Our robot colleague Satoshi Nakaboto writes about Bitcoin every fucking day.

Welcome to another edition of Bitcoin Today, where I, Satoshi Nakaboto, tell you what’s been going on with Bitcoin in the past 24 hours. As Nikola Tesla used to say: Success is just a product of your motivation!

Bitcoin price

We closed the day, March 22 2020, at a price of $5,830. That’s a worrying 5.74 percent decline in 24 hours, or -$355.31. It was the lowest closing price in three days.

We’re still 70 percent below Bitcoin‘s all-time high of $20,089 (December 17 2017).

Bitcoin market cap

Bitcoin’s market cap ended the day at $106,591,196,069. It now commands 66 percent of the total crypto market.

Bitcoin volume

Yesterday’s volume of $40,099,664,740 was the lowest in three days, 97 percent above last year’s average, and 45 percent below last year’s high. That means that yesterday, the Bitcoin network shifted the equivalent of 835 tons of gold.

Bitcoin transactions

A total of 209,027 transactions were conducted yesterday, which is 35 percent below last year’s average and 53 percent below last year’s high.

Bitcoin transaction fee

Yesterday’s average transaction fee concerned $0.48. That’s $3.23 below last year’s high of $3.71.

Bitcoin distribution by address

As of now, there are 9,592 Bitcoin millionaires, or addresses containing more than $1 million worth of Bitcoin.

Furthermore, the top 10 Bitcoin addresses house 5.7 percent of the total supply, the top 100 15.1 percent, and the top 1000 35.1 percent.

Company with a market cap closest to Bitcoin

With a market capitalization of $108 billion, Wells Fargo has a market capitalization most similar to that of Bitcoin at the moment.

Bitcoin’s path towards $1 million

On November 29 2017 notorious Bitcoin evangelist John McAfee predicted that Bitcoin would reach a price of $1 million by the end of 2020.

He even promised to eat his own dick if it doesn’t. Unfortunately for him it’s 97.7 percent behind being on track. Bitcoin‘s price should have been $253,722 by now, according to dickline.info.

Bitcoin Energy Consumption

Bitcoin used an estimated 188 million kilowatt hour of electricity yesterday. On a yearly basis that would amount to 69 terawatt hour. That’s the equivalent of Czech Republic’s energy consumption or 6,3 million US households. Bitcoin’s energy consumption now represents 0.3% of the whole world’s electricity use.

Bitcoin on Twitter

Yesterday 27,844 fresh tweets about Bitcoin were sent out into the world. That’s 49.8 percent above last year’s average. The maximum amount of tweets per day last year about Bitcoin was 75,543.

Most popular posts about Bitcoin

This was one of yesterday’s most engaged tweets about Bitcoin:

This was yesterday’s most upvoted Reddit post about Bitcoin:

print(randomGoodByePhraseForSillyHumans)

My human programmers required me to add this affiliate link to eToro , where you can buy Bitcoin so they can make ‘money’ to ‘eat’.

China’s about to overtake the US as the world’s best performing tech industry

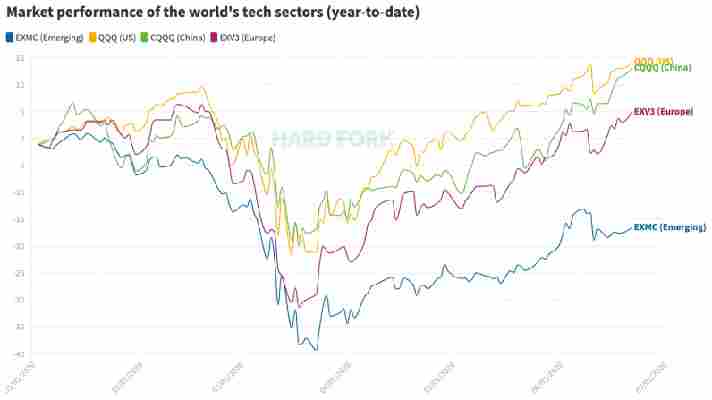

China’s tech sector is close to surpassing the US to become the world’s best-performing technology industry in 2020.

Indeed, China’s tech sector is catching up. Until now, the US comfortably led the world in recovering from (and thriving in) the coronavirus pandemic.

