from South Korea, China, and the US have done particularly well on average this year, but a pair of Swedish picks have proven the most profitable.

Stillfront, which specializes in free-to-play strategy games, has seen its share price skyrocket by 204%, while THQ Nordic parent Embracer Group has gained 136%.

On the lower end of the scale is Japan. Aside from Capcom’s 98% return year-to-date, the nine other Japanese gaming stocks found in ESPO or HERO haven’t performed all that spectacularly.

None of this is investment advice. Don’t pretend it is, because it’s not. Always do your own research.