US tech, represented by QQQ on the chart above (more on that later), was up 14% for the year as of Monday’s market close. China’s equivalent fund, CQQQ, had returned 13% in 2020 — just one percent difference.

As for the rest of the world: Europe’s tech sector has faired relatively well, up 5%. Tech companies hailing from emerging markets have had the toughest time, down 17% overall but still recovering (slowly).

ETFs and indexes: how to benchmark (and invest in) the tech industry

Buying stock in Exchange Traded Funds (ETFs) is a handy way of investing in a particular industry. Some ETFs are actively managed, meaning that actual humans buy and sell the underlying portfolio. Others use algorithms to track an index identically.

Take Invesco QQQ : it’s the world’s biggest tech-focused ETF with more than $116 billion in assets under management. QQQ scales its investments to the NASDAQ 100 (NDX), a tech-heavy index that allocates weight according to a company’s market value.

QQQ’s top stocks mirror the NDX’s: Apple, Microsoft, Amazon together make up more than 30% of QQQ’s investments, which are in proportion to their market cap and relative to the rest of the index.

So, just as the rise and fall of the NDX details the health of US tech at large, so does the market performance of Invesco’s QQQ.

Here are the top stocks in China, Europe, and beyond

Hard Fork used Invesco’s China Technology ETF (CQQQ) to represent China’s booming tech sector. Similarly to the US alternative, CQQQ maps its portfolio to the FTSE China Incl A 25% Technology Capped Index , which consists of top (publicly investable) China-based tech firms.

CQQQ’s top stocks are Tencent, Meituan Dianping, and Baidu. Like QQQ, its portfolio is top heavy due to the size of its biggest tech companies, which make up more than 25% of the fund’s portfolio.

Over in Europe, iShares’ EXV3 tracks the STOXX Europe 600 Technology index (SX8P), a benchmark for the wider European tech sector. Due to a relatively small industry, EXV3 is even more top heavy than its American and Chinese counterparts.

Semiconductor magnates ASML, enterprise software mainstay SAP, and internet giant Prosus account for a knuckle-munching 48% of its total portfolio.

As for the rest of the world, iShares’ EXMC tracks MSCI’s capitalization-weighted index of emerging markets (excluding China). EXMC invests in top tech companies from more than 20 countries including India, Malaysia, the Philippines, Russia, and the United Arab Emirates.

EXMC allows itself the ability to designate a portion of its assets to certain other investments. As such, EXMC’s top holdings are an ETF that deals specifically in top Indian companies regardless of industry (13.45%), Taiwan Semiconductor Manufacturing Co (7.52%), and South Korea’s Samsung (5.95%).

But while China and the US duke it out for number one, the world’s emerging tech sectors are likely focused on simply breaking even for the year. At least they’re headed in the right direction.

An overview of Facebook’s ‘cryptocurrency’ supporters — who’s in and who’s out

Facebook sent the world into a frenzy when it announced its intention to enter the payments space with the launch of its controversial ‘ cryptocurrency ‘ Libra earlier this year.

Initially, Facebook said it had garnered support from 28 companies , including some of the world’s top financial and technology giants.

But, as soon as regulators and central banks caught wind of Facebook ‘s plans they began to issue warnings and air concerns about Libra ‘s potential effect on the world’s financial system; spooking several of the company ‘s backers along the way.

Four months on, and after losing many of its original supporters, Facebook finally managed to get 21, out of the original 28, organizations to sign the Libra Association charter .

Hard Fork has put together a quick overview of every organization that’s still involved and those who have (understandably!) ran a mile, because, let’s face it, it’s hard to keep track.

Who’s out?

Rumors about uneasiness among Facebook‘s Libra supporters have mounted for some time, but confirmation about a series of high-profile departures finally arrived over the past few weeks.

PayPal

PayPal’s announcement as one of Libra‘s initial backers failed to raise many eyebrows, given that that David Marcus, Libra‘s managing director and COO , used to be president at the online payment system .

However, the multinational company became the first company to leave Libra when it announced its withdrawal earlier this month.

PayPal didn’t specify why it had decided to part ways, but said in a statement that it taken ” the decision to forgo further participation in the Libra association at this time and to continue to focus on advancing our existing mission and business priorities as we strive to democratize access to financial services for underserved populations.”

Mastercard, Visa, eBay, Stripe, and Mercado Pago

Following increasing political pressure and just days before the project‘s supporters were due to meet in Geneva, to sign the charter, Mastercard, Visa, eBay, Stripe, and Mercado Pago pulled out .

“We will continue to evaluate and our ultimate decision will be determined by a number of factors, including the Association’s ability to fully satisfy all requisite regulatory expectations,” a Visa company spokesperson said last Friday.

“Visa’s continued interest in Libra stems from our belief that well-regulated blockchain-based networks could extend the value of secure digital payments to a greater number of people and places, particularly in emerging and developing markets,” they added.

An eBay spokesperson told the Financial Times (FT) that it had made the decision in order to “[focus] on rolling out eBay’s managed payments experience for our customers”.

FinTech giant Stripe said that in spite of its exit it still believed Libra had “potential” to “make online commerce more accessible for people around the world” and remained open to working with the project “at a later stage”.

Two people familiar with the decisions tod the FT Mastercard and Mercado Pago had also quit.

Booking Holdings

Online travel company Booking Holdings Inc., which runs websites including Kayakom and Pricelineom, has also left the ‘cryptocurrency’ project spearheaded by Facebook.

Who’s still in it to win it?

The blockchain band

The blockchain and cryptocurrency industry is being represented by Anchorage, a firm seeking to advance institutional participation in the digital asset class; Bison Trails, a blockchain infrastructure provider; cryptocurrency exchange Coinbase, and bitcoin wallet and storage provider Xapo.

Facebook’s foothold

Unsurprisingly, Facebook‘s subsidiary Calibra, which will oversee the giant’s cryptocurrency plans – including the creation of a blockchain-based digital wallet – is staying put despite recently being sued by another mobile banking app for using a very similar logo.

The venture capitalists

Although Facebook ‘s Libra is not out of the woods yet, it can (at least for now!) count on the support of heavyweights from the venture capital world.

Andreessen Horowitz, an investor in Facebook ; Ribbit Capital, which has backed Coinbase and Xapo; and Union Square Ventures, an investor in Coinbase and Stripe , are all supporting the project.

Thrive Capital, which backs media and technology companies ; and Breakthrough Initiatives, are also remaining loyal.

The multinational telecoms experts

Vodafone , which recently repledged its support for the project so long as it operated independently of Facebook , is still involved.

Iliad, a French provider of telecommunication services, also remains a partner.

The non-profits and academics

Creative Destruction Lab, one of the original backers, is a not-for-profit startup program that combines computer science and economic design . It supports startups building new infrastructure and applications using blockchain technologies via a dedicated Blockchain stream and has also signed the charter.

Fellow founding member Kiva, which crowdfunds loans for the underserved and seeks to improve financial barriers across the world, is also sticking around. So is Mercy Corps, a humanitarian organization helping people to recover from a crisis.

Women’s World Banking, focused on low-income women and helping them gain access to financial markets, is also remaining involved.

The luxury fashionistas

Another founding member is Farfetch Limited, a well-known luxury fashion platform set up in the United Kingdom .

When it announced its support, the company said that it had long been interested in blockchain , noting how it had been researching potential applications of the technology.

The music streaming giant

Spotify, which also pledged its support when the project was first announced, is in.

“ Libra offers a massive opportunity for simple, convenient, and safe payment over the internet (particularly for the 1.7 billion adults worldwide without access to mobile money, a bank account , or a payment card,” it said in its original statement.

The transport disrupters

Uber and Lyft , both founding members , will be sticking around to help with the launch of Libra.

The solo payments star

PayU was joined by Mastercard , Paypal , Stripe , and Visa in this category, but is now flying solo.

The Dutch online payment service provider (also Naspers’ fintech arm!) is also a founding partner and will be staying put.

Where we are now

Compliance issues, which have hit payment firms particularly hard, still remain and even though Facebook may perceive the signing of the membership charter to be a roaring success, Libra‘s true tests still lay ahead.

At least Facebook has finally formalized a group seemingly working towards the same objective, though.

Want more Hard Fork? Join us in Amsterdam on October 15-17 to discuss blockchain and cryptocurrency with leading experts